1 Green Flag for Boeing Stock Right Now

-

Boeing's commercial airplane business is making a recovery and regaining trust with airlines and investors.

-

The aerospace giant's defense business has finally returned to profitability after a senior management change.

If you think that one executive can't change that much at Boeing (BA 2.38%), just ask shareholders at its partner, engine maker GE Aerospace, about its CEO, Larry Culp. While Boeing's CEO, Kelly Ortberg, is unlikely to generate the kind of returns that Culp has for the former General Electric investors, he is making great strides in improving matters at Boeing.

A heavyweight Boeing board hires Ortberg

Boeing's board of directors has been significantly improved in recent years, and it contains industrial heavyweights like Carrier Global CEO David Gitlin, former GE Aviation CEO David Joyce, and former United Technologies CFO Akhil Johri. Their choice of former Collins Aerospace CEO Ortberg (a colleague of both Gitlin and Johri at United Technologies) looks like a great decision.

Improvements all around

Since Ortberg's appointment in August 2024, Boeing has improved its production rate on the 737 MAX, reaching its initial target of 38 a month in the second quarter, and Ortberg expects Boeing will seek approval from the Federal Aviation Administration (FAA) to increase production to 42 a month soon. Improving the production rate on the 737 MAX is the key to growing profit margin and cash flow at the company.

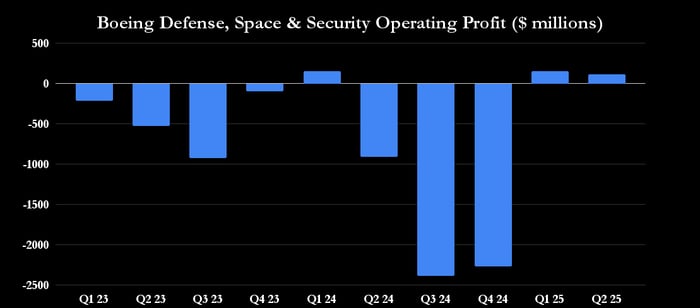

However, the most significant improvement is arguably in the defense business, Boeing Defense, Space & Security (BDS). One of the first things Ortberg did was to replace BDS CEO Ted Colbert in September 2024 with Boeing veteran Steve Parker. As you can see in the chart below, BDS is now generating profit again, after a long period of losses.

Data source: Boeing presentations. Chart by author.

Most notably, Ortberg said BDS "had another good quarter on our fixed-price development programs" and held its estimated-at-completion (cost forecasts based on performance) for the second consecutive quarter. That's a big deal for a business which struggled to keep a lid on costs under Colbert.

It all points to improved execution at Boeing, and with a $619 billion backlog, there's plenty of potential for the improved execution to lead to profit growth at Boeing.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10