Comerica Incorporated (NYSE:CMA) reported better-than-expected earnings for its first quarter on Monday.

The company posted quarterly earnings of $1.25 per share which beat the analyst consensus estimate of $1.15 per share. The company reported quarterly sales of $829.00 million which missed the analyst consensus estimate of $831.34 million.

Comerica shares dipped 4.4% to close at $50.60 on Monday.

These analysts made changes to their price targets on Comerica following earnings announcement.

- JP Morgan analyst Anthony Elian downgraded Comerica from Neutral to Underweight and lowered the price target from $64 to $52.

- Baird analyst David George maintained Comerica with an Outperform rating and lowered the price target from $80 to $75.

- Wells Fargo analyst Mike Mayo maintained the stock with an Equal-Weight rating and cut the price target from $67 to $55.

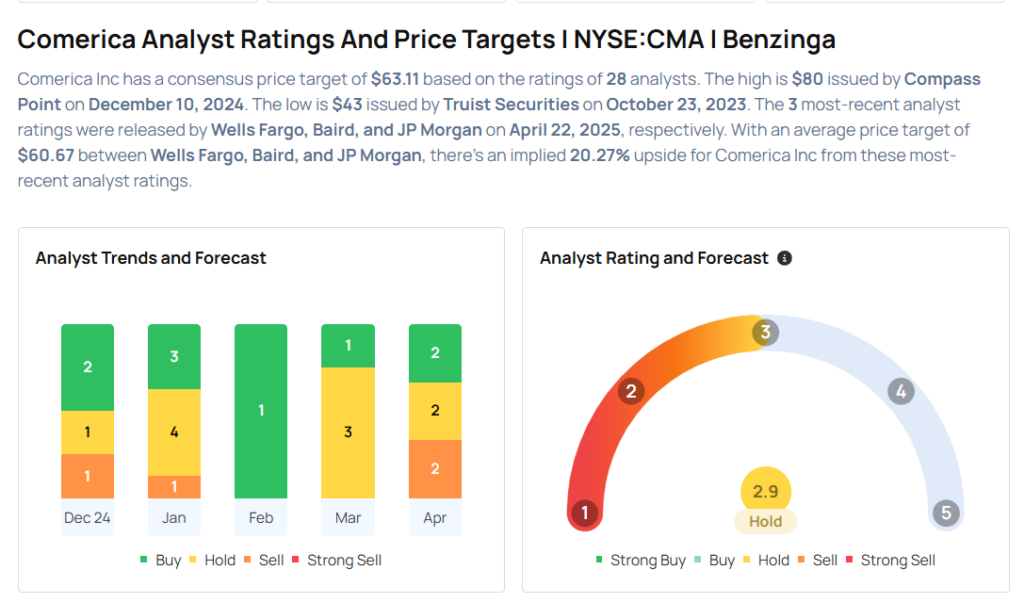

Considering buying CMA stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From 3M Stock Ahead Of Q1 Earnings

Photo via Shutterstock