Oshkosh Corporation (NYSE:OSK) posted weaker-than-expected earnings for the first quarter on Wednesday.

The company posted adjusted earnings of $1.92 per share, missing market estimates of $2.05 per share. The company's quarterly sales came in at $2.31 billion versus expectations of $2.41 billion.

“We are pleased with our start to 2025, led by strong performance in our Vocational segment, double-digit margins in our Access segment and solid progress on the ramp-up of Next Generation Delivery Vehicle production. Adjusted earnings per share of $1.92 was in line with our expectations of approximately $2.00 per share,” said John Pfeifer, president and chief executive officer of Oshkosh Corporation. “These results reflect the strength of our team and our People First culture, our portfolio of industry-leading businesses and the resilience of our operating model.

Oshkosh shares gained 3.8% to trade at $86.96 on Thursday.

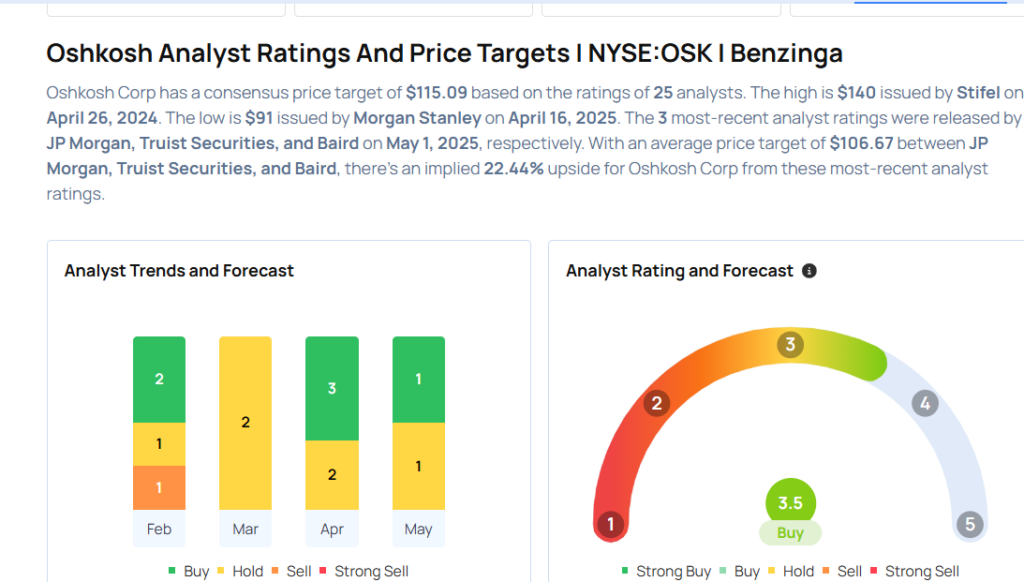

These analysts made changes to their price targets on Oshkosh following earnings announcement.

- Baird analyst Mircea Dobre maintained Oshkosh with an Outperform rating and lowered the price target from $163 to $135.

- Truist Securities analyst Jamie Cook maintained the stock with a Hold and cut the price target from $94 to $93.

- JP Morgan analyst Tami Zakaria maintained Oshkosh with a Neutral and lowered the price target from $100 to $92.

Considering buying OSK stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From Apple Stock Ahead Of Q2 Earnings

Photo via Shuterstock