What is contra trade?

A contra trade is a flexible way of trading that allows investors to buy or sell securities without immediate settlement. In simple terms, you can purchase a stock and then sell it shortly after. If trade makes a profit, the gains are credited directly to your account. However, if there’s a loss, you’ll need to cover the difference.

When might you use contra trade?

Suppose investor Tom spots a great trading opportunity, but his funds are still tied up in another investment and will take a few days to settle. Or perhaps it’s Friday night and he wants to trade U.S. stocks, but the bank can't transfer funds over the weekend.

In these cases, Tom can use his contra trading limit to buy the stock immediately, so he doesn’t miss the opportunity.

Two possible outcomes might follow:

Scenario 1-Price rises, sells and takes profit If the stock price rises within a few days, Tom sells the stock and locks in the profit. Since he completed the buy-sell process quickly and earned a price difference, no additional funds need to be deposited.

Scenario 2-Deposit funds, continue holding the stock If the stock price remains stable and Tom believes it has long-term potential, he can wait for the funds to arrive, complete the purchase, and continue holding the stock. This results in a standard trade settlement, concluding the contra trade.

How to do contra trade with Tiger Brokers?

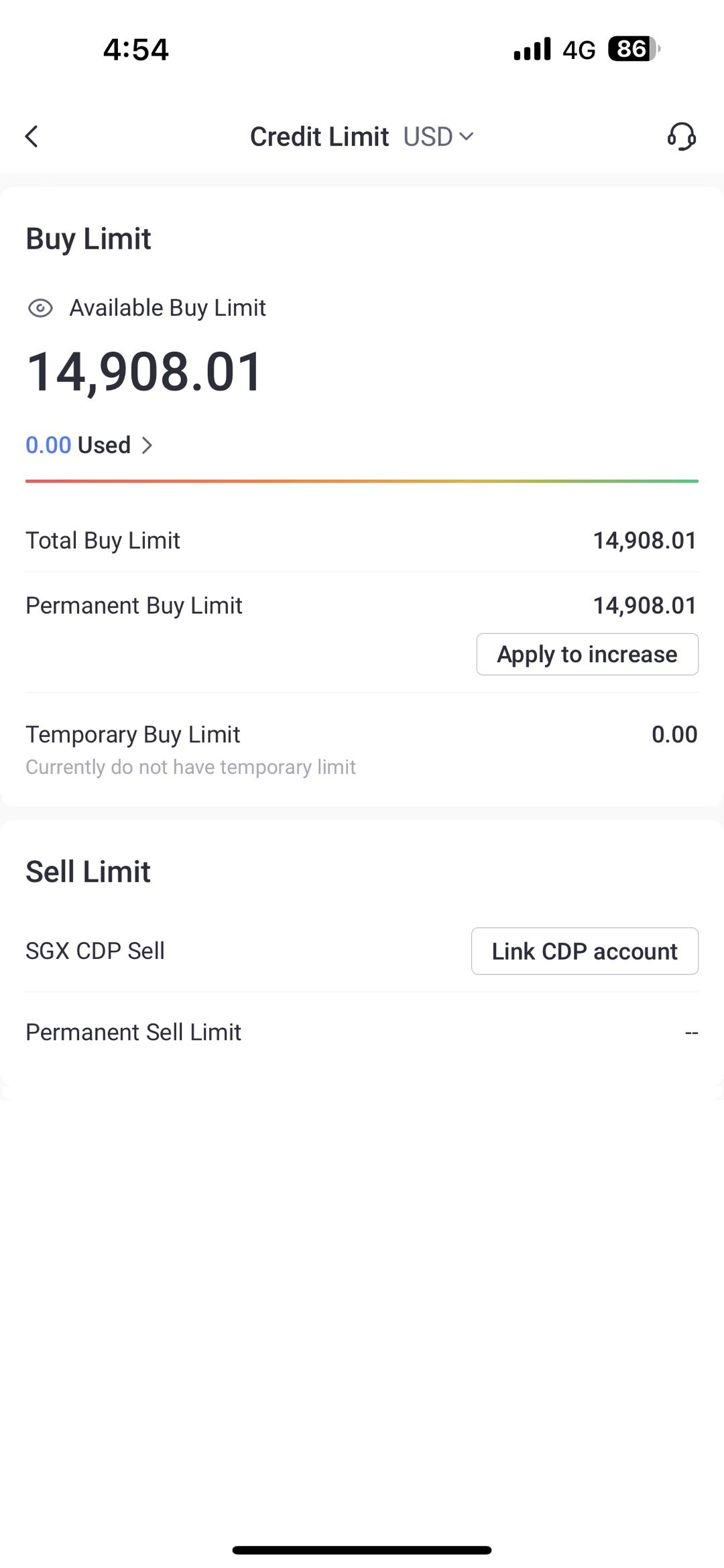

With Tiger Brokers, you can easily execute contra trades through a Cash Boost Account. New users can get an initial credit of over SGD 20,000, allowing them to trade first and settle later. This feature supports trading stocks and ETFs in Singapore, Hong Kong, and the US.

If you use the Cash Boost Account for contra trading and sell the stock before the settlement date*, the system calculates the difference between the purchase and sale price:

If the difference is positive, you’ll pocket the profits directly into your account.

If the difference is negative, you’ll need to deposit funds to cover the loss before the settlement date.

For example, Tom buys 100 shares at SGD 10 each.

If the price rises to SGD 15 and he sells, he’ll make a SGD 500 profit, which is credited to his Cash Boost Account.

If the price drops to SGD 8, he incurs a SGD 200 loss and needs to deposit this amount to settle the trade.

If there are insufficient funds in the account and the stock hasn’t been sold, the system will automatically force-sell the stock on the settlement date + 2 days to prevent further losses.

*Singapore and Hong Kong markets settle on T+2, and the US market settles on T+1.

How to calculate outstanding balance and interest?

If you haven’t sold the stock by the settlement date or don’t have enough funds in your account, interest will start accruing. The system uses the “First In, First Out” (FIFO) method to settle the oldest trades first. For example:

Tom buys 100 shares at SGD 10 on Monday, buys another 300 shares at SGD 9 on Tuesday, and sells 300 shares when the price falls to SGD 8 on Wednesday. FIFO means the first 100 shares are sold at a loss of SGD 200, followed by a further SGD 200 loss from the next 200 shares. He now has 100 shares left and a SGD 400 loss.

If Tom doesn’t sell the remaining 100 shares or deposit funds by settlement date + 2 days, the system will force-sell the stock at the current market price. If the price drops to SGD 5, his total loss will increase to SGD 800.

Interest starts accruing on the 8th trading day (7th for US stocks) at an annual rate of 8.5%. If the debt remains unpaid five days after forced liquidation, the credit limit will be frozen until all debts are cleared. If unpaid for longer, the account will be place on the SGX delinquent list, affecting Tom’s credit score. To avoid extra costs and credit risks, it’s crucial to settle or sell positions promptly.

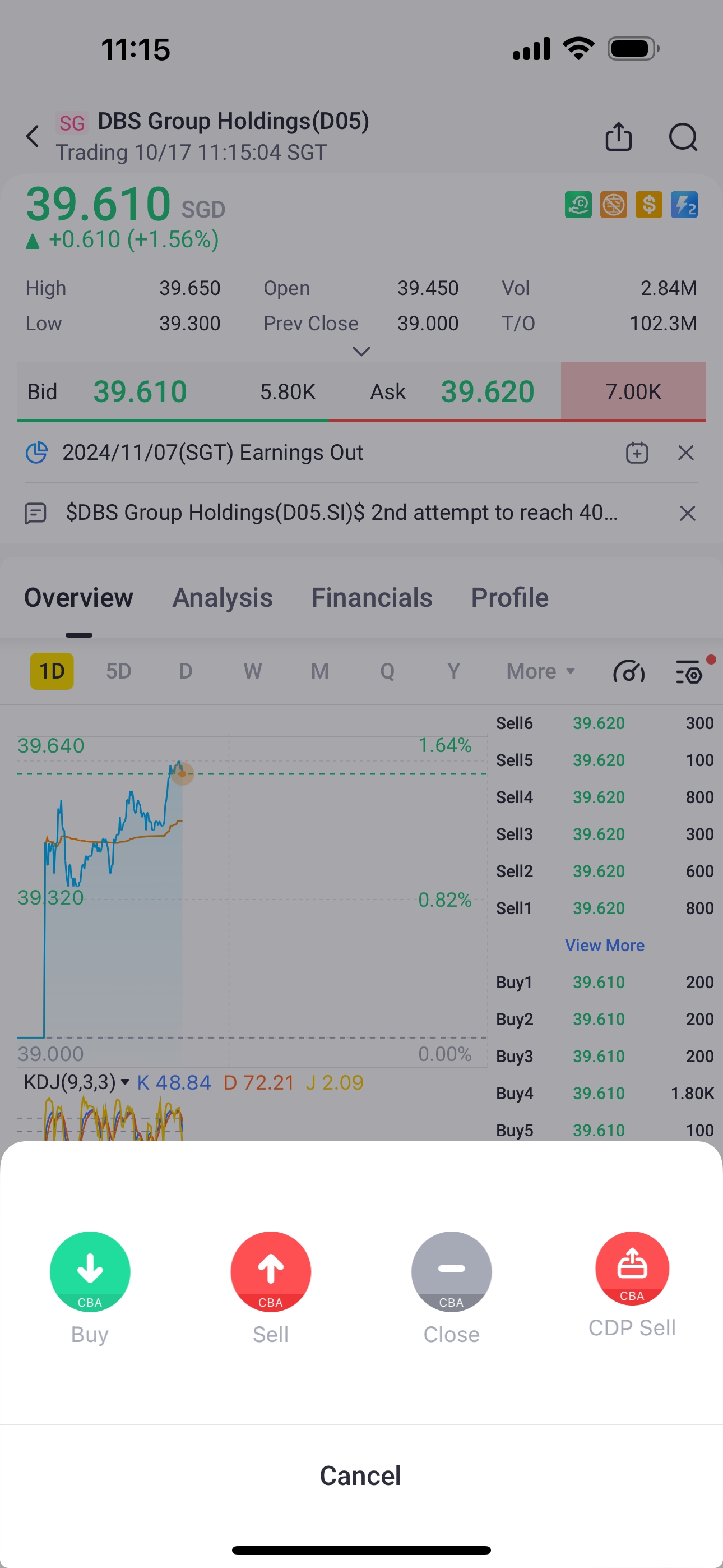

How to connect your CDP account and sell shares

Cash Boost Account also allows you to sell stocks directly from your CDP account without extra transfers. Here’s how:

Open the Tiger Trade app and log in to your Cash Boost account.

Search for the SGX stock you want to sell and click “Sell.”

In the options, select “Sell from CDP.”

Note: Currently, you can only sell shares from CDP. Newly purchased stocks cannot be transferred into CDP for now.

Please ensure you check your CDP holdings before selling stocks to prevent accidental short selling.

How to open a Cash Boost Account

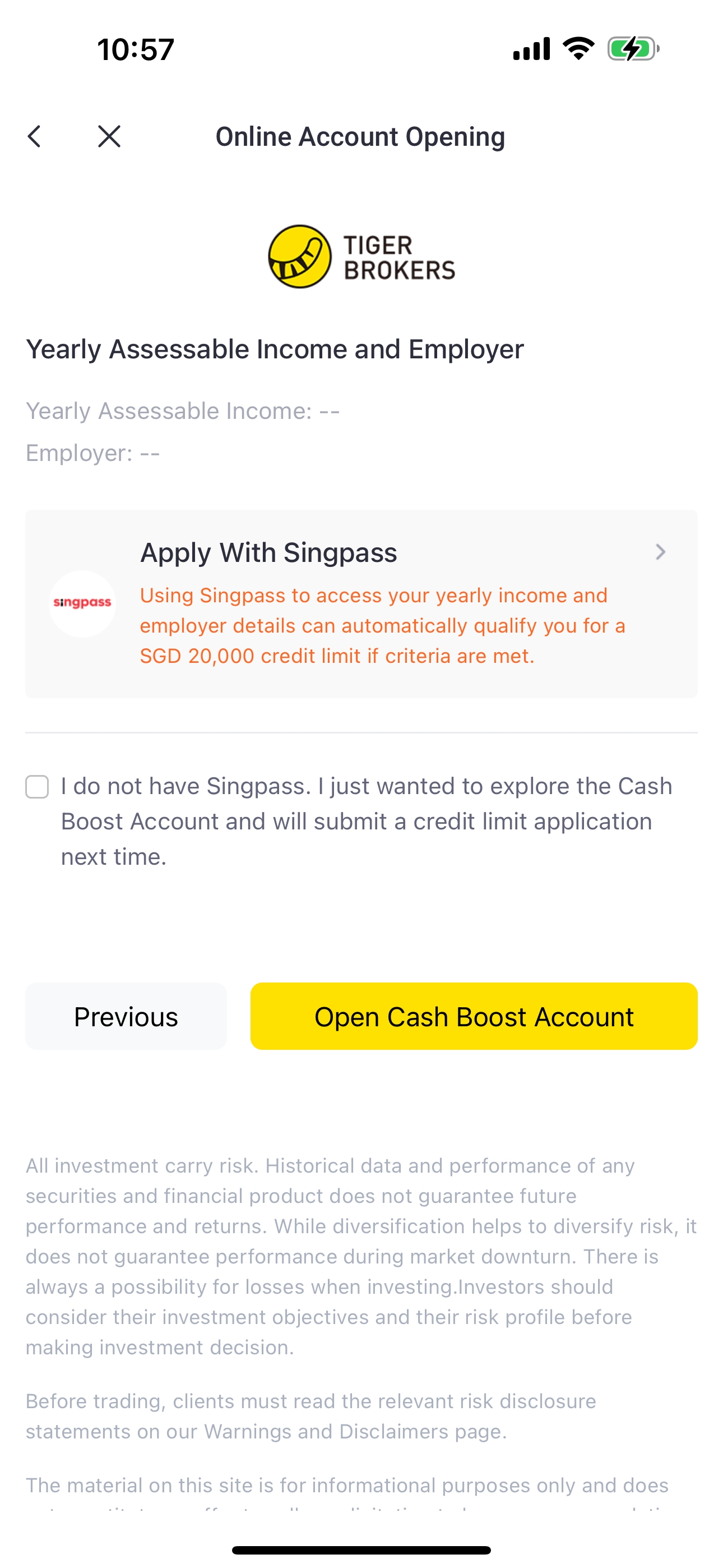

Step 1: Open an account by clicking here and submitting your personal information. You can register easily with SingPass.

Step 2: Scroll to the bottom and check the box for [Contra Account].

Step 3: Submit your application, and once the account is approved, you’ll automatically receive at least SGD 20,000 in credit.

For more information, visit: https://www.itiger.com/sg/hans/help/detail/contra-faq. Remember, investing involves risk, so plan your finances wisely!

For more info on Cash Boost Account and Fees: https://www.tigerbrokers.com.sg/commissions/fees.

Not financial advice. Investment involves risk. Cash Boost Account enables you to make purchases using credit limit, allowing you to buy beyond your current available funds and may potentially incur losses exceeding your account balance. Please make decisions according to your own risk tolerance.

This advertisement has not been reviewed by the Monetary Authority of Singapore.