AbbVie (ABBV) Reports Positive Phase 3 Results For RINVOQ In Alopecia Areata Study

AbbVie (ABBV) recently announced positive results from pivotal studies for its drug upadacitinib, which targeted severe alopecia areata, showcasing promising therapeutic advancements. Over the last quarter, AbbVie's share price increased by 15%, coinciding with broader product announcements and a strategic dividend declaration of $1.64 per share. Despite mixed earnings reports and market fluctuations, AbbVie's advances in product development and strategic expansions may have provided support against the market's overall 1.5% decline in recent days. However, AbbVie's activities added weight to the broader price move in line with the overall positive one-year market trend.

We've identified 6 possible red flags for AbbVie that you should be aware of.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

The recent positive results from AbbVie's upadacitinib studies targeting severe alopecia areata could reinforce the company's strong narrative centered around expanding its immunology and neuroscience sectors. This aligns well with AbbVie's strategy to offset potential declines from older drugs and continue its robust revenue stream. Given the new product successes and the strategic dividend announcement, the 15% increase in AbbVie's share price over the last quarter highlights market confidence in its future prospects.

Over the past five years, AbbVie's total return, including share price and dividends, has delivered 171.10%, a significant performance indicative of the company’s long-term value creation. However, in the past year, AbbVie's stock did not perform as strongly, as it underperformed the broader US market's 14.4% return. Despite facing challenges in the previous year, the company's emphasis on product development and market expansion continues to support investor sentiment.

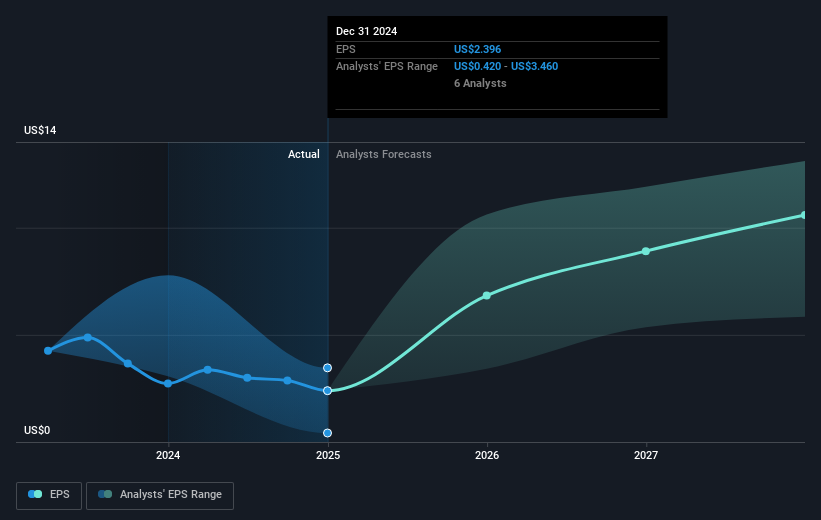

The promising trial results for new therapies could positively affect revenue and earnings forecasts, particularly as the company enhances its pipeline's depth and breadth. Analysts predict revenue growth of 7.7% annually over the next three years, along with a considerable increase in profit margins. With a current share price of $209.15 and a consensus price target of $214.77, the stock appears to be trading slightly below expectations, signifying potential future appreciation. Investors are advised to consider these factors when evaluating the stock's potential alignment with their portfolio strategies.

The analysis detailed in our AbbVie valuation report hints at an inflated share price compared to its estimated value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10