Hello Tigers!

In the previous lesson, we learned about the influence of market sentiment on investments. In this lesson, I want to introduce you to an interesting theory: the herd effect.

What is Herd Mentality in the Stock Market?

Herd mentality, also called herd behavior, is a phenomenon where individuals are influenced by the actions of a larger group, leading to uniform behavior. In finance, this "herd instinct" can cause investors to follow trends and make decisions based on collective emotion rather than independent analysis.

This isn't a new concept. History provides many herd mentality examples that show its disruptive power.

A Classic Example: The Tulip Mania

In the 1630s, the Netherlands experienced a speculative frenzy over tulip bulbs. Prices soared to astronomical levels, with a single bulb reportedly being exchangeable for a house.

People from all walks of life invested their savings, driven by the crowd. The price of tulips surged by an incredible 5900% in a year. However, when a few sellers decided to cash out, it triggered mass panic. The market collapsed overnight on February 4, 1637, bankrupting thousands.

Nearly every major financial crisis, from the Tulip Mania to the 2008 crash, has been linked to the herd effect.

So, how does the herd effect operate in the financial markets? This leads us to the concept of "conceptual speculation." But, before that, let’s get to know the “meme stock market.”

The Digital Herd: Understanding the Meme Stock Market

So, what is a meme stock?

A meme stock is a stock that gains immense popularity among retail investors through social media platforms like Reddit, X (formerly Twitter), and TikTok. This online buzz can create a powerful herd effect, leading to a frenzy of buying that drives the stock price up dramatically, disconnected from the company's actual financial performance.

The term "Meme" originated from Richard Dawkins' 1976 book "The Selfish Gene," derived from the Greek word "mimēma." After the rise of the internet, "Meme" came to refer to popular images, videos, or content that spread rapidly online and became synonymous with group behaviors that quickly imitate and spread.

And this type of investing is a form of "conceptual speculation," where the narrative and hype become more important than the fundamentals.

Modern Meme Stock Drama in 2022

In early July 2022, the stock price of Bed Bath & Beyond (BBBY), a U.S. home goods retailer, surged from its low of $4.5 to a peak of $28 within half a month, a 4.5-fold increase. Then, within just three trading days, it plummeted to $8.5. Such drastic fluctuations in stock prices are typical characteristics of Meme stocks.

It's essential to note that you should not be misled by the enormous gains of Meme stocks. Remember the "overconfidence" sentiment we talked about in the previous lesson?

Up-to-Date Fact: GameStop and the Birth of the Modern Meme Stock

The GameStop (GME) saga in 2021 is a prime example. Retail investors, largely organized on Reddit's WallStreetBets forum, collectively bought GME shares, driving the price up by over 1,700% in a month to challenge institutional short-sellers. This event cemented the power of the digital herd and brought the term "meme stock" into the mainstream.

Up-to-Date Fact: The Rise of Trump Media (DJT) Stock

A more recent example from 2024 is the stock of Trump Media & Technology Group (DJT). The stock, linked to the Truth Social platform, experienced extreme volatility driven by political sentiment and discussion on social media rather than traditional business metrics. This is a clear example of how a powerful brand and online community can create a "trump meme coin stock"-like effect in the equity markets, attracting investors who are drawn to the movement behind the stock.

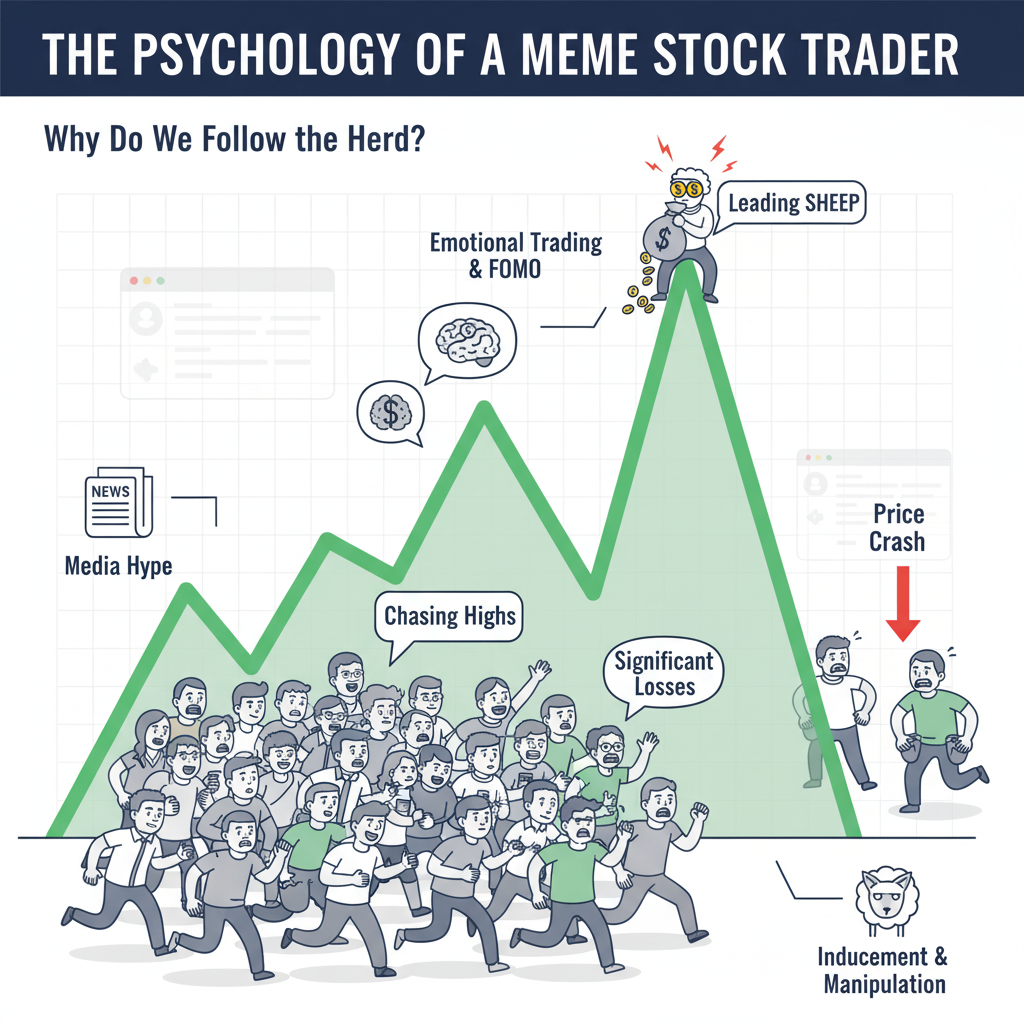

The Psychology of a Meme Stock Trader: Why Do We Follow the Herd?

Analyzing the herd effect in conceptual speculation, we can find that chasing hotspots in investment behaviors is highly irrational. Here are a few reasons:

Fear of Missing Out (FOMO): Seeing others profit from a skyrocketing stock triggers a fear of being left behind, compelling people to buy in without proper research.

Overconfidence: Early success in a meme stock trade can lead to a belief that you're a "stock genius," encouraging riskier behavior like chasing highs.

Attention Deficit: Investors are naturally drawn to high-yield, low-probability events. We see the incredible returns but ignore the slim chance of actually achieving them, especially when someone is actively inducing you to become part of the "herd".

How to Protect Your Portfolio from Herd Mentality?

While the meme stock frenzy can be tempting, disciplined investors can avoid its traps. Here are some strategies commonly advised by financial experts:

Focus on Fundamentals, Not Hype: Before investing, analyze the company's financial health, competitive position, and long-term prospects. Is the price justified by its performance, or just by social media buzz?

Do Your Own Research (DYOR): Don't rely on anonymous online forums or social media influencers for financial advice. These platforms are where rational investors or companies can exploit the herd effect for their own gain. Keep in mind the BBBY example, where a key influencer cashing out triggered a 40% price drop in a single day.

Recognize and Resist FOMO: Acknowledge the feeling of Fear of Missing Out (FOMO), but don't act on it impulsively. A stock that has already surged dramatically carries immense risk. There will always be other opportunities.

Set Clear Entry and Exit Points: If you do decide to trade a volatile asset, have a clear plan. Define the price at which you will buy, the price at which you will take profits, and the stop-loss price to limit potential losses.

Follow Tiger Tiger Brokers for More Stock Trading Tips

In the next lesson, I'll teach you trading strategies brought about by behavioral finance theories, seizing investment opportunities with behavioral finance principles.

Stay tuned! See you in the next lesson!

Download Tiger Trade Singapore to get the updated financial news and reports, instantly.