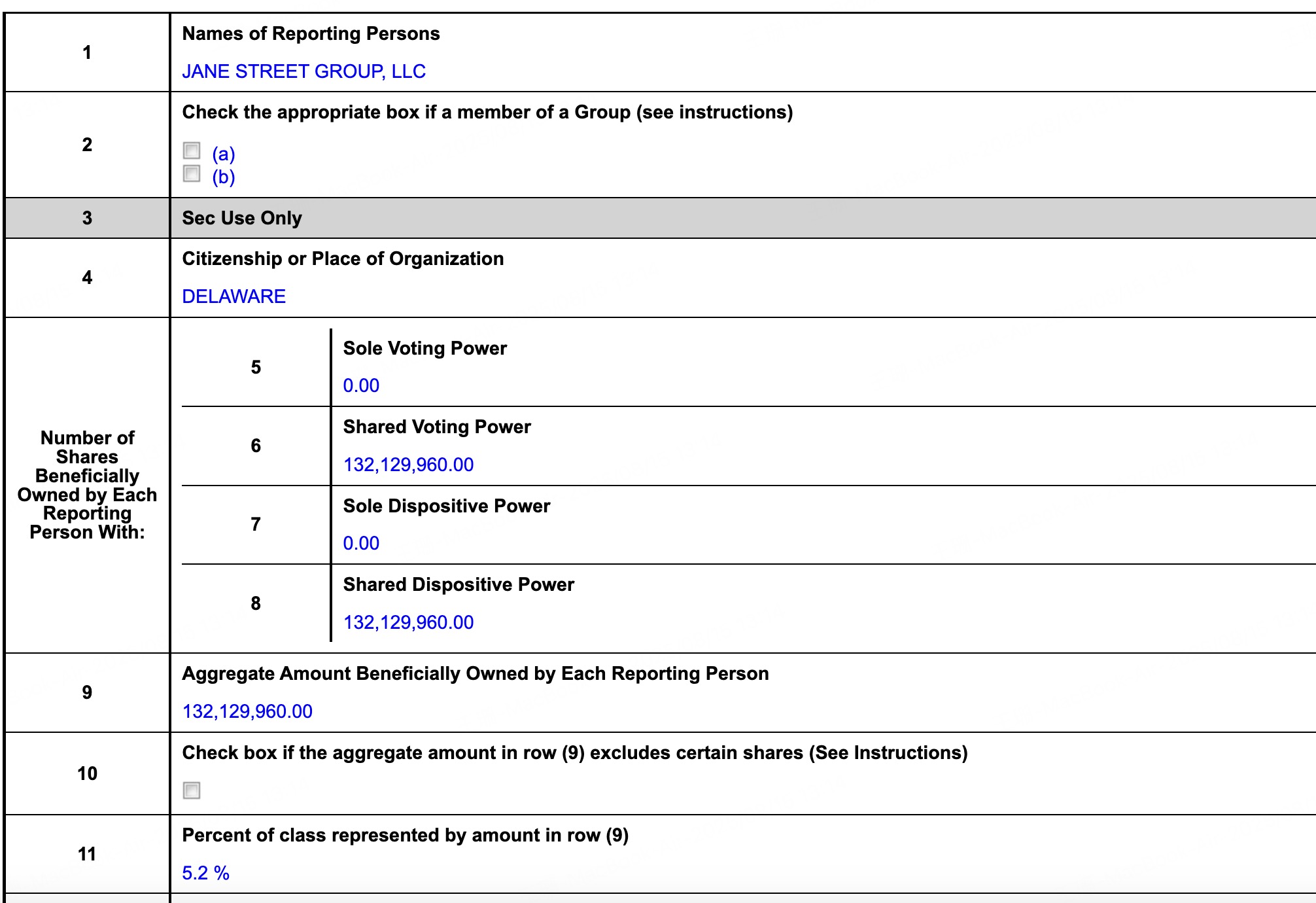

According to a Schedule 13G filing submitted to the U.S. Securities and Exchange Commission (SEC), New York-based financial company Jane Street Group, LLC and its two subsidiaries disclosed that as of June 30, 2025, they collectively hold 5.2% of the shares of Tiger Brokers (UP Fintech Holding Ltd).

The document, signed on August 14, 2025, indicates that Jane Street Group, LLC, as the reporting entity, along with its subsidiaries Jane Street Capital, LLC and Jane Street Options, LLC, jointly report their holdings in Tiger Brokers.

Detailed shareholding information is as follows:

Jane Street Group, LLC: Reports holding 132,129,960 Class A ordinary shares of Tiger Brokers (equivalent to ADS), representing 5.2% of the company's total share capital. The company is classified as a Holding Company (HC).

Jane Street Options, LLC: Reports holding 98,189,145 shares, representing 3.9% of the total share capital.

Jane Street Capital, LLC: Reports holding 33,940,815 shares, representing 1.3% of the total share capital.

The shareholding ratio is based on the total of 2,552,302,315 Class A ordinary shares of Tiger Brokers outstanding as of March 31, 2025. The document also mentions that the reported shares are held in the form of American Depositary Shares (ADS), with each ADS representing 15 Class A ordinary shares.