Assessing Diodes (DIOD) Valuation Following Launch of Advanced 48V Automotive Buck Converters

Diodes (DIOD) just made waves with the launch of four new automotive-grade asynchronous buck converters aimed at 48V point-of-load applications. These compact devices are built to handle everything from motor control to advanced driver assistance systems across the full automotive battery range. The technical improvements, such as fast transient response, advanced protection features, and noise reduction, are designed to meet pressing industry demands for more reliable and simplified power solutions in next-generation vehicles.

This move arrives as Diodes looks to reenergize momentum after a tough year in the markets. Despite impressive annual growth in revenue and net income, the stock is still down nearly 20% over the past twelve months and has slipped 8% since January. There has been a strong rally in the past three months, with shares up 21%, suggesting investors are taking another look in light of product innovation and recent conference appearances. However, longer-term returns remain mixed compared to sector peers.

After last year’s rocky ride and a recent burst of optimism, some questions remain about whether the market is still discounting Diodes’ growth potential or if buyers are getting ahead of themselves.

Most Popular Narrative: 4% Undervalued

According to the community narrative, Diodes is currently priced below its calculated fair value. This reflects optimism around the company’s future growth prospects and underlying market catalysts.

Rapid electrification in automotive, particularly EVs in China, is leading to growing content per vehicle and an expanding set of design wins for Diodes' automotive-qualified products (such as protection devices, LED controllers, and power management ICs). This supports higher average selling prices and future margin expansion. Strategic focus on new product introductions, especially in high-margin analog, mixed-signal, and power management segments, positions Diodes to benefit from product mix improvement. This could translate into structurally higher gross and operating margins over time.

Is Diodes’ true value hiding in plain sight? The narrative’s calculations hinge on projected margin expansion, manufacturing efficiency, and outsized bottom-line growth. Wondering what future milestones analysts believe could unlock even greater upside? Discover the surprising assumptions and benchmarks that could reshape your view of this semiconductor player.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistently high inventory levels and the company’s reliance on cyclical, consumer-driven sales could undermine the bullish outlook if demand softens.

Find out about the key risks to this Diodes narrative.Another View: Multiples Challenge the Optimism

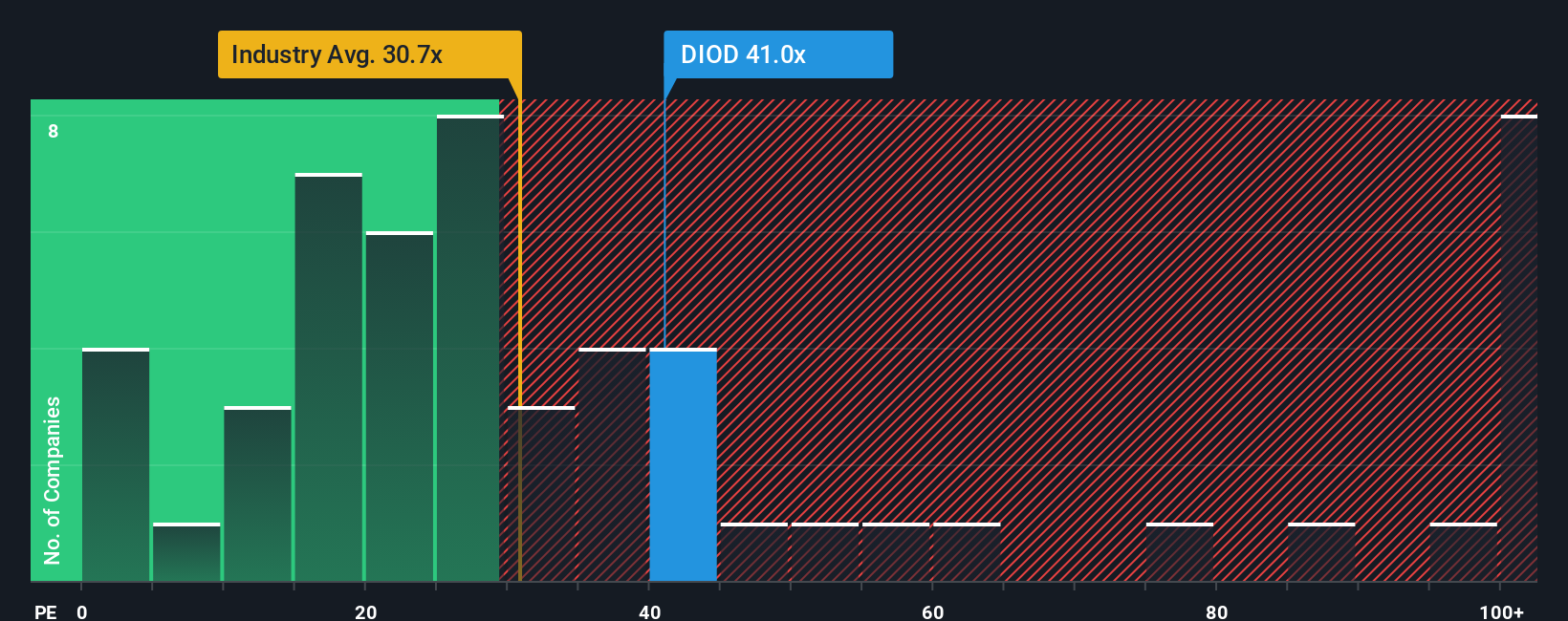

Looking at the company through the lens of price-to-earnings compared to the US semiconductor industry, Diodes actually appears expensive rather than cheap. This raises questions about whether the current optimism is already reflected in the share price. Is it possible that the market may not be as generous as some narratives suggest?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Diodes Narrative

If you see things differently or want to dive into the numbers yourself, you can craft a personalized narrative in just a few minutes using do it your way.

A great starting point for your Diodes research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investing means not limiting yourself to one stock or strategy. Expand your search and find your next opportunity by exploring promising companies across different themes. These carefully selected screens can help you discover exceptional businesses that fit your goals, whether you are seeking growth, stability, or innovation.

- Uncover generous income potential by exploring dividend stocks with yields > 3% and identifying companies offering yields above 3% for your portfolio.

- Begin building wealth early by exploring penny stocks with strong financials, featuring up-and-coming stocks with strong financials.

- Enhance your returns with AI penny stocks, highlighting businesses leading the way in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10