These Analysts Revise Their Forecasts On Compass Minerals Following Q4 Earnings

Compass Minerals International, Inc. (NYSE:CMP) reported weaker-than-expected first-quarter adjusted EPS results and cut its FY25 salt segment revenue guidance, after the closing bell on Monday.

Compass Minerals Intl reported quarterly losses of 55 cents per share which missed the analyst consensus estimate of 15 cents per share. The company reported quarterly sales of $307.20 million which beat the analyst consensus estimate of $294.00 million.

“This quarter we began to see results from our back-to-basics strategy and initiatives to reduce inventory volumes, improve our cost structure, and enhance profitability. Our efforts are expected to further strengthen our future financial performance, leveraging our exceptional set of unique assets that are virtually irreplaceable, enjoy durable competitive advantages and have strong leadership positions in their respective marketplaces,” said Edward C. Dowling Jr., president and CEO.

Compass Minerals slashed its 2025 salt segment revenue outlook from $940 million – $1.04 billion to $900 million – $1 billion.

Compass Minerals shares gained 3.3% to trade at $11.80 on Wednesday.

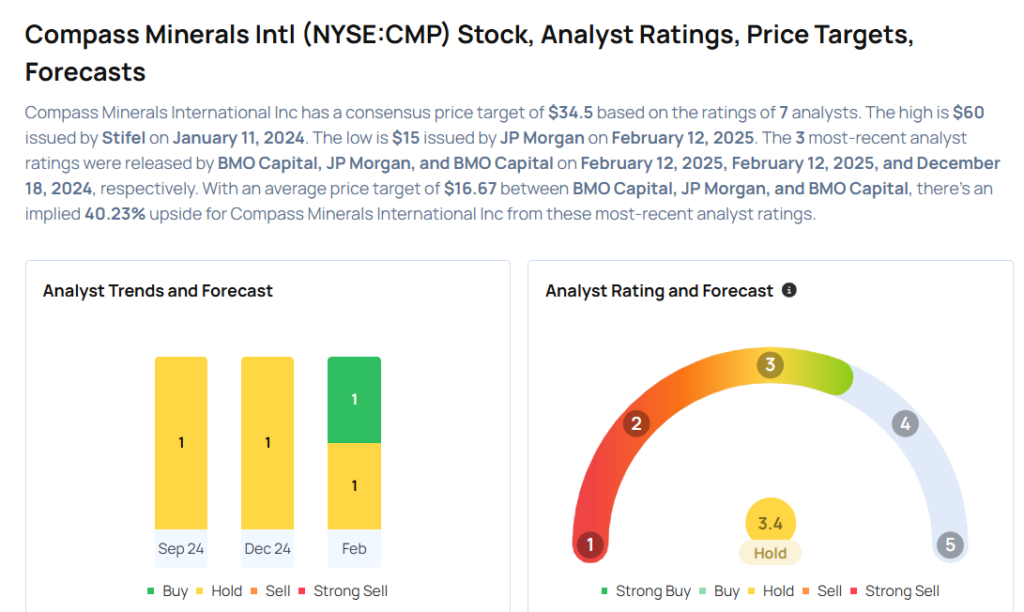

These analysts made changes to their price targets on Compass Minerals following earnings announcement.

- JP Morgan analyst Jeffrey Zekauskas upgraded Compass Minerals Intl from Neutral to Overweight and raised the price target from $13 to $15.

- BMO Capital analyst Joel Jackson maintained Compass Minerals with a Market Perform and lowered the price target from $18 to $17.

Considering buying CMP stock? Here’s what analysts think:

Read This Next:

- Snowflake To Rally Around 9%? Here Are 10 Top Analyst Forecasts For Wednesday

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10