Assessing Broadridge Stock After Strong 14% Rally and Ongoing Digital Expansion in 2025

Thinking about what to do with Broadridge Financial Solutions stock right now? You are not alone. With so many investors buzzing about where the market is headed, Broadridge has been quietly putting in the work, and its share price stories reflect that determination. Whether you are a cautious buyer or someone looking for growth upside, there is a lot here to consider.

Broadridge’s recent price action makes it tough to ignore. The stock is up more than 14% year-to-date, and long-term investors have seen returns of over 26% in the past year. In fact, if you look back even further, the 5-year total return is an eye-catching 104%. This kind of track record tends to draw attention, especially given the evolving landscape in financial services and technology. Recent momentum has been fueled by steady revenue and earnings growth, reflecting both resilience and an appetite for innovation in Broadridge’s core businesses.

Of course, even the most exciting stock needs a closer look before you decide whether to buy, hold, or take profits. When it comes to value, Broadridge currently scores a 2 out of 6 based on standard undervaluation checks. In short, it is undervalued in two out of six ways analysts might typically measure. That is good to know, but it might not tell the whole story.

Valuation is more than a number, and there are a few mainstream methods we can use to see how Broadridge stacks up. Next, we will walk through those approaches and see what they reveal. Even then, there is an argument for a more holistic way of looking at this stock, and we will get to that by the end.

Broadridge Financial Solutions delivered 26.0% returns over the last year. See how this stacks up to the rest of the Professional Services industry.Approach 1: Broadridge Financial Solutions Cash Flows

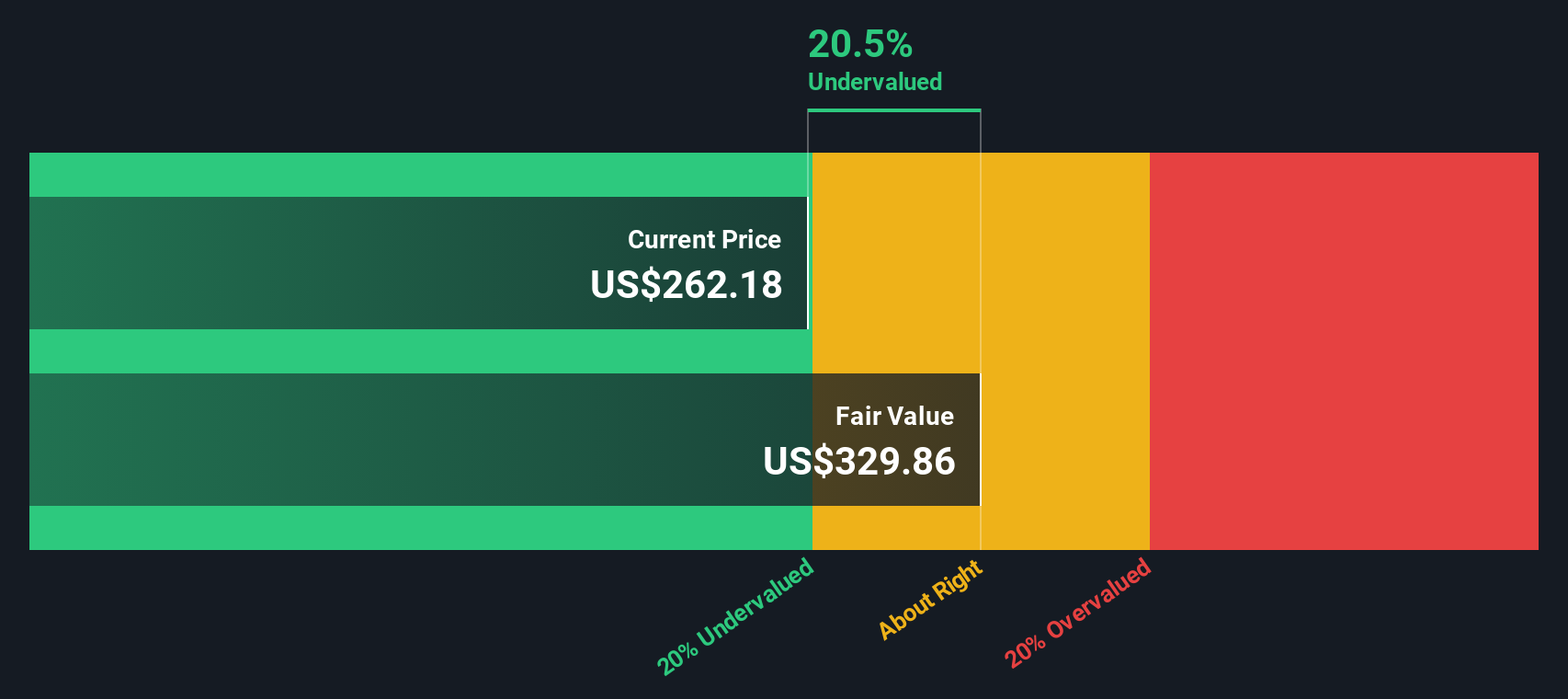

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting them back to their present value. This helps investors see what the business might be worth today, based on how much cash it is expected to generate in the years ahead.

For Broadridge Financial Solutions, the most recent Free Cash Flow is approximately $1.06 billion. Analysts expect this number to grow over time, with projections reaching $1.72 billion by 2030. The company’s ten-year outlook suggests consistent growth in Free Cash Flow, indicating that there is genuine momentum behind these projections rather than just a single strong year.

After crunching the numbers using a two-stage Free Cash Flow to Equity model, the estimated intrinsic value for Broadridge is $330.38 per share. This is approximately 21.1% below current prices. In other words, the DCF suggests the stock may have solid upside potential compared to where it is trading now.

Result: UNDERVALUED

Approach 2: Broadridge Financial Solutions Price vs Earnings

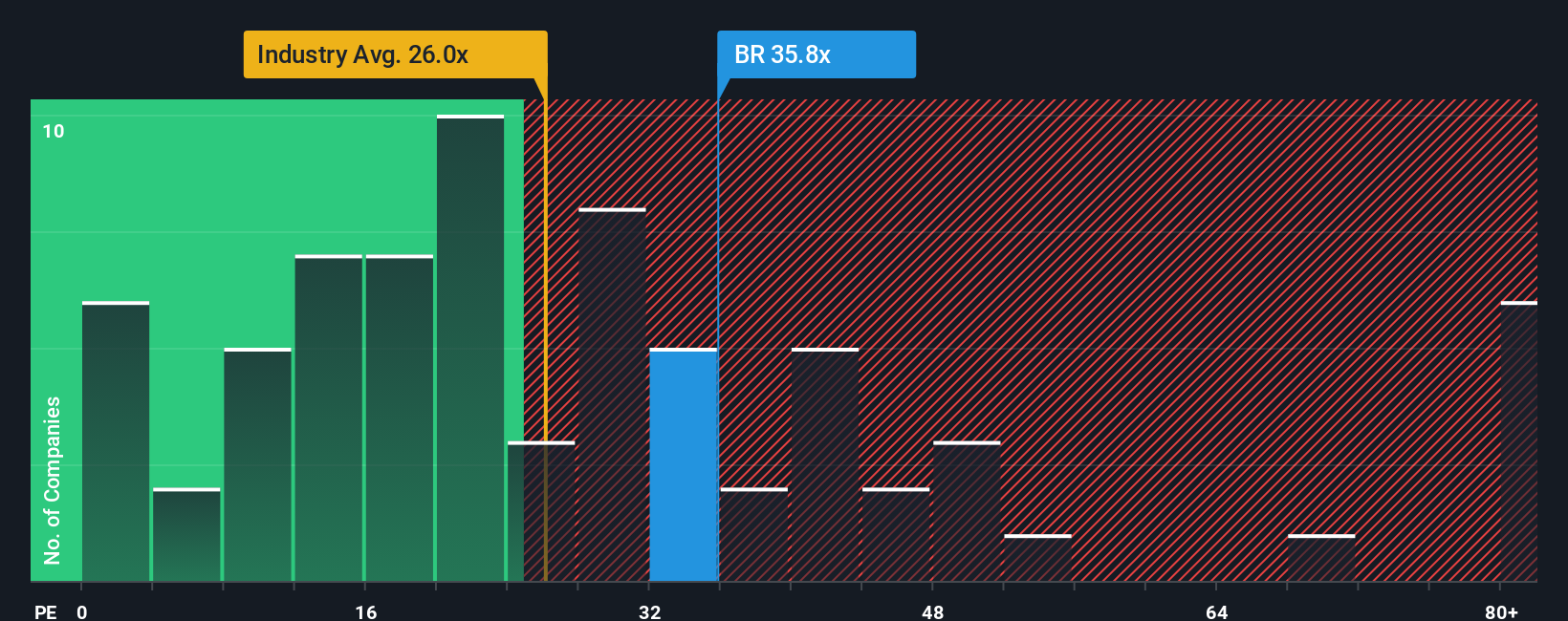

The Price-to-Earnings (PE) ratio is a classic tool for valuing profitable companies like Broadridge Financial Solutions. This metric gives investors a quick way to gauge how much the market is paying for each dollar of a company’s earnings. Generally, a higher PE can signal that the market expects strong growth ahead, while a lower PE may reflect slower growth or potential risks. However, not all high PEs are unjustified; it really comes down to the company’s future prospects and how they compare against competitors and broader industry trends.

Currently, Broadridge trades at a PE ratio of 36.4x. This is notably higher than the Professional Services industry average of 26.9x and also sits well above the average of close peers, which is 21.6x. On the surface, this premium suggests that investors are pricing in robust growth or lower perceived risk for Broadridge compared to others in the space.

To add more clarity, we consider the Fair Ratio, a more nuanced benchmark tailored to Broadridge’s earnings growth forecasts, industry standing, profit margins, company size, and specific risk profile. For Broadridge, the Fair Ratio comes in at 29.1x. When compared to its current PE of 36.4x, this indicates the stock is priced above what would typically be expected for these fundamentals.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Broadridge Financial Solutions Narrative

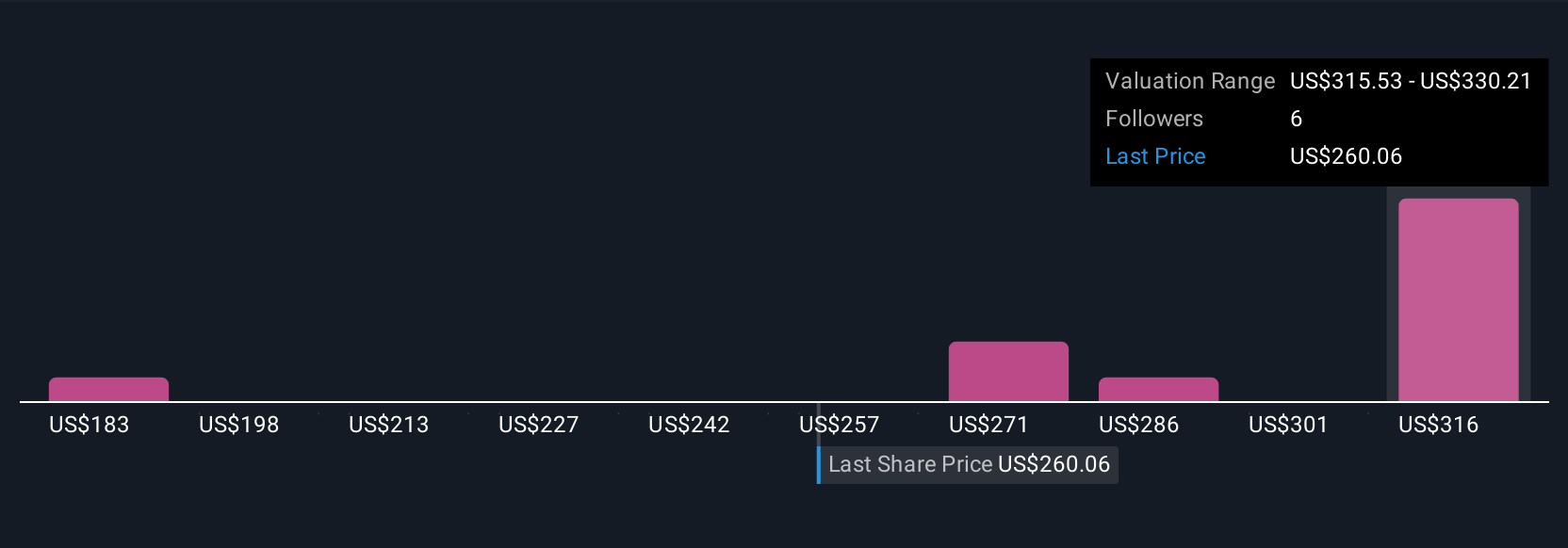

Numbers alone rarely tell the whole story, which is why many investors now use Narratives, a simple and powerful way to connect your perspective about Broadridge Financial Solutions with real financial forecasts and a fair value estimate.

A Narrative is more than just an opinion. It is your story of what matters for Broadridge, including your expectations on digital growth, international expansion, or macro headwinds. All of this is grounded in actual assumptions about revenue, earnings, and profit margins. Narratives link this story to a financial model, so you can see at a glance what you believe the company should be worth, and compare that fair value to the current price to help decide your next steps.

On Simply Wall St’s platform, crafting and comparing Narratives is easy and accessible for any investor, with millions in the community sharing their evolving views. Best of all, Narratives update dynamically as news, earnings, or market trends change. This ensures your conclusions are always built on the latest data. For example, one investor’s Narrative might see long-term margin expansion and assign a $305 fair value, while another sees more risk and sets theirs at $240. This highlights how diverse perspectives can shape smarter, more confident investment decisions.

Do you think there's more to the story for Broadridge Financial Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10