Summary:Chip giant Qualcomm will release its fiscal Q4 2025 earnings after market close on November 5. The market anticipates Qualcomm's non-handset businesses will continue rapid growth, creating more future opportunities.

Fiscal Q3 Review

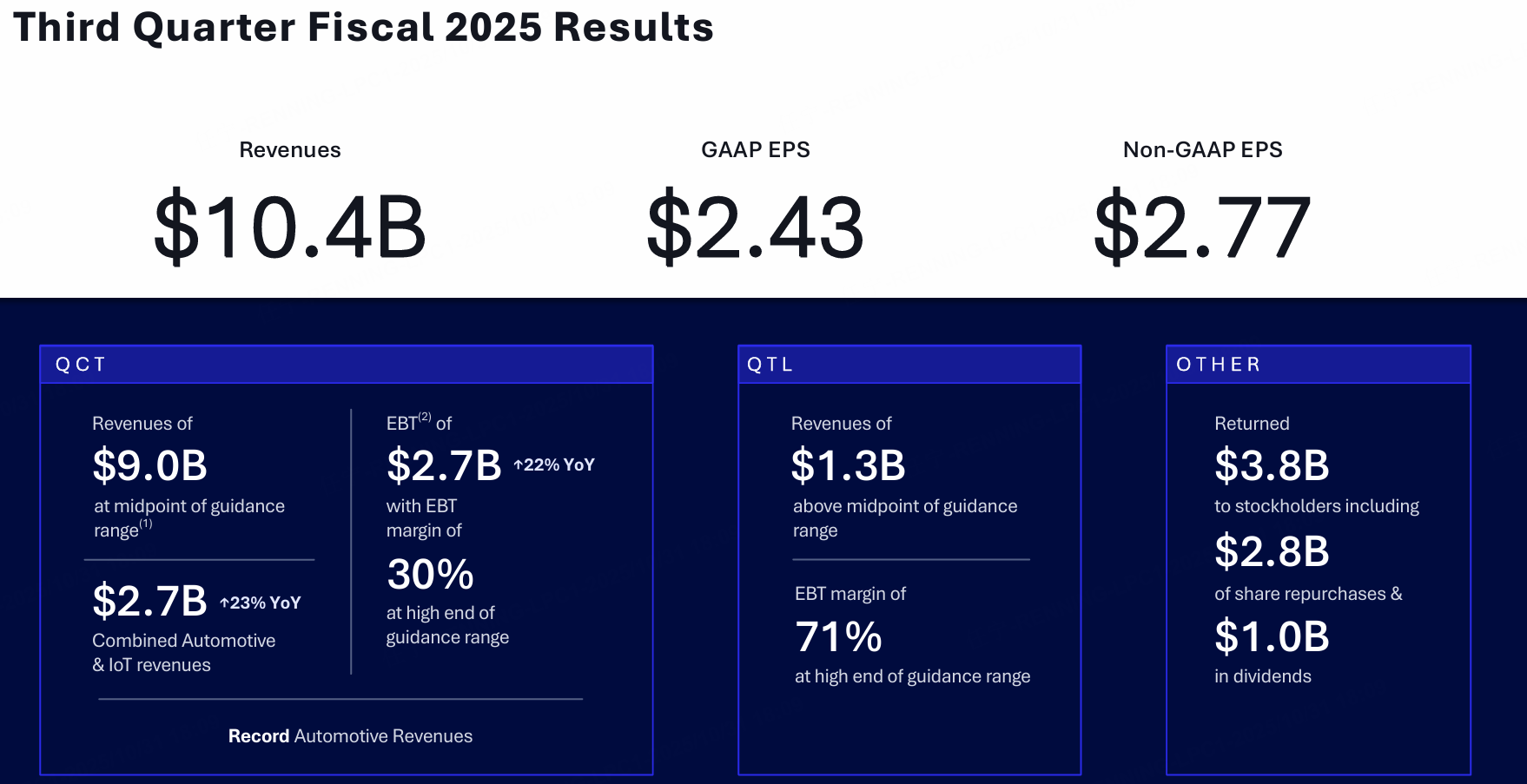

In fiscal Q3 2025, Qualcomm reported non-GAAP adjusted revenue of $10.37 billion, up 10% YoY; adjusted EPS of $2.77, up 19% YoY. Pre-tax profit (EBT) reached $3.54 billion, a 17% YoY increase.

At the business level, both Chips and Technologies (QCT) and Technology Licensing (QTL) demonstrated resilience, with double-digit non-handset growth effectively offsetting smartphone demand volatility. QCT revenue totaled approximately $8.993 billion, while QTL contributed $1.318 billion. Handset revenue reached $6.328 billion, automotive $984 million, and IoT $1.681 billion, with automotive and IoT posting YoY growth of approximately 21% and 24% respectively.

Fiscal Q4 Outlook

In last quarter's earnings report, Qualcomm projected Q4 revenue between $10.3-$11.1 billion, with QCT revenue guidance of $9.0-$9.6 billion and QTL guidance of $1.25-$1.45 billion.

According to Tiger Trade APP data, analysts currently expect Qualcomm's Q4 total revenue at $10.76 billion, EPS of $2.86, and EBIT of $3.621 billion.

Key Points to Watch

Core revenue continuation driven by AI smartphones and premium platform upgrades

Supported by smartphone refresh cycles and premium platform iterations, handset revenue may sustain moderate growth this quarter. Last quarter's $6.328 billion handset revenue (up ~7% YoY) demonstrated premium and mid-high-end models' demand traction. Android manufacturers' investments in imaging, connectivity, and on-device AI features increase reliance on Qualcomm's RF front-end and SoC solutions, helping maintain per-device value. With OEMs launching flagships in China and overseas markets, unit value and structural improvements should continue, supporting YoY EPS gains alongside disciplined expense management. Seasonal shipments and channel inventory dynamics remain key variables – if rational channel stocking coincides with premium model share expansion, revenue and profit quality would improve.

Order fulfillment and revenue trajectory for intelligent connected vehicle platforms

Automotive business maintained double-digit growth over multiple quarters, with last quarter's $984 million (up ~21% YoY) reflecting cockpit, ADAS, and connectivity drivers. This quarter's focus is on model launches and regional expansions converting orders into revenue and EBIT contributions. Qualcomm's digital chassis and modular platforms provide automakers with sustainable iteration capabilities, enhancing client stickiness while stabilizing pricing and margins. As new models launch regionally, higher-margin platforms should directly support gross margins. Automaker timelines and mass-production progress require monitoring – smooth production ramps would reduce seasonal revenue and profit fluctuations.

Edge AI penetration and scaling in IoT and wearables/XR

Last quarter's IoT revenue of $1.681 billion (up ~24% YoY) reflected synergies among edge computing, Wi‑Fi/Bluetooth connectivity, and AI at the Edge. Key IoT drivers this quarter include smart glasses, wearables, and industrial product cycles boosting Qualcomm's AR/wearable platforms and connectivity chips. Optimized power efficiency and cost for edge AI inference accelerate growth in premium IoT segments, improving blended margins. New product launches coupled with overseas channel expansion would further optimize revenue mix. Macro impacts on entry-level IoT demand warrant assessment – if premium categories maintain growth despite weaker low-end demand, overall margins should remain stable.

Analyst Views

Multiple institutions noted: "Double-digit non-handset growth provides Qualcomm with a more resilient revenue structure; automotive and IoT demonstrate sustainability, enhancing EPS improvement visibility." Others emphasized: "Strategic moves in data centers boost AI ecosystem participation but offer limited near-term financial impact; core focus remains handset and edge AI execution."

Bullish arguments center on three points: first, handset premiumization stabilizes unit value and margins; second, automotive and IoT sustain double-digit growth, diversifying against single-segment volatility; third, AI product iterations and ecosystem expansion increase growth visibility for upcoming quarters.