Monday.com Ltd (NASDAQ:MNDY) reported better-than-expected earnings for its fiscal fourth quarter on Monday.

The company posted fiscal fourth-quarter 2024 revenue growth of 32% year-on-year to $267.98 million, beating the analyst consensus estimate of $261.37 million. The project management software company's adjusted EPS of $1.08 beat the analyst consensus estimate of 79 cents.

“2024 was a remarkable year for monday.com, reflecting our rapid product innovation and focus on go-to-market execution, driving strong demand across customers of all sizes. We are proud to have further expanded our product suite with monday service, which is already seeing rapid adoption from both existing and new customers,” said monday.com co-founders and co-CEOs, Roy Mann and Eran Zinman. “As we look to 2025, we are excited to double-down on our AI efforts, with a focus on AI Blocks, Product Power-ups, and our new Digital Workforce of AI Agents. We believe AI can be a game-changer for our customers, giving them the ability to transform their workflows and scale faster than ever before.”

Monday.com expects fiscal first-quarter 2025 revenue of $274 million—$274.32 million (versus the consensus of $246.1 million) and an adjusted operating margin of 9%–10%. Monday.com expects 2025 revenue of $1.208 billion—$1.221 billion, against the consensus of $1.210 billion, and an adjusted operating margin of 11%–12%.

Monday.com shares gained 26.5% to close at $326.58 on Monday.

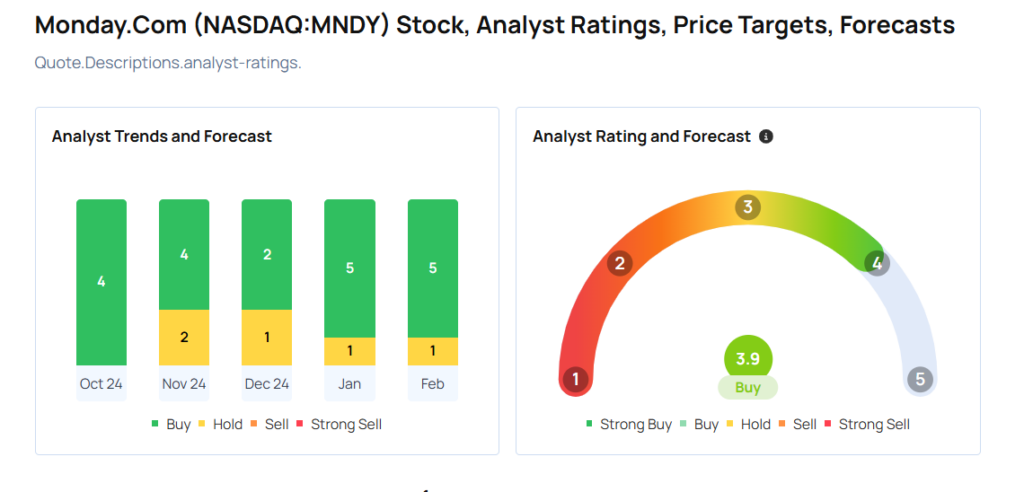

These analysts made changes to their price targets on Monday.com following earnings announcement.

- Jefferies analyst Brent Thill maintained Monday.Com with a Buy and raised the price target from $300 to $400.

- JP Morgan analyst Pinjalim Bora maintained the stock with an Overweight rating and raised the price target from $350 to $400.

- Wells Fargo analyst Michael Berg maintained the stock with an Overweight rating and increased the price target from $340 to $380.

Considering buying MNDY stock? Here’s what analysts think:

Read This Next:

- Top 3 Tech Stocks That May Jump This Month