Quest Diagnostics Incorporated (NYSE:DGX) posted better-than-expected first-quarter earnings on Tuesday.

Quest Diagnostics reported quarterly earnings of $2.21 per share which beat the analyst consensus estimate of $2.15 per share. The company reported quarterly sales of $2.65 billion which beat the analyst consensus estimate of $2.63 billion.

"In the first quarter, we delivered strong revenue growth of approximately 12%, including nearly 2.5% in organic growth, as demand rebounded in March following weather impacts early in the quarter. Our growth was due to contributions from acquisitions and large enterprise accounts, demand for our advanced diagnostics portfolio, and expanded health plan access," said Jim Davis, chairman, CEO and president. "We are reaffirming our revenue and adjusted EPS guidance for the full year 2025."

Quest Diagnostics reaffirmed 2025 guidance for revenue of $10.70 billion—$10.85 billion versus the consensus of $10.78 billion and adjusted EPS of $9.55-$9.80 compared to the consensus of $9.68.

Quest Diagnostics shares fell 0.1% to trade at $172.71 on Wednesday.

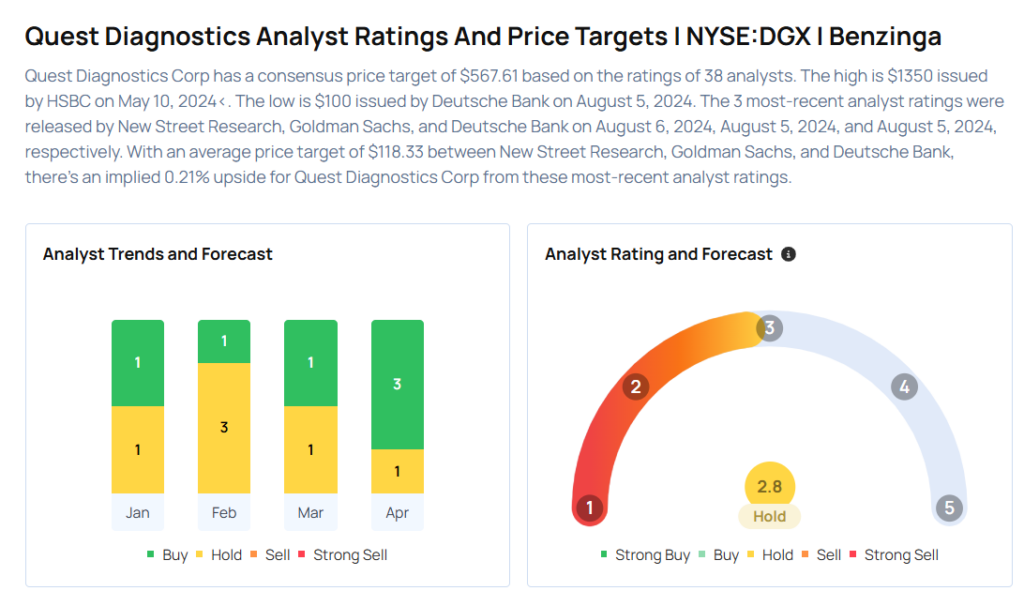

These analysts made changes to their price targets on Quest Diagnostics following earnings announcement.

- Baird analyst Eric Coldwell maintained Quest Diagnostics with an Outperform rating and raised the price target from $191 to $194.

- Evercore ISI Group analyst Elizabeth Anderson maintained the stock with an In-Line rating and raised the price target from $175 to $180.

- Barclays analyst Stephanie Davis maintained Quest Diagnostics with an Equal-Weight rating and increased the price target from $175 to $185.

- Truist Securities analyst David Macdonald maintained the stock with a Hold rating and raised the price target from $182 to $190.

Considering buying DGX stock? Here’s what analysts think:

Read This Next:

- Tesla To $303? Here Are 10 Top Analyst Forecasts For Wednesday

Photo via Shutterstock