Teradyne (TER): Evaluating Valuation After a Quiet but Notable Stock Surge

Teradyne (TER) shares have been quietly making moves this month, catching some investors off guard. There was no headline-grabbing event to set things in motion, but the stock's recent surge of nearly 17% over the past month is hard to ignore. This kind of swing, absent a big announcement, often gets investors thinking: is something quietly shifting under the hood, or is the market simply readjusting its view on what Teradyne is worth after a stretch of sluggish performance?

Looking at the bigger picture, Teradyne's longer-term story is a mix of rebounds and pullbacks. The stock is still down roughly 16% over the past year, even with the recent upswing, and is sitting off its year-to-date highs. Yet, zooming out, returns over three and five years show gains of 15% and 32% respectively. This suggests a company experiencing periods of momentum, though not rapid or continual growth. While there has not been a specific news item sparking this rally, the shift in momentum this month is raising fresh questions about valuation and future returns.

After last year's slide and the sudden lift in the past month, some investors may be considering whether Teradyne is starting to look like a bargain, or if the market is simply pricing in optimism about its growth pipeline.

Most Popular Narrative: 5.8% Undervalued

According to community narrative, Teradyne is considered moderately undervalued, with analysts expecting meaningful improvements in both earnings and revenue as a result of growth in automation and AI-related technology.

Teradyne expects significant future growth potential from AI accelerators, robotics, and semiconductor automation. These areas are being driven by long-term industry themes such as AI, verticalization, and electrification, and are likely to boost future revenue.

The real magic behind this narrative lies in bold forecasts, especially rapid scaling in earnings and margins, with expectations for a future profit profile more commonly seen in market leaders. Interested in the aggressive growth, profitability, and market share assumptions behind this eye-catching fair value? Discover which projections are quietly shaping the story and driving this perspective of undervaluation.

Result: Fair Value of $116.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing trade tensions and declining robotics revenue could quickly challenge these upbeat forecasts if macro conditions fail to improve.

Find out about the key risks to this Teradyne narrative.Another View: Are Fundamentals Overstretched?

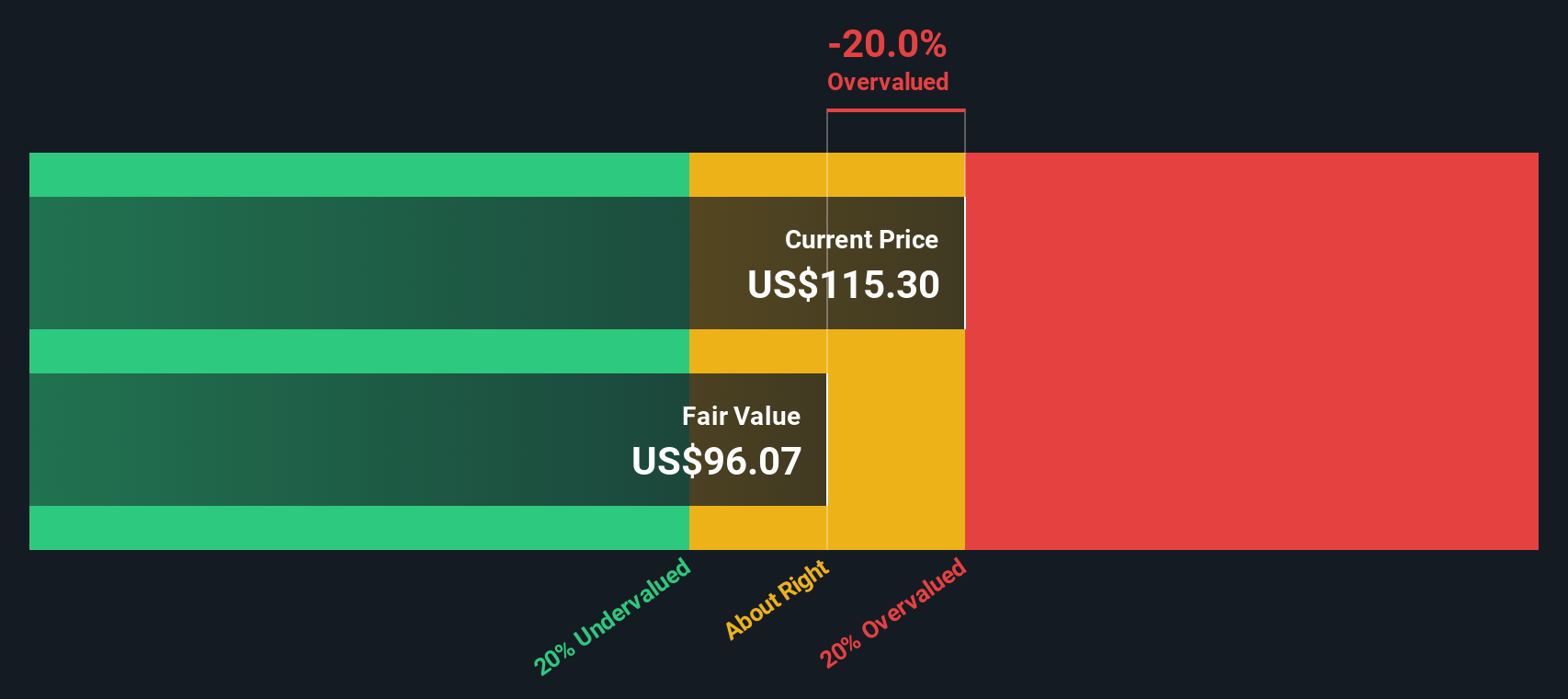

While analysts see Teradyne as undervalued with plenty of growth potential, our DCF model offers a more cautious perspective and suggests the shares might be overvalued at current levels. Which approach tells the truer story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teradyne Narrative

If you have a different view or want to dig deeper into Teradyne's numbers yourself, you can craft your own narrative in just a few minutes. do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Teradyne.

Looking for Even More Smart Investment Opportunities?

Smart investing means staying a step ahead, so don’t miss out on other hand-picked opportunities beyond Teradyne. The Simply Wall Street Screener puts you in the driver’s seat to spot compelling stocks that match your strategy. Give yourself every edge and see where your next winning idea could come from:

- Unlock steady income streams and grow your portfolio with dividend stocks with yields > 3%.

- Tap into the booming AI revolution by finding promising up-and-comers through AI penny stocks.

- Expand your reach in healthcare innovations and spot game-changers with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10