High Insider Ownership Growth Stocks To Watch In August 2025

In the wake of Federal Reserve Chair Jerome Powell's recent comments indicating potential interest rate cuts, U.S. markets have surged with the Dow Jones Industrial Average reaching a record high. This optimistic market environment highlights the importance of identifying growth companies with substantial insider ownership, as these stocks can offer unique insights into company confidence and potential resilience amidst shifting economic policies.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Prairie Operating (PROP) | 30.4% | 86.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hippo Holdings (HIPO) | 12.9% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 41.5% |

| FTC Solar (FTCI) | 23.2% | 63.1% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.5% |

| Astera Labs (ALAB) | 12.3% | 37.1% |

Click here to see the full list of 194 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let's uncover some gems from our specialized screener.

Clearfield (CLFD)

Simply Wall St Growth Rating: ★★★★☆☆

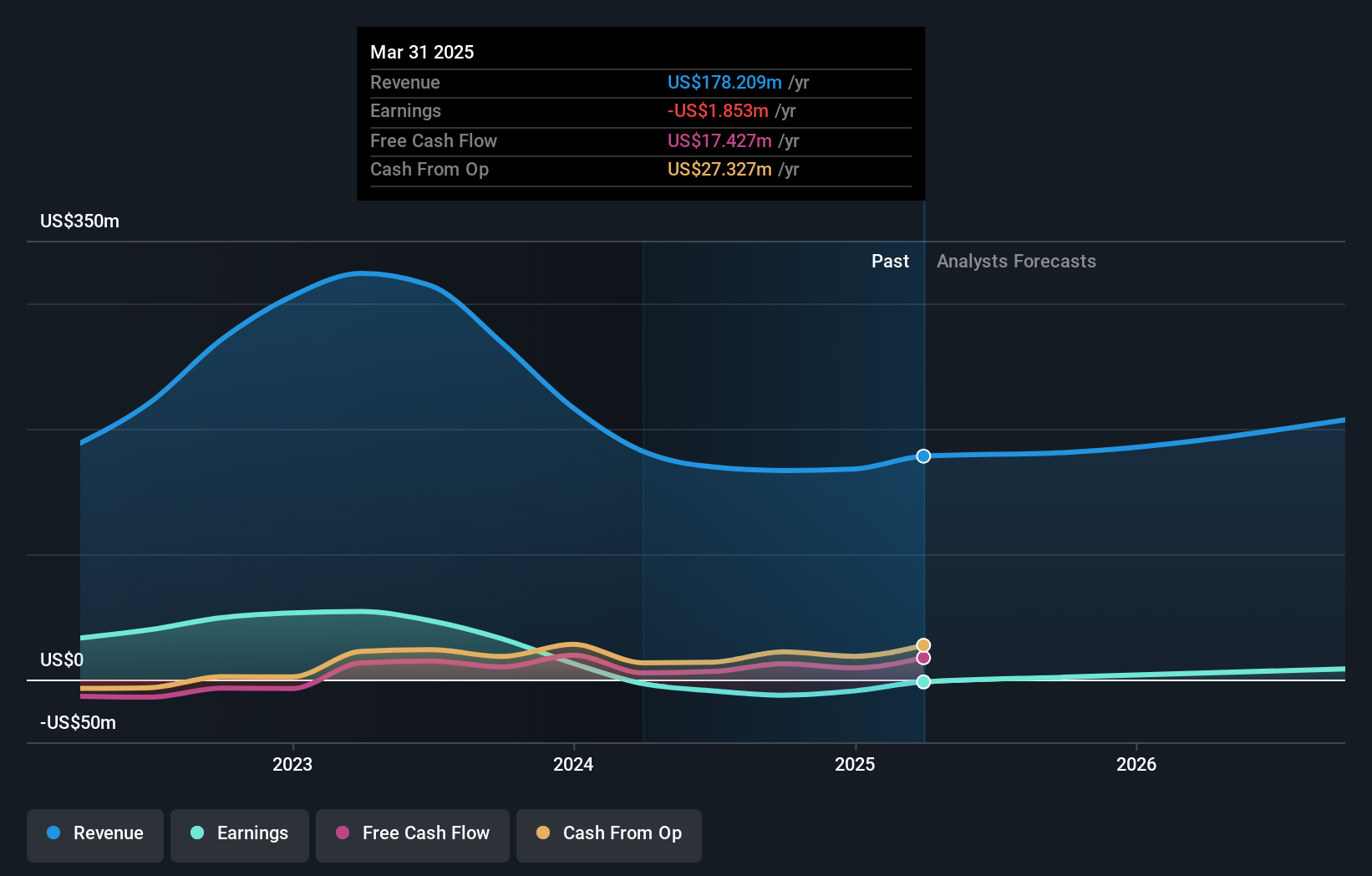

Overview: Clearfield, Inc. manufactures and sells various fiber connectivity products both in the United States and internationally, with a market cap of $429.78 million.

Operations: The company generates revenue from its fiber connectivity products, with $145.33 million coming from Clearfield and $36.06 million from Nestor Cables.

Insider Ownership: 17.3%

Return On Equity Forecast: N/A (2028 estimate)

Clearfield, Inc. has demonstrated significant growth potential with its earnings expected to rise substantially over the next three years, outpacing the US market. Recent financial results show a turnaround from losses to profitability, with net income of US$1.61 million in Q3 2025 compared to a loss last year. The company raised its revenue guidance for 2025 and continues strategic share buybacks, enhancing shareholder value while maintaining strong insider ownership.

- Take a closer look at Clearfield's potential here in our earnings growth report.

- The analysis detailed in our Clearfield valuation report hints at an deflated share price compared to its estimated value.

Eton Pharmaceuticals (ETON)

Simply Wall St Growth Rating: ★★★★★☆

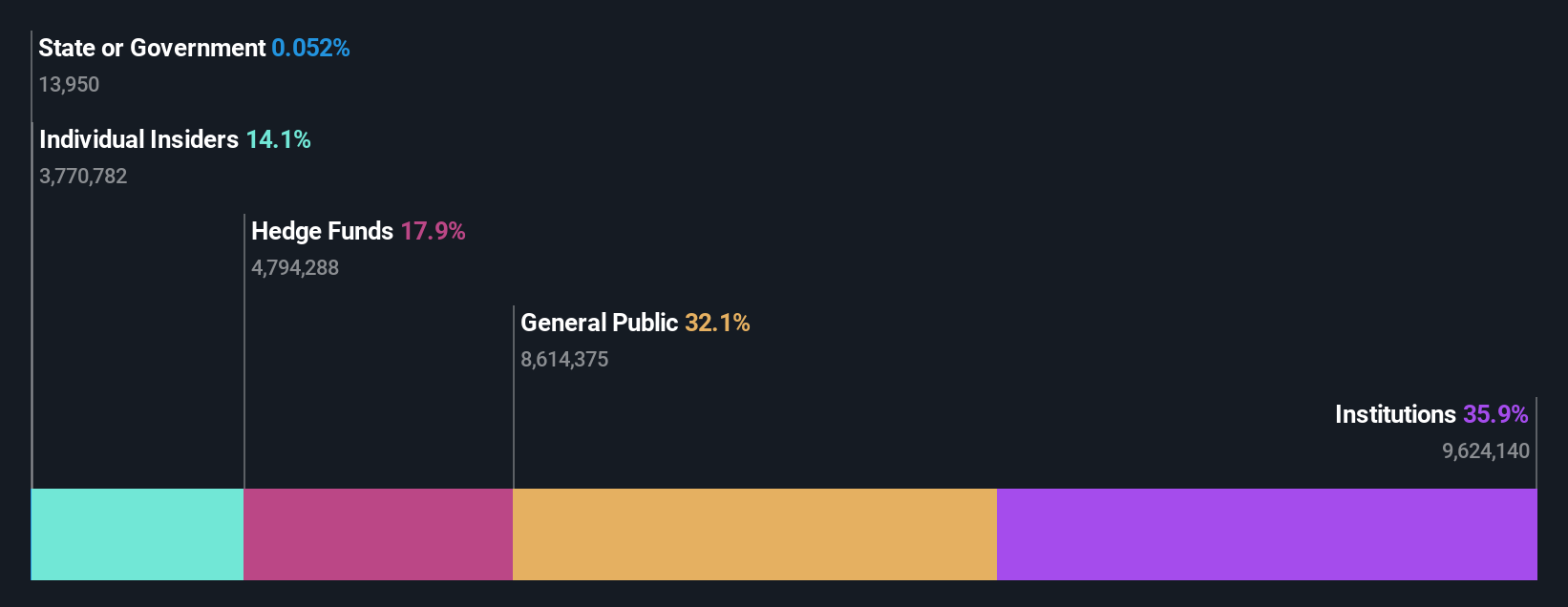

Overview: Eton Pharmaceuticals, Inc. is a pharmaceutical company that develops and commercializes treatments for rare diseases, with a market cap of $443.83 million.

Operations: The company's revenue is primarily derived from its focus on developing and commercializing prescription drug products, amounting to $58.18 million.

Insider Ownership: 14.1%

Return On Equity Forecast: N/A (2028 estimate)

Eton Pharmaceuticals is poised for growth with earnings projected to increase 50.75% annually, surpassing US market averages. The company reported significant revenue gains in Q2 2025, reaching US$18.93 million, nearly doubling from the previous year. Despite recent insider selling, Eton's addition to multiple Russell growth indices highlights its potential. The FDA's acceptance of their new drug application and positive revenue guidance further support its trajectory towards profitability within three years.

- Click to explore a detailed breakdown of our findings in Eton Pharmaceuticals' earnings growth report.

- Our valuation report here indicates Eton Pharmaceuticals may be undervalued.

Atour Lifestyle Holdings (ATAT)

Simply Wall St Growth Rating: ★★★★★★

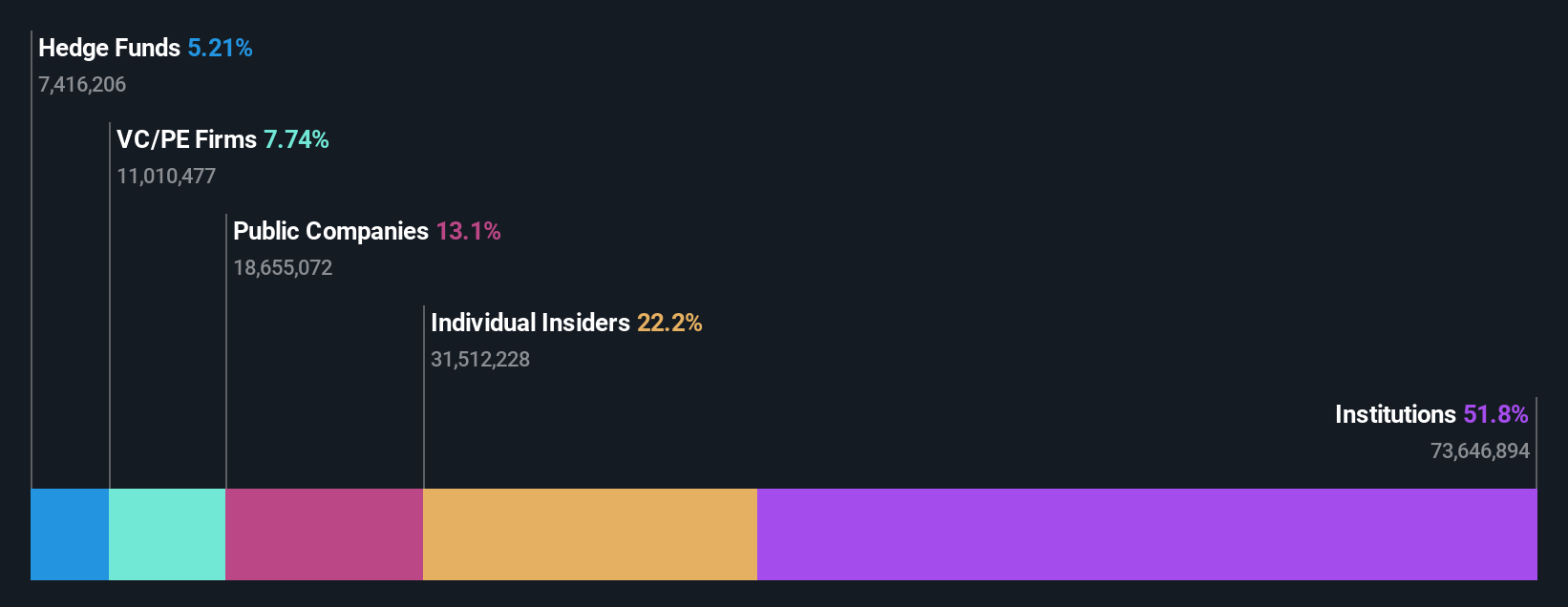

Overview: Atour Lifestyle Holdings Limited, with a market cap of $4.67 billion, develops lifestyle brands centered around hotel offerings in the People’s Republic of China through its subsidiaries.

Operations: The company's revenue is primarily generated from the Atour Group segment, which amounts to CN¥7.69 billion.

Insider Ownership: 21.9%

Return On Equity Forecast: 44% (2028 estimate)

Atour Lifestyle Holdings, a Shanghai-based hotel chain, is experiencing robust growth with earnings forecasted to rise 23.5% annually, outpacing the US market. The company anticipates revenue growth of 20.8% per year and plans a share repurchase program worth US$400 million to enhance shareholder value. Despite lower Q1 net income compared to last year, Atour's strategic move towards a second Hong Kong listing could mitigate delisting concerns in the US market.

- Dive into the specifics of Atour Lifestyle Holdings here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Atour Lifestyle Holdings is trading behind its estimated value.

Taking Advantage

- Investigate our full lineup of 194 Fast Growing US Companies With High Insider Ownership right here.

- Seeking Other Investments? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10