Zions Bancorp (NASDAQ:ZION) posted weaker-than-expected results for the first quarter on Monday.

The company reported first-quarter revenue of $795 million, missing analyst estimates of $797.07 million, according to Benzinga Pro. The bank reported first-quarter earnings of $1.13 per share, missing analyst estimates of $1.17 per share.

"Credit quality remained in very good shape during the quarter, with nonperforming assets stable compared with last quarter at 0.51% of loans and leases and annualized net charge-offs of 0.11% of loans and leases. At the same time, the outlook for the economy is perhaps more uncertain than it's been in a number of years, clouded by the very real potential for negative impacts from tariffs and trade policy, both here and abroad," said Harris Simmons, chairman and CEO of Zions Bancorp.

Zions Bancorp shares dipped 1.5% to close at $43.62 on Monday.

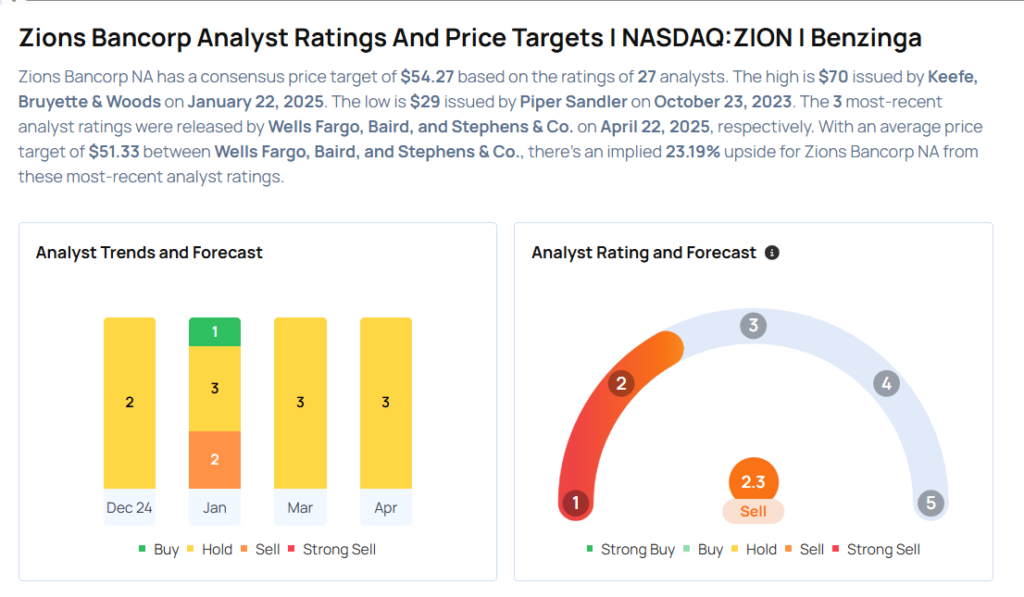

These analysts made changes to their price targets on Zions Bancorp following earnings announcement.

- Stephens & Co. analyst Terry McEvoy maintained Zions Bancorp with an Equal-Weight rating and lowered the price target from $54 to $52.

- Baird analyst David George maintained the stock with a Neutral rating and lowered the price target from $58 to $55.

- Wells Fargo analyst Mike Mayo maintained Zions Bancorp with an Equal-Weight rating and cut the price target from $58 to $47.

Considering buying ZION stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From 3M Stock Ahead Of Q1 Earnings

Photo via Shutterstock