Hello Tigers!

Ever wondered why we sometimes buy a stock at its peak, only to panic-sell when it dips? Or why we hold onto a losing investment for too long, hoping it will turn around? This isn't just bad luck; it's often human psychology at play. In our last lesson, we introduced behavioral finance. Today, we delve deeper into the invisible force that drives many of these decisions: Cognitive bias.

In simple terms, cognitive biases are mental shortcuts that can prevent you from seeing the full picture clearly. Let's break down how they appear in your investment journey and, most importantly, how to start managing them.

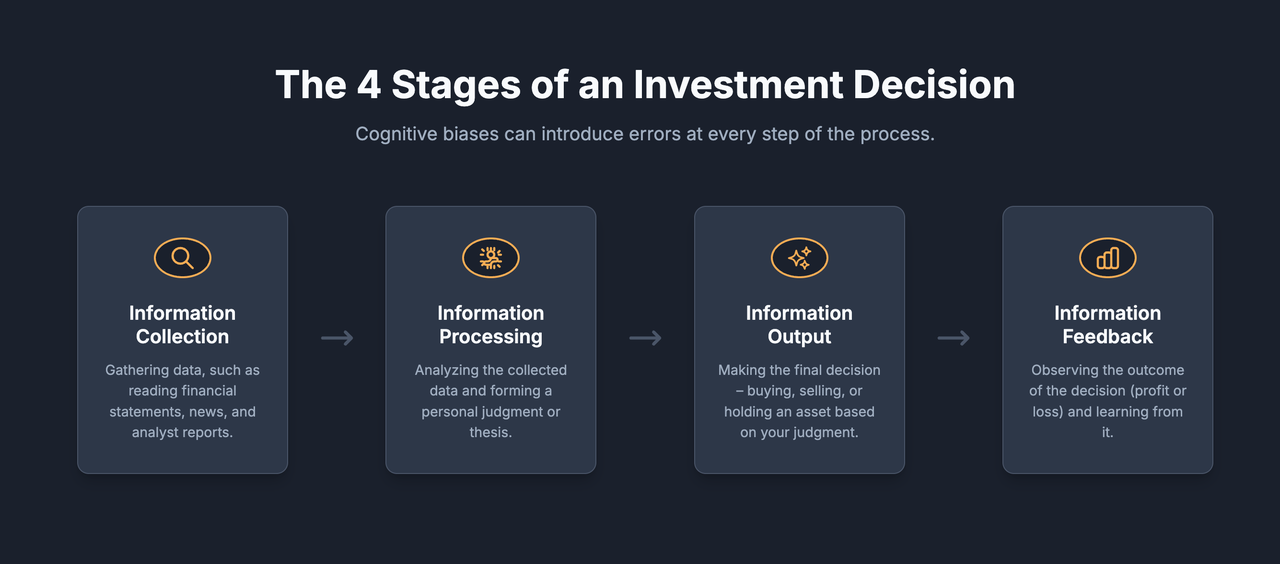

The four stages of an investment decision: where things go wrong

Let's first talk about a common cognitive bias: Do you really understand a company?

Many will first get to know a company before making investment decisions. They believe that without a thorough understanding of a company, it's impossible to make the right investment.

Do you think the same?

Yet, an unexpected finding reveals that regardless of the extent of your pre-investment research or your perceived comprehension of a company, you never truly grasp its essence. From a psychological perspective, cognitive biases can arise at each of the four stages of processing information:

Information collection: Gathering data, such as reading financial statements or news.

Information processing: Analyzing the data and forming a judgment.

Information output: Making a decision, like when and what to buy or sell.

Information feedback: Observing the outcome, whether the investment gains or loses.

To make a truly objective decision, we need to get all four stages right. However, biases can creep in at every step, causing us to repeat the same mistakes. Even when we recognize our errors, it's difficult to correct them without a system, a concept often called "knowing but not doing".

Let's look at the specific biases that appear in each stage.

Common biases that lead to costly mistakes

Some of you might wonder, given our understanding of these four stages, can we rectify these mistakes through ongoing learning and introspection? Is it possible to sidestep the pitfalls we've encountered?

Regrettably, that's not the reality. In the investment journey, even upon recognizing our own shortcomings, it's challenging to address them solely through learning and self-reflection.

In other words, you may continue to make the same mistakes.

This occurs because different cognitive biases may arise at various stages of information feedback. Even if you see the results, it's hard to execute commands flawlessly like a robot, leading to what we often call "knowing but not doing".

Next, I will present these cognitive biases individually.

A. Information collection stage

We are more likely to rely on information that we remember and ignore information that is not remembered, which is the availability bias. This bias makes you focus only on the information you care about and ignore other important factors.

How to overcome it: Before making a trade based on recent news or a "hot tip," force yourself to zoom out. Look at the company's 1-year and 5-year performance, read its latest annual report, and check its key financial ratios. This creates a more balanced view beyond what's immediately available.

B. Information processing stage

The most typical mistake at this stage is the representativeness bias. For instance, upon witnessing a fund manager receive the "Best Fund Manager" accolade, we promptly assume: they must be an exceptional fund manager.

A classic example is the dot-com bubble of the late 1990s. Investors saw a few tech companies achieve massive success. Soon, they began to believe that any company with ".com" in its name was a representative of a future tech giant, even if it had no solid business plan or revenue. They chased these stocks, leading to a massive bubble and eventual crash. This bias causes us to see patterns where they may not exist.

C. Information output stage

Investors are most prone to the trap of "overconfidence". In trading, overconfidence leads people to ignore risks and make irrational trades, often resulting in heavy losses.

How to overcome it: Keep a trading journal. Document not just your trades, but your reasoning for entering and exiting them. This creates an objective record of your decision-making process and results, providing an honest mirror to your actual performance, not just your perceived skill.

D. Information feedback stage

In this final stage, investors may face several common cognitive biases that prevent them from learning from their results. The two most common are:

Self-Attribution Bias: This is the tendency to attribute good results to our own abilities and bad results to external factors like the market or bad luck. When a stock rises, we believe it's due to our correct judgment, but when it falls, we blame the environment.

Confirmation Bias: This is when you only see what you want to see. After buying a stock, you tend to only notice good news that supports your decision, while ignoring negative news. In reality, both favorable and unfavorable information always coexist.

How to overcome it: Actively seek out dissenting opinions. Before you invest, make it a rule to read at least one well-researched article or analyst report that argues against your investment thesis. This forces you to confront the risks and weaknesses, leading to a more robust and less biased decision.

Conclusion

Now that you can recognize these cognitive biases, you understand the psychological traps that lead to repetitive mistakes. The goal isn't to become a robot, as these biases are a natural part of being human. The key to successful investing is not to eliminate them, but to be aware of them and build systems to manage them.

By developing a consistent research process, keeping a trading journal, and challenging your own assumptions, you can move from "knowing" to "doing" and start making more rational, objective investment decisions.

In our next lesson, we will explore how these individual biases combine to create a powerful collective force: What is market sentiment, and how you can learn to read it without being swept away by it.

See you in the next class!