Johnson & Johnson (NYSE:JNJ) will release earnings results for the first quarter, before the opening bell on Tuesday, April 15.

Analysts expect the New Brunswick, New Jersey-based company to report quarterly earnings at $2.58 per share, down from $2.71 per share in the year-ago period. Johnson & Johnson projects to report quarterly revenue at $21.57 billion, compared to $21.38 billion a year earlier, according to data from Benzinga Pro.

Protagonist Therapeutics, on April 10, announced new data for a pill that treats moderate-to-severe plaque psoriasis. The Phase 3 study was conducted in adolescents and adults simultaneously. The ICONIC program, with icotrokinra (JNJ-2113) data from a subgroup analysis, came about through a partnership with Johnson & Johnson.

Johnson & Johnson shares gained 1.7% to close at $154.36 on Monday.

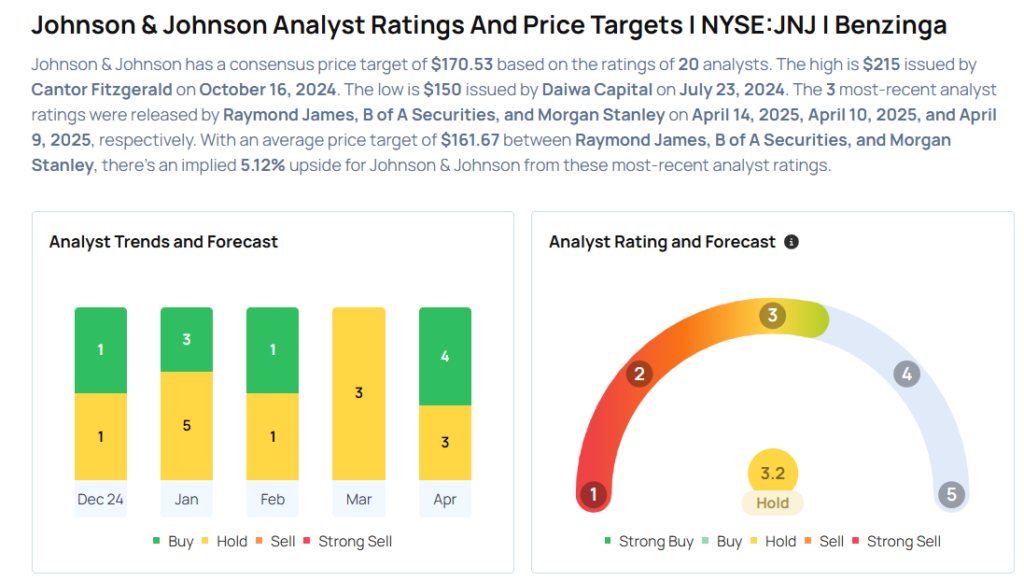

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Raymond James analyst Jayson Bedford maintained an Outperform rating and cut the price target from $165 to $162 on April 14, 2025. This analyst has an accuracy rate of 69%.

- Morgan Stanley analyst Terence Flynn maintained an Equal-Weight rating and raised the price target from $163 to $164 on April 9, 2025. This analyst has an accuracy rate of 66%.

- Guggenheim analyst Vamil Divan reiterated a Neutral rating on April 2, 2025. This analyst has an accuracy rate of 72%.

- Barclays analyst Matt Miksic maintained an Equal-Weight rating and increased the price target from $159 to $166 on Jan. 28, 2025. This analyst has an accuracy rate of 66%.

- Stifel analyst Rick Wise maintained a Hold rating and slashed the price target from $170 to $155 on Jan. 23, 2025. This analyst has an accuracy rate of 73%.

Considering buying JNJ stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Spotlight On 3 Consumer Stocks Delivering High-Dividend Yields

Photo via Shutterstock