Recently, the market fluctuations in Singapore have introduced some uncertainty for investors seeking predictable income. Therefore, for investors seeking stable investment avenues in Singapore, diversifying beyond local markets can be a strategic move.

In this landscape, US treasuries emerge as a noteworthy alternative, offering a blend of perceived safety and potentially steady returns, but not guaranteed. But how can investors in Singapore access these instruments? This guide explores US treasuries and provides insights into how to buy US treasuries in Singapore.

What are US treasuries?

US treasuries, notes, and US treasury bills are debt securities issued by the US department of the Treasury to finance government spending. Investors essentially lend money to the US government and, in return, receive interest payments and the return of their principal investment upon maturity.

There are several types of Treasury securities, including Treasury bills (T-bills), Treasury notes (T-notes), Treasury bonds (T-bonds) and Treasury Inflation-Protected Securities (TIPS).

Characteristic | T-bills | T-notes | T-bonds | TIPS |

Maturity | 4 weeks to 1 year | 2–10 years | 10–30 years | 5,10 or 30 years |

Interest payment | Discount to face value | Fixed-rate, semi-annually | Fixed-rate, semi-annually | Semi-annually, based on adjusted principal |

Inflation protection | No | No | No | Yes |

Primary/secondary market | Issued at auction (primary), actively traded (secondary) | Issued at auction (primary), actively traded (secondary) | Issued at auction (primary), actively traded (secondary) | Issued at auction (primary), actively traded (secondary) |

Table 1: Comparison of different US treasuries types

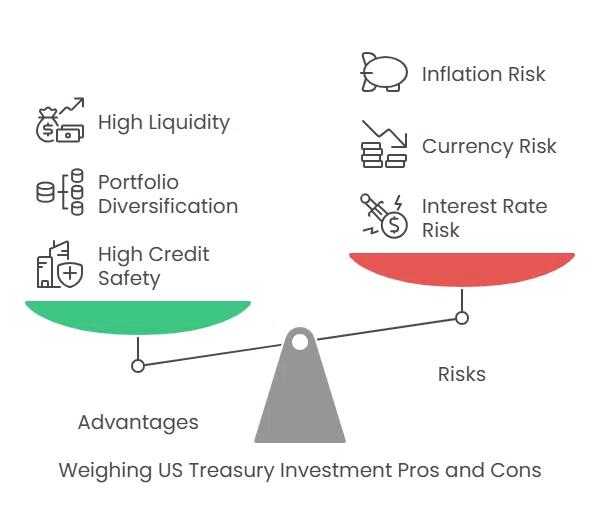

Advantages and potential risks of US treasuries

Advantages

High credit safety: Backed by the full faith and credit of the US government, US government bonds are considered among the safest investments globally.

Portfolio diversification: Adding US treasuries can diversify a portfolio heavily weighted towards Singapore or regional assets, potentially hedging against local market risks.

High liquidity: US treasuries are actively traded in large secondary markets, making them generally easy to buy and sell before maturity if needed.

Potential risks

Interest rate risk: Bond prices inversely correlate with interest rates, meaning if market rates rise, the value of existing bonds with lower fixed rates may decrease, especially for longer-term bonds.

Exchange Rate risk: Singaporean investors may experience fluctuating returns due to the SGD-USD exchange rate, as a stronger SGD can decrease the value of USD-denominated interest payments and principal when converted to SGD.

Inflation risk: For fixed-rate bonds (non-Treasury Inflation-Protected Securities, or TIPS), the purchasing power of fixed interest payments and principal can be eroded by inflation over time, especially for longer-term bonds.

Market Risk: Factors such as interest rates and political events can cause market fluctuations, affecting the prices and yields of U.S. Treasury bonds. For example, when the Federal Reserve raises interest rates or there are changes in the U.S. political environment, bond prices may decline.

Credit Risk: Although U.S. Treasuries have a very high credit rating. In theory, if the U.S. government faces difficulties in repaying its debt, investors could experience losses. However, the likelihood of this happening is extremely low.

US treasuries vs. Singapore government bonds – risk & return comparison

Feature | US treasuries | SGS bonds |

Issuer | US Department of the Treasury | Monetary Authority of Singapore (MAS) |

Yield* | Varies by maturity, US treasury bond rates and market conditions. As of late April 22 2025, the US 10-year treasury yield was around 4.4% (subject to significant fluctuations).[1] | Generally lower than comparable US yields recently. SSB 10-year average returns were recently below 3%. [2] |

Currency risk | Yes (USD vs SGD) | No (Issued in SGD) |

Market access | Accessible via international brokers (e.g., Tiger Brokers) | Accessible via local banks, brokers, ATMs (SSB), CDP (SGS Primary Auctions) |

Liquidity | Very high liquidity in the global secondary market | Good, but potentially less liquid than US treasuries in the secondary market. |

Examples | Invest US$20,000 in a 10-year T-note with a 4.4% coupon rate. Receive US$440 (US$20,000 * 4.5% / 2) every 6 months. At maturity (10 years), receive the US$20,000 principal plus the final US$440 interest payment. | Invest $20,000, with a 10-year maturity date and coupon rate of 3% p.a. Receive $300 every 6 months until maturity. Receive $20,000 plus the final coupon ($300) at maturity. |

Table 2: The comparison of US treasuries and Singapore government bonds

Step-by-step guide to buying US treasuries via Tiger Trade

When trading US treasuries on the Tiger Trade app, Tiger Brokers fees may generally incur 0.08% commission (face value), 0.04% platform fee (face value) and 0.08% custody fee (place value). Here’s a general overview of how to buy US treasury bonds in Singapore by Tiger Trade:

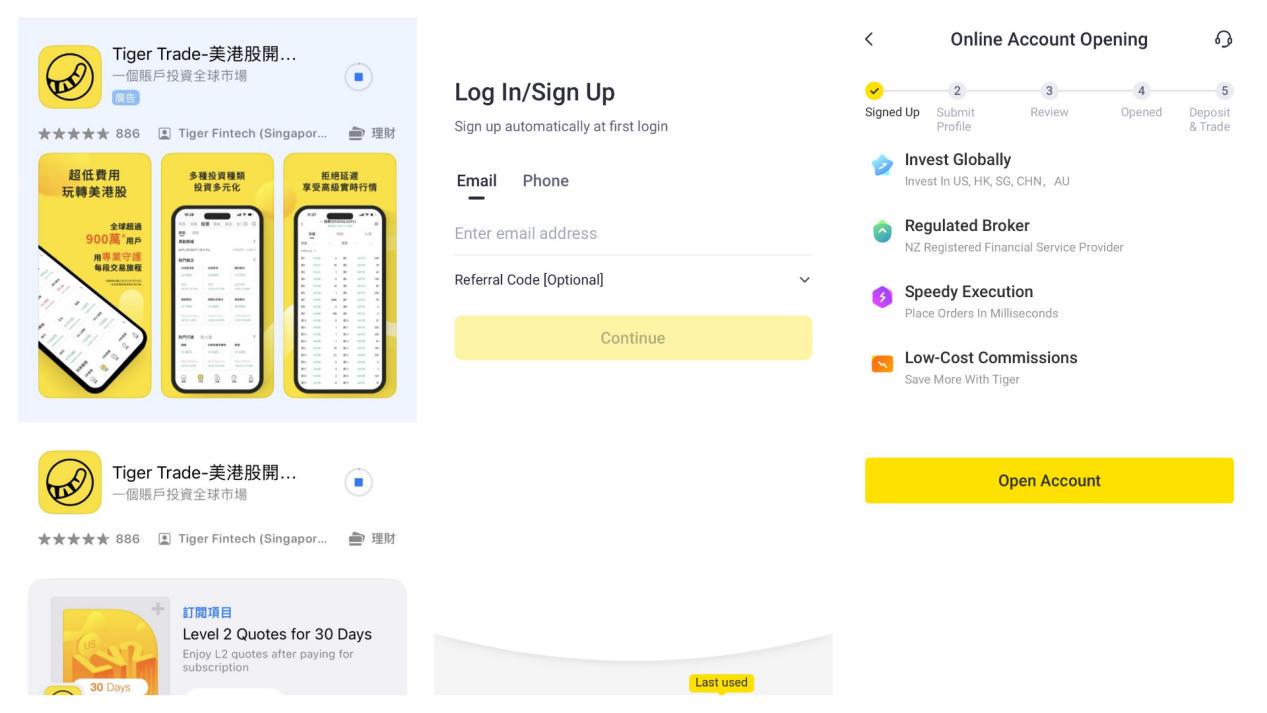

1、Open a Tiger Trade account:

Download the Tiger Trade app or visit our website.

Register for an account, typically using Singpass for faster verification.

Awaiting review by Tiger Brokers, typically taking 1-3 business days.

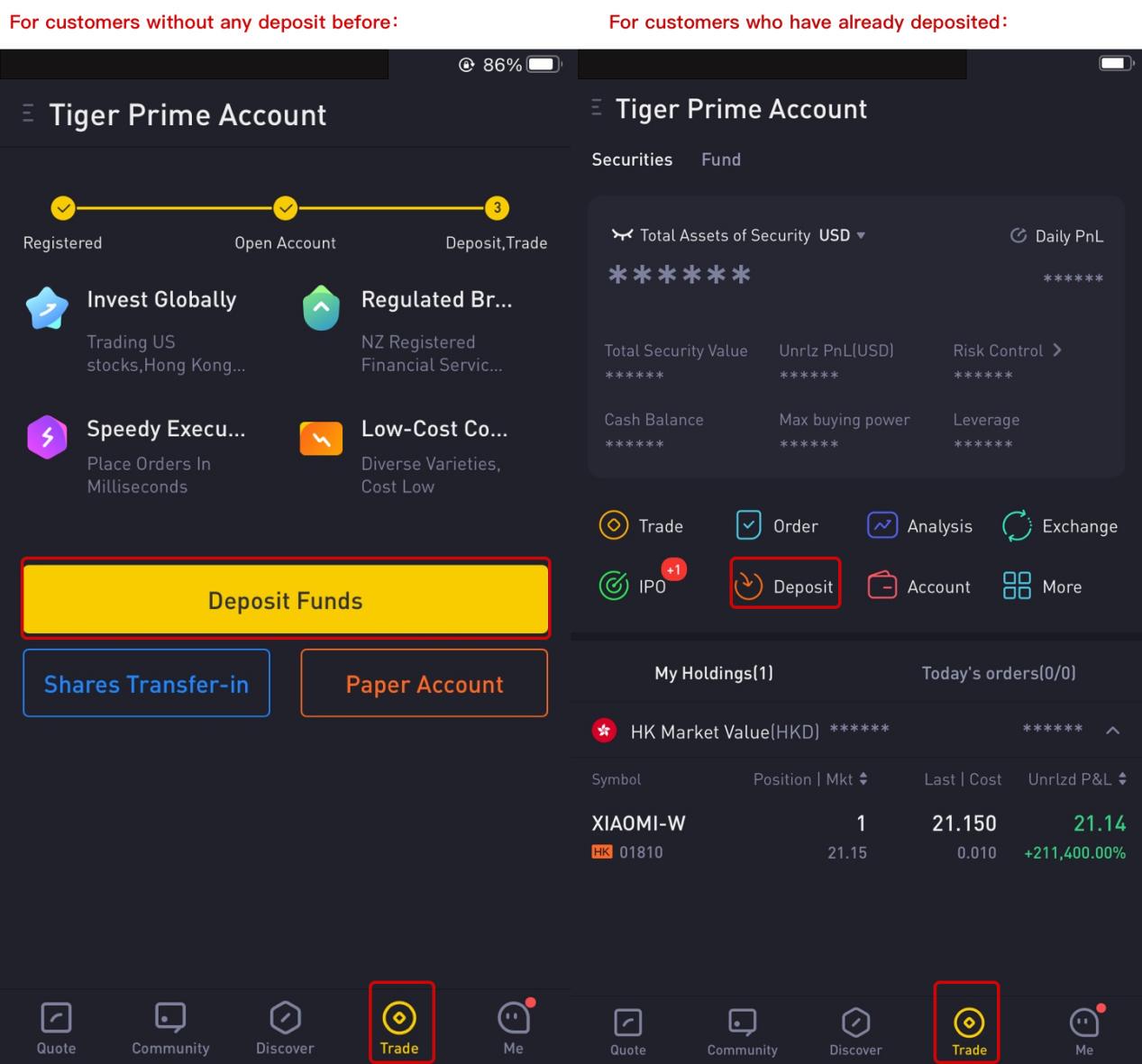

2、Fund your account:

Choose currency - USD or SGD.

Bank transfers to fund.

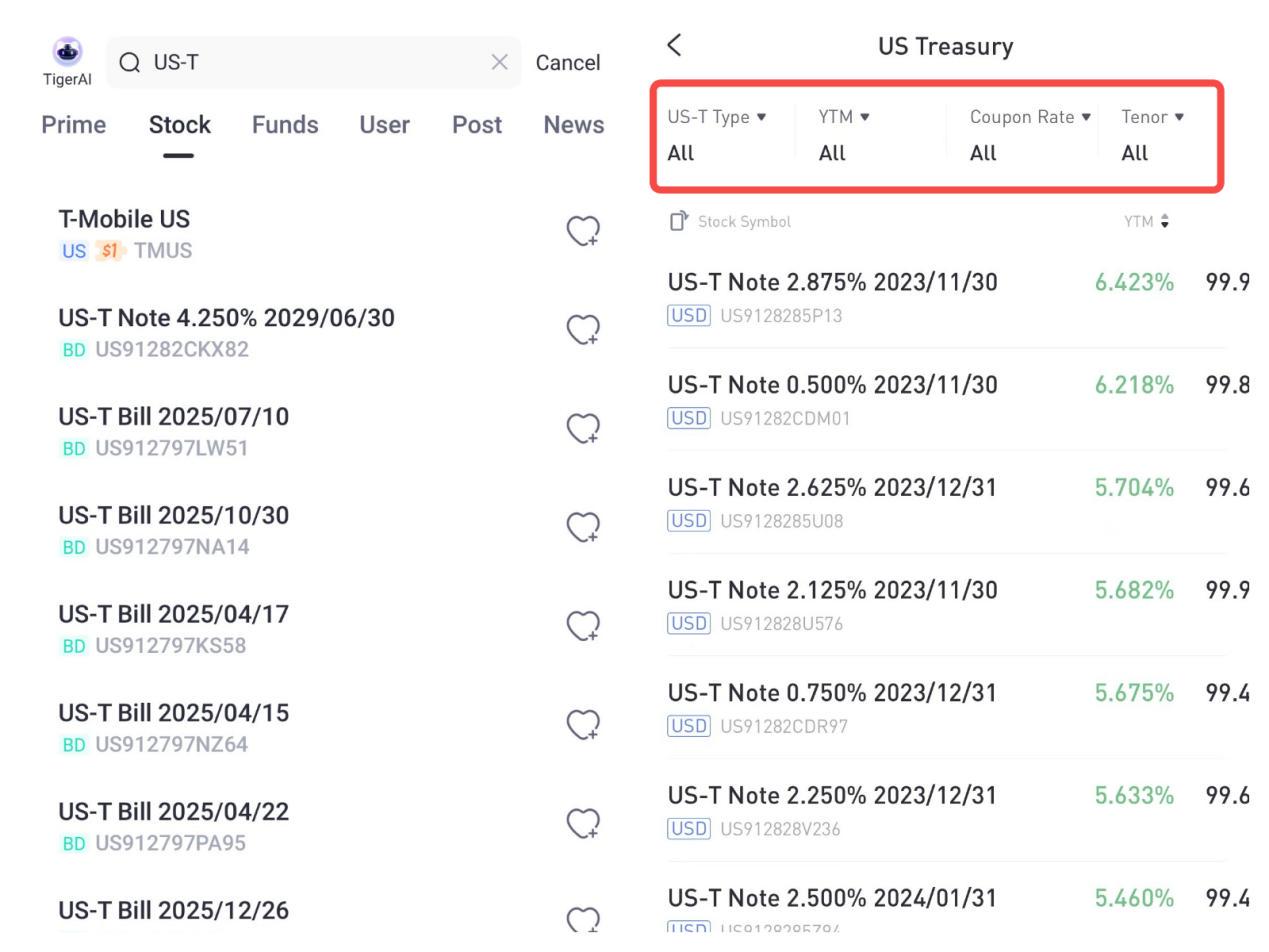

3、US treasuries selection:

Enter “US-T” in the search bar to view related US treasury products.

Use the filter bar to specify the type of treasury bond, desired yield to maturity, coupon rate, and remaining term to find a suitable treasury bond product.

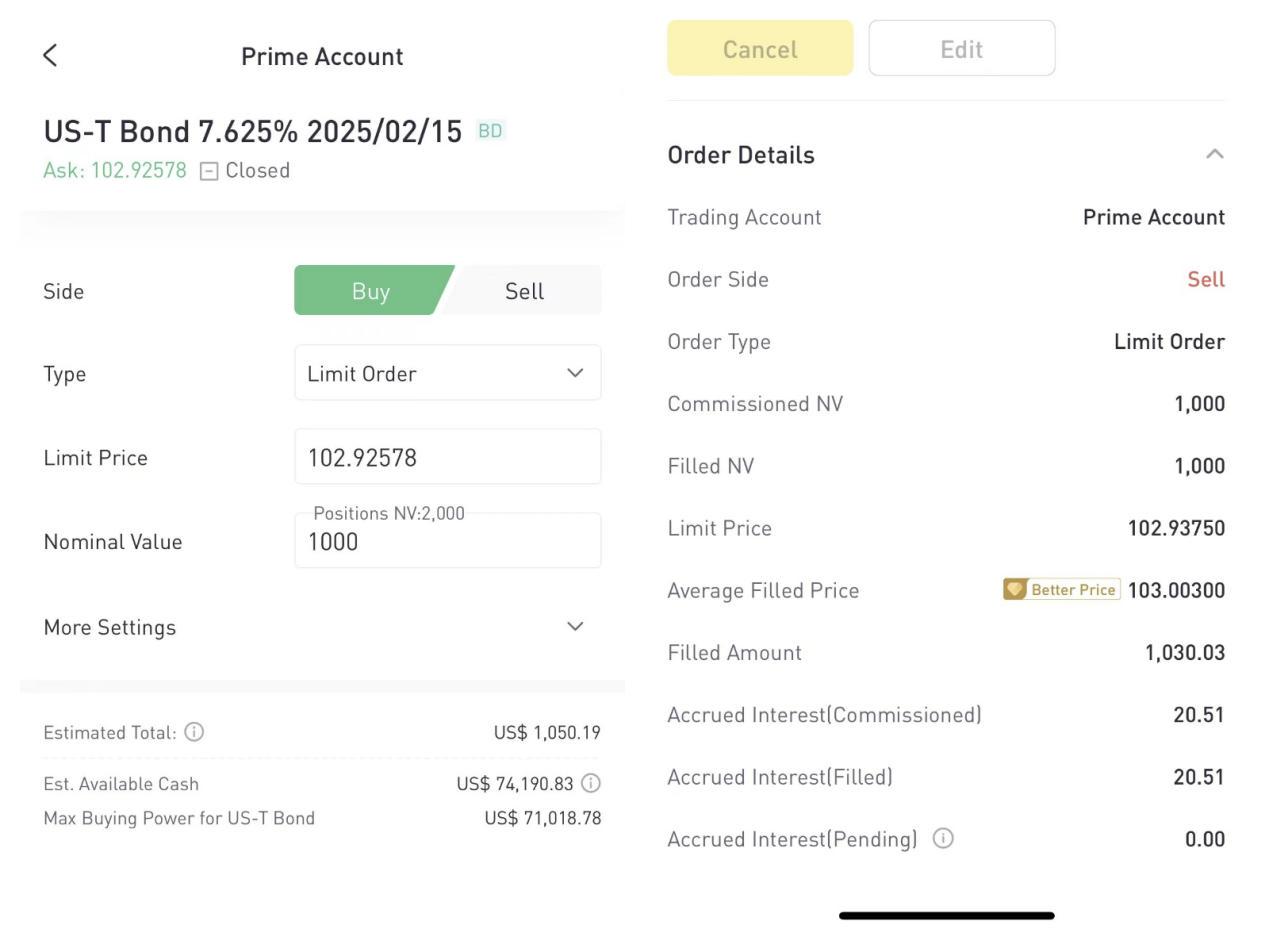

4、Place an order

Click “Buy” to enter the order page for treasury bonds.

Enter your desired purchase price for bonds, which are typically quoted per $100 of face value, and choose between placing a limit order or a market order.

Enter the “Nominal Value” you want to buy, typically in increments of USD 1,000.

Confirm the trade by entering your trading password.

(Screenshots are only for illustrative purposes.)

Conclusion

U.S. Treasuries are USD-denominated securities available to Singaporean investors through certain trading platforms such as Tiger Trade.

Like all investments, they carry risks, including interest rate risk and currency risk. When considering these instruments, factors like interest rate fluctuations and SGD/USD exchange rate movements are worth noting.

References

https://tradingeconomics.com/united-states/government-bond-yield

https://eservices.mas.gov.sg/statistics/fdanet/SgsBenchmarkIssuePrices.aspx

Disclaimer:

The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future performance. Investment involves risk. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any person or affiliated companies. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, objectives and circumstances. Tiger Brokers assumes no fiduciary responsibility or liability for any consequences financial or otherwise arising from trading in securities if opinions and information in this document may be relied upon. This advertisement has not been reviewed by the Monetary Authority of Singapore.