3 Reliable Dividend Stocks Yielding Up To 5.7%

As the U.S. stock market navigates a period of volatility with tech stocks sliding and retailers capturing attention amid earnings reports, investors are keenly observing Federal Reserve signals for potential rate cuts. In such an environment, reliable dividend stocks can offer stability and income, making them an attractive option for those looking to weather market fluctuations while benefiting from consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.56% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.73% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.23% | ★★★★★★ |

| Ennis (EBF) | 5.48% | ★★★★★★ |

| Employers Holdings (EIG) | 3.00% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.64% | ★★★★★☆ |

| Dillard's (DDS) | 5.01% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.58% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.80% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.61% | ★★★★★☆ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ACNB (ACNB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ACNB Corporation is a financial holding company that provides banking, insurance, and financial services to individual, business, and government customers in the United States with a market cap of $461.73 million.

Operations: ACNB Corporation generates its revenue primarily from banking services, contributing $114.40 million, and insurance services, which bring in $9.95 million.

Dividend Yield: 3.1%

ACNB Corporation has maintained stable and reliable dividend payments over the past decade, with a current yield of 3.07%, which is below the top quartile of US dividend payers. Despite recent dilution, its payout ratio remains reasonable at 48.1%, suggesting dividends are well covered by earnings. Recent earnings reports show increased net interest income but decreased net income compared to last year. The company also completed a share buyback program, repurchasing 2.36% of shares for $8.16 million.

- Click here to discover the nuances of ACNB with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that ACNB is trading beyond its estimated value.

Citizens & Northern (CZNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens & Northern Corporation is a bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate clients, with a market cap of $300.06 million.

Operations: Citizens & Northern Corporation generates revenue primarily through its Community Banking segment, which accounts for $108.31 million.

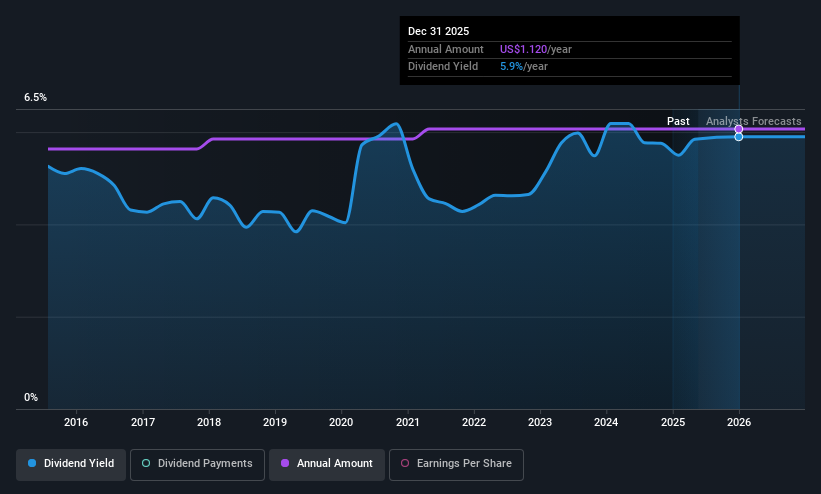

Dividend Yield: 5.8%

Citizens & Northern offers a reliable dividend yield of 5.8%, placing it in the top quartile of US dividend payers. Dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 64.2%. Recent earnings show steady net income growth, with a Q2 net interest income of US$21.14 million. However, recent impairments increased net charge-offs to $548,000 for Q2 2025, which could affect future financial stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Citizens & Northern.

- The analysis detailed in our Citizens & Northern valuation report hints at an deflated share price compared to its estimated value.

Northeast Community Bancorp (NECB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northeast Community Bancorp, Inc. is the holding company for NorthEast Community Bank, offering financial services to individuals and businesses, with a market cap of $255.78 million.

Operations: Northeast Community Bancorp, Inc. generates its revenue primarily from its Thrift / Savings and Loan Institutions segment, which accounts for $103.15 million.

Dividend Yield: 3.7%

Northeast Community Bancorp provides a stable dividend yield of 3.71%, though it falls short of the top quartile in the US market. The dividend is well-covered by earnings, with a low payout ratio of 20.7%. Despite recent declines in net interest income and net income, dividends have been reliably paid and increased over the past decade. Recent buybacks completed for $17.02 million may indicate confidence in long-term value despite near-term earnings challenges.

- Dive into the specifics of Northeast Community Bancorp here with our thorough dividend report.

- Our valuation report unveils the possibility Northeast Community Bancorp's shares may be trading at a discount.

Where To Now?

- Discover the full array of 136 Top US Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10