Wondering what to do with Woodside Energy Group stock? You are not alone. With the share price delivering a modest 0.4% pop over the past day and a sizable 23% jump in the last three months, investors are clearly noticing some shifting tides. If you are the type who keeps an eye on the long game, you might also note that Woodside's five-year total return sits just north of 92%, showing just how much fortunes can change over time.

But what is fueling these movements lately? Energy market volatility, shifting supply expectations, and global headlines have all had their say. Still, Woodside’s price remains about 3.5% below analyst targets. According to a value score based on six core valuation checks, the company looks undervalued in four out of six, giving it a healthy score of 4. Not too shabby for a name that has seen both ups and downs in its recent growth figures.

If all this price action has you asking whether now is the time to buy, hold, or cash out, it is the perfect moment to dig deeper. Next up, we will break down the common valuation frameworks used by analysts, compare how Woodside Energy stacks up, and just as importantly, reveal a more insightful way to understand whether the market is truly underestimating Woodside’s potential.

Woodside Energy Group delivered 11.0% returns over the last year. See how this stacks up to the rest of the Oil and Gas industry.Approach 1: Woodside Energy Group Cash Flows

The Discounted Cash Flow (DCF) model works by estimating what a business’s future cash flows might look like and then discounting them back to today’s value. This method aims to calculate what the company is really worth based on the money it is expected to generate over time.

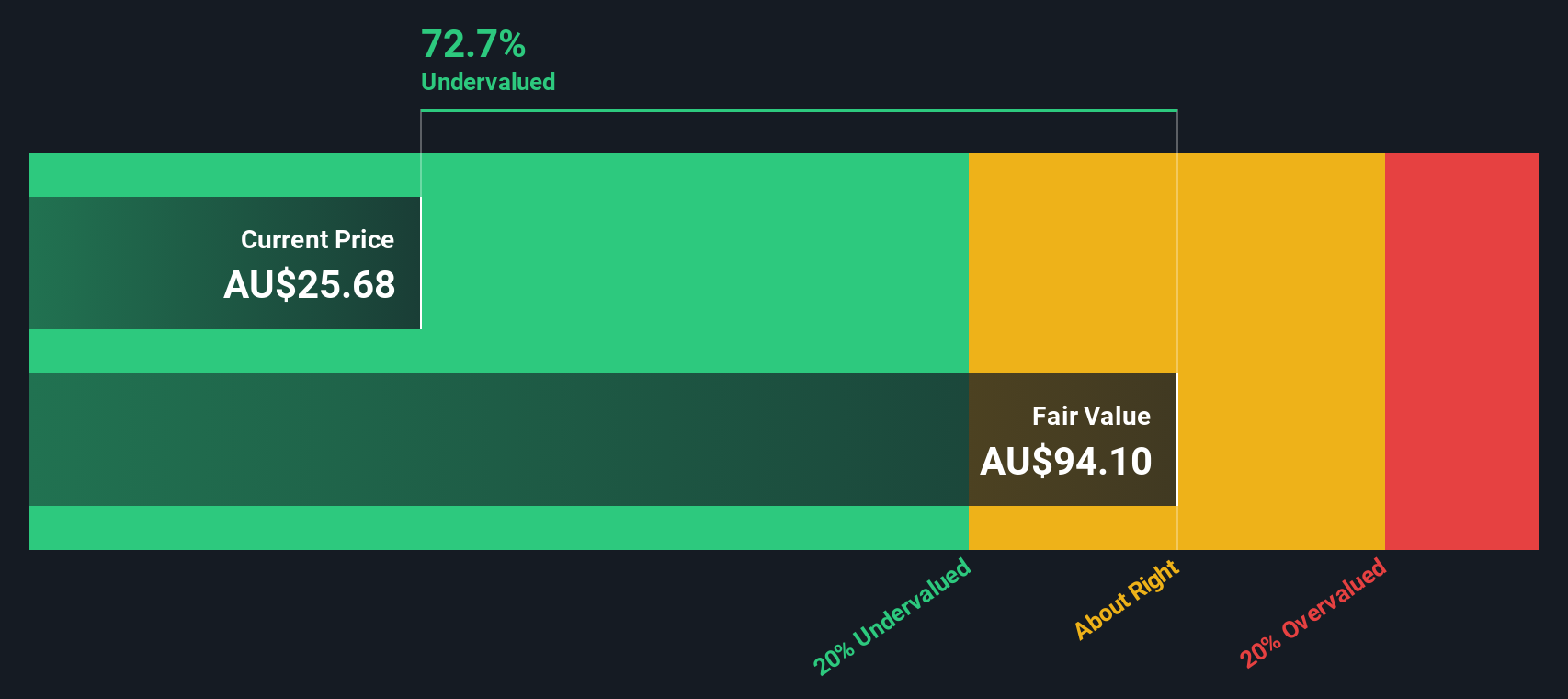

Woodside Energy Group reported a Last Twelve Months (LTM) Free Cash Flow of A$1.17 billion. Analysts and estimates project continued growth, with free cash flow projected to rise to A$3.72 billion in 2035. The estimated fair value for the stock, based on this 2-Stage Free Cash Flow to Equity model, is A$57.97 per share.

Comparing this intrinsic value to the current share price, the DCF calculation suggests Woodside Energy is trading at a 54.1% discount. In other words, the stock appears 54.1% undervalued according to this framework.

Result: UNDERVALUED

Approach 2: Woodside Energy Group Price vs Earnings

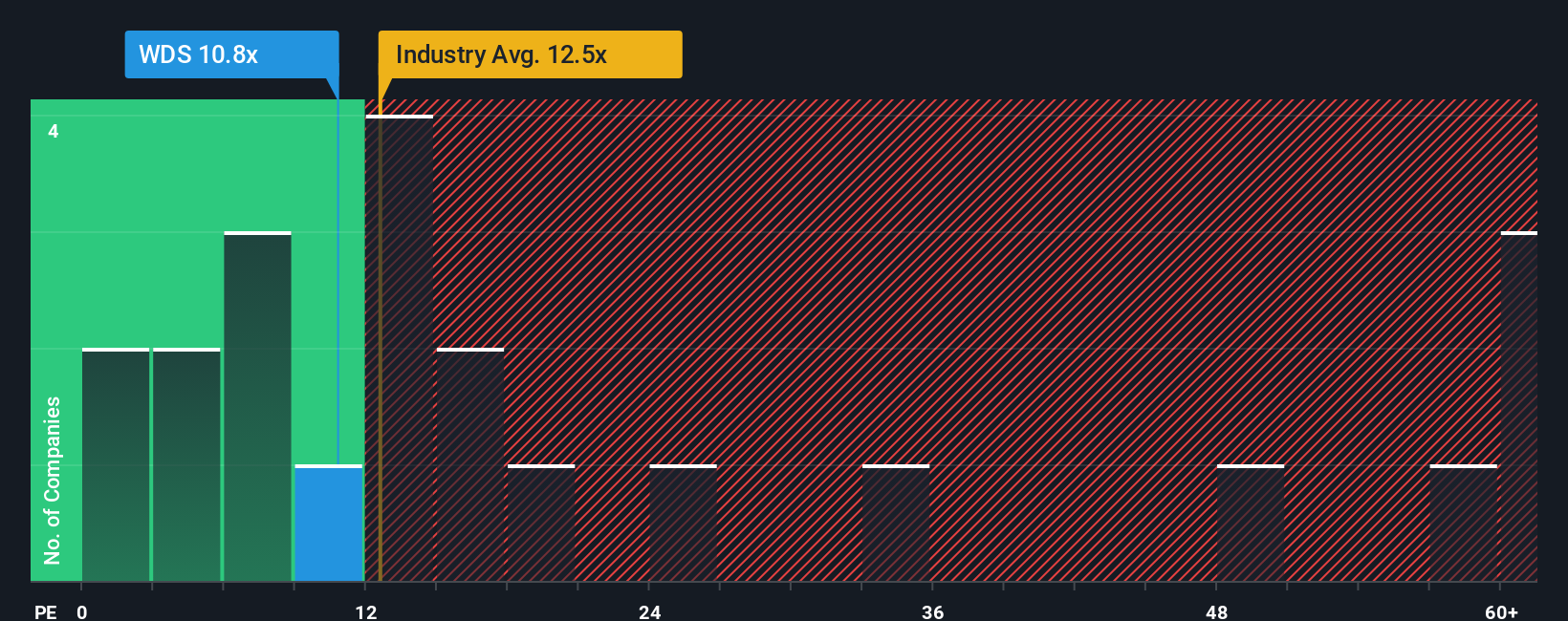

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies because it is straightforward and connects a company’s share price directly to its earnings. When consistent profits underpin the business, as with Woodside Energy Group, the PE ratio can act as a reliable gauge of investor expectations for future growth.

Growth prospects and risk play a big role in shaping what is considered a “normal” or “fair” PE ratio. If a company shows strong earnings growth and stability, the market generally rewards it with a higher PE. Conversely, greater risks or slower growth tend to drag the PE ratio lower.

Right now, Woodside Energy Group trades on a PE of 11x. That stands near its peer average of 10.7x, but below the wider oil and gas industry average of 12.1x. The company’s Fair Ratio, a proprietary benchmark that factors in its earnings outlook, risk, margins, and size, sits higher at 15.3x. This suggests the market is pricing Woodside’s shares at a discount relative to its expected performance and characteristics.

Compared to its Fair Ratio, the current PE implies that Woodside is undervalued based on this approach.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Woodside Energy Group Narrative

Instead of just relying on ratios or single forecasts, Narratives offer a smarter, more flexible way to make investment decisions by letting you define your own story and outlook for a company, including your expectations for fair value, future revenue, earnings, and margins.

Think of a Narrative as the bridge that connects a company’s bigger picture, such as its projects, risks, and opportunities, with financial forecasts and a resulting fair value. This way, your investment decisions are backed by both numbers and context.

On the Simply Wall St platform, Narratives are easy to build and share. This allows anyone, from beginners to seasoned investors, to capture and compare their unique perspectives within a large, engaged investor community.

With Narratives, you can track how your view of Woodside Energy Group might differ from others. You can then compare your Fair Value estimate directly to today’s share price to help decide if it is time to buy, hold, or sell.

Even better, Narratives update dynamically as new news, analyst forecasts, or company results come in so your investment thesis stays relevant and actionable.

For example, some investors currently see Woodside Energy Group’s fair value as high as A$41.48, while others estimate it as low as A$21.47. This shows just how much your story and outlook can influence your assessment of the stock’s opportunity.

Do you think there's more to the story for Woodside Energy Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woodside Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com