High Growth Tech Stocks To Watch In The US August 2025

As the U.S. markets experience a tech stock slump with the S&P 500 falling for the fourth consecutive day, all eyes are on Federal Reserve Chair Jerome Powell's upcoming speech for potential insights into future interest rate adjustments. In this environment of heightened volatility and investor caution, identifying high growth tech stocks that demonstrate resilience and potential in innovation can be crucial for navigating these challenging market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.87% | 25.66% | ★★★★★☆ |

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.25% | 31.57% | ★★★★★★ |

| Workday | 11.35% | 29.87% | ★★★★★☆ |

| OS Therapies | 57.14% | 70.11% | ★★★★★☆ |

| Mereo BioPharma Group | 51.44% | 64.61% | ★★★★★★ |

| Circle Internet Group | 27.36% | 78.79% | ★★★★★☆ |

| RenovoRx | 65.63% | 68.83% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Gorilla Technology Group | 27.68% | 129.58% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

CyberArk Software (CYBR)

Simply Wall St Growth Rating: ★★★★☆☆

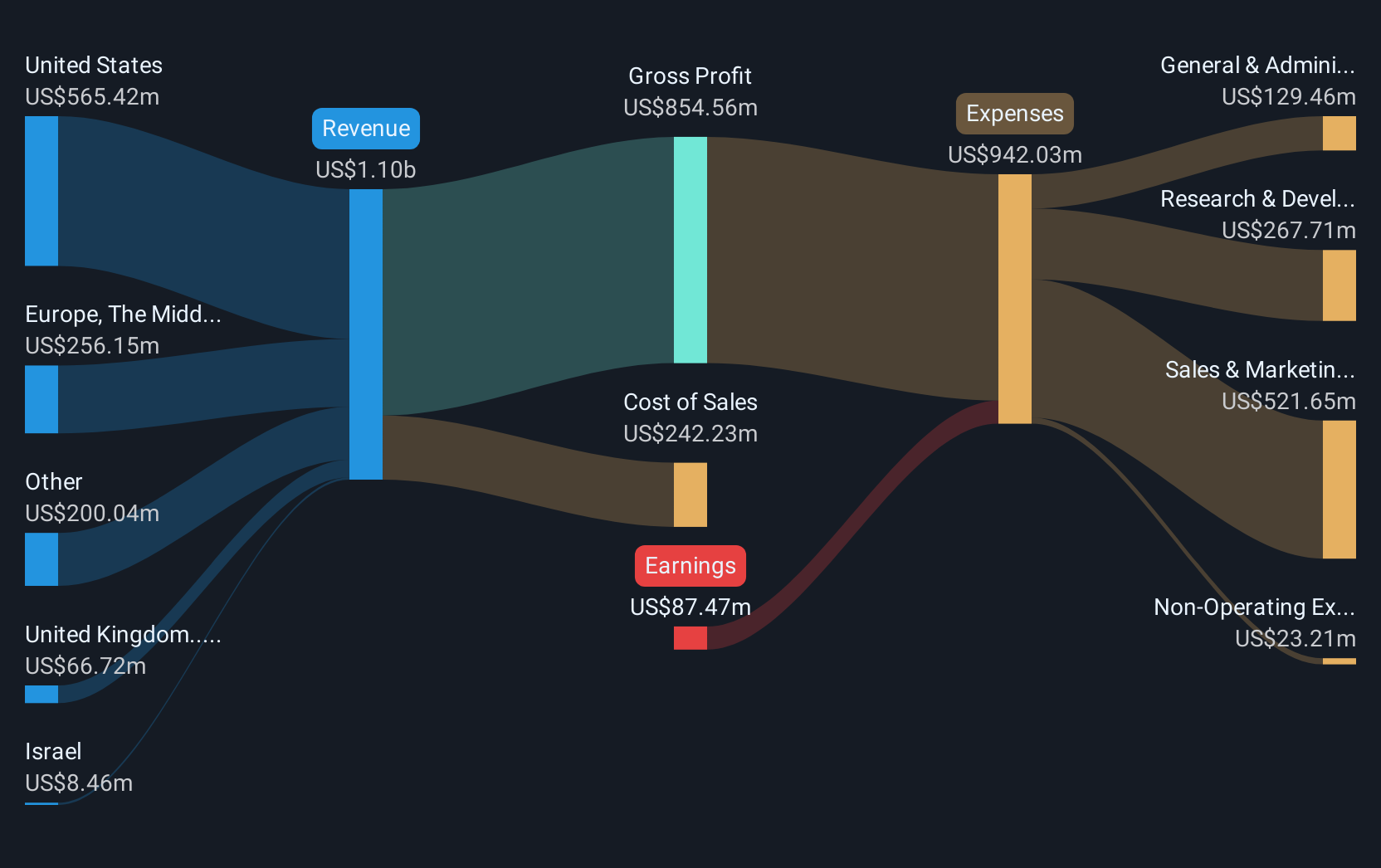

Overview: CyberArk Software Ltd. is a company that develops, markets, and sells software-based identity security solutions and services globally, with a market cap of approximately $21.75 billion.

Operations: The company generates revenue primarily from its security software and services segment, which brought in $1.20 billion.

CyberArk Software, amidst a turbulent financial period with a significant net loss of $90.83 million in Q2 2025, still showcases robust revenue growth, up by 46% year-over-year to $328.03 million. This growth trajectory is underpinned by strategic initiatives including its recent inclusion in a high-profile NIST cybersecurity project alongside tech giants like Google and Microsoft. The firm's strategic alignment with industry leaders for enhancing software supply chain security underscores its commitment to innovation in cybersecurity solutions. Moreover, the impending acquisition by Palo Alto Networks at a 26% premium indicates strong market confidence in CyberArk's value proposition within the identity security sector.

- Navigate through the intricacies of CyberArk Software with our comprehensive health report here.

Learn about CyberArk Software's historical performance.

Neurocrine Biosciences (NBIX)

Simply Wall St Growth Rating: ★★★★☆☆

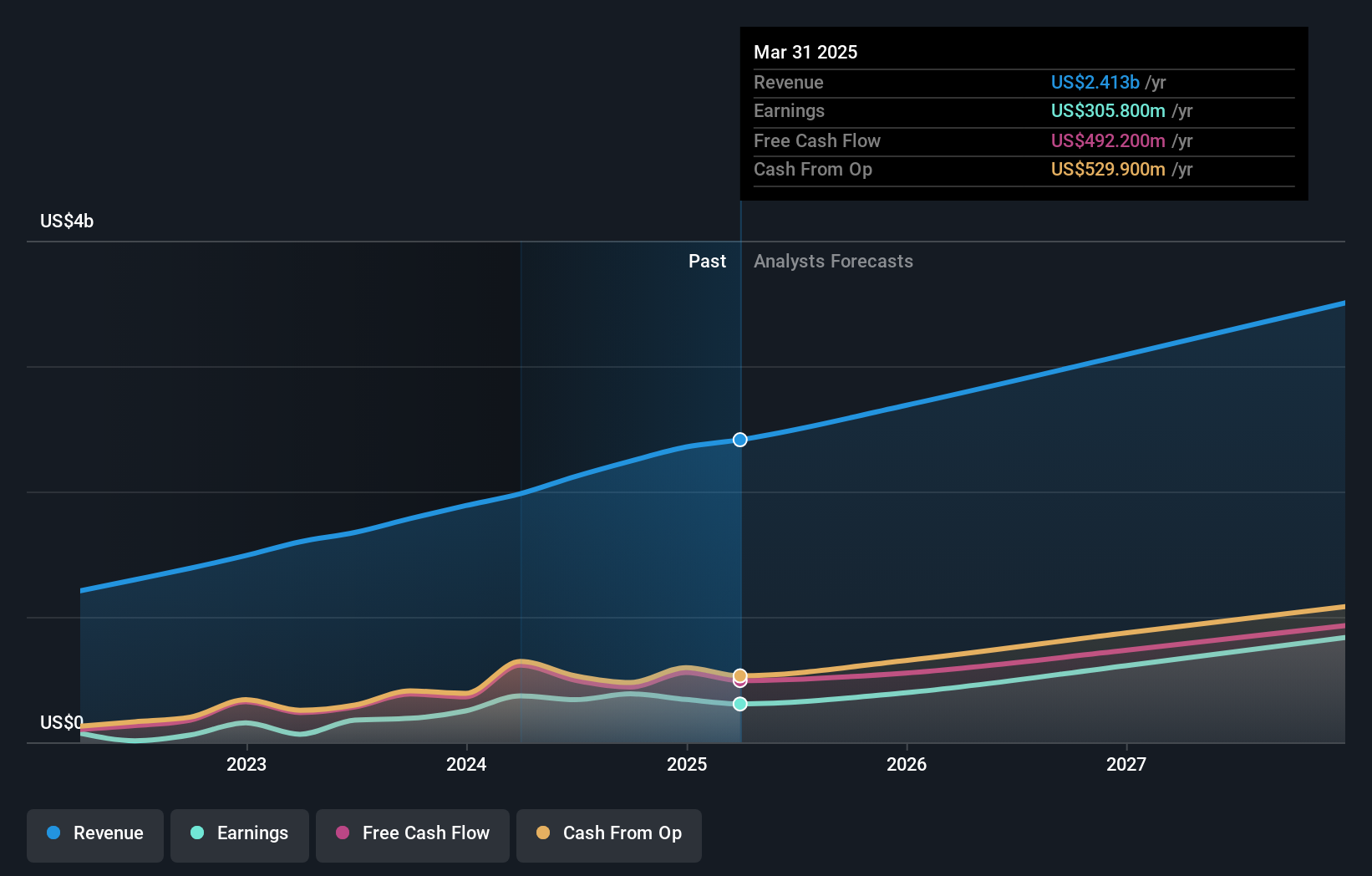

Overview: Neurocrine Biosciences, Inc. focuses on the discovery, development, and marketing of pharmaceuticals targeting neurological, neuroendocrine, and neuropsychiatric disorders in both the United States and international markets with a market cap of approximately $13.17 billion.

Operations: With a primary focus on pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders, Neurocrine Biosciences generates revenue primarily from its research, development, and commercialization efforts amounting to $2.51 billion.

Neurocrine Biosciences has demonstrated a notable uptick in its financial health, with Q2 2025 revenues soaring to $687.5 million from $590.2 million the previous year, alongside a robust increase in net income to $107.5 million from $65 million. This growth is complemented by strategic advancements such as the company's recent share repurchase, completing buybacks worth $167.73 million, which underscores their confidence in sustained growth and shareholder value enhancement. Additionally, their innovative strides in healthcare tech are evident from their collaboration with PicnicHealth on the CAHtalog Registry using AI to improve patient outcomes for congenital adrenal hyperplasia—a move that not only highlights their commitment to leveraging technology for advanced patient care but also positions them favorably within the biotech landscape for continued relevance and impact.

- Unlock comprehensive insights into our analysis of Neurocrine Biosciences stock in this health report.

Gain insights into Neurocrine Biosciences' past trends and performance with our Past report.

DoubleVerify Holdings (DV)

Simply Wall St Growth Rating: ★★★★☆☆

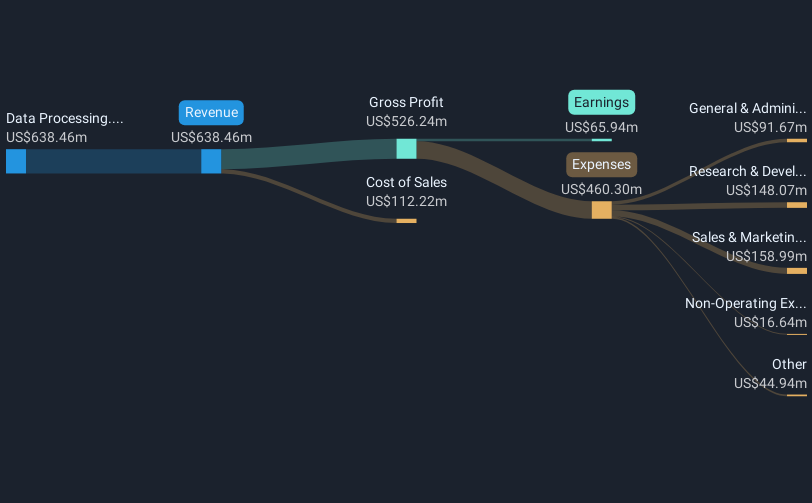

Overview: DoubleVerify Holdings, Inc. offers media effectiveness platforms both in the United States and internationally, with a market cap of $2.56 billion.

Operations: DoubleVerify Holdings, Inc. specializes in media effectiveness platforms, focusing on enhancing the quality and performance of digital advertising globally.

DoubleVerify Holdings has shown resilience and innovation in the tech landscape, notably expanding its verification capabilities across major platforms like Meta and Snap. In Q2 2025, it posted a revenue increase to $189.02 million from $155.89 million year-over-year, with net income rising to $8.76 million from $7.47 million. This growth trajectory is complemented by their recent product launches such as DV Authentic Attention® for Social, enhancing ad performance analytics on Snapchat through advanced attention measurement tools. Furthermore, the company's strategic focus on AI-driven solutions was underscored by its acquisition of Scibids in 2023, integrating AI-powered campaign optimization into its services which fortify its market position despite a competitive environment marked by rapid technological evolutions and varying advertiser needs.

- Delve into the full analysis health report here for a deeper understanding of DoubleVerify Holdings.

Gain insights into DoubleVerify Holdings' historical performance by reviewing our past performance report.

Key Takeaways

- Dive into all 67 of the US High Growth Tech and AI Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10