U.S. Bancorp (NYSE:USB) reported better-than-expected first-quarter earnings on Wednesday.

The company posted earnings per share of $1.03, which beat the analyst consensus estimate of 98 cents. The parent company of U.S. Bank reported quarterly revenues of $6.95 billion. It outpaced the analyst consensus estimate of $6.91 billion.

U.S. Bancorp's average total loans increased 2.1% on a year-over-year basis and 0.9% on a linked quarter basis.

"We managed expenses with discipline and delivered 270 basis points of positive operating leverage on an adjusted basis – our third consecutive quarter of yearover-year growth in revenues outpacing expenses," said U.S. Bancorp CEO Gunjan Kedia.

U.S. Bancorp shares gained 1.6% to trade at $38.40 on Thursday.

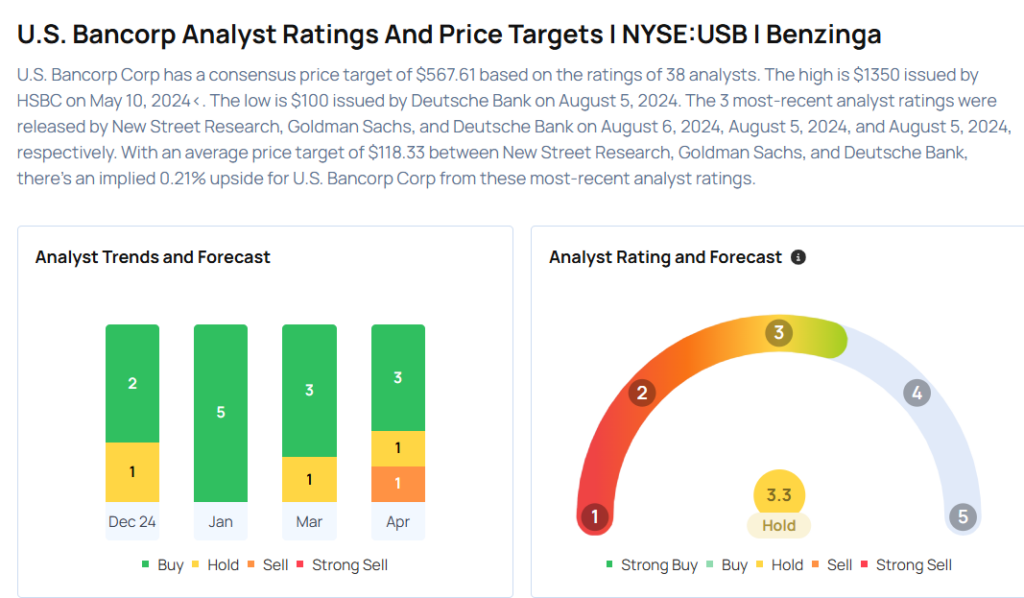

These analysts made changes to their price targets on U.S. Bancorp following earnings announcement.

- Keefe, Bruyette & Woods analyst David Konrad maintained U.S. Bancorp with a Market Perform rating and lowered the price target from $54 to $49.

- Truist Securities analyst John McDonald maintained the stock with a Hold rating and cut the price target from $51 to $48.

- Barclays analyst Jason Goldberg maintained U.S. Bancorp with an Overweight rating and lowered the price target from $61 to $56.

Considering buying USB stock? Here’s what analysts think:

Read This Next:

- Netflix Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Photo via Shutterstock