UL Solutions' (NYSE:ULS) Dividend Will Be $0.13

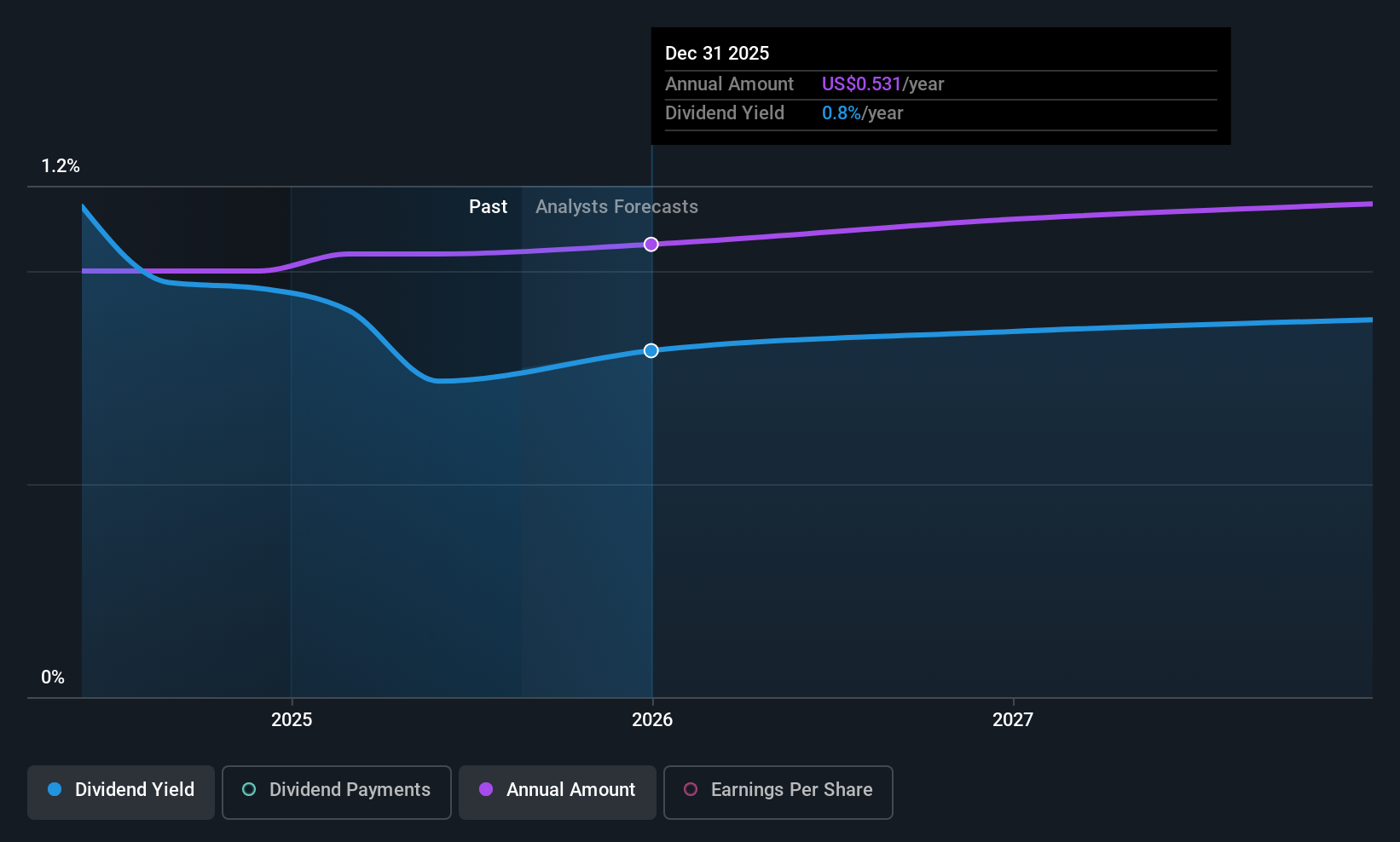

UL Solutions Inc. (NYSE:ULS) will pay a dividend of $0.13 on the 8th of September. The dividend yield is 0.8% based on this payment, which is a little bit low compared to the other companies in the industry.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

UL Solutions' Projected Earnings Seem Likely To Cover Future Distributions

If it is predictable over a long period, even low dividend yields can be attractive. However, prior to this announcement, UL Solutions' dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS is forecast to expand by 44.6%. If the dividend continues on this path, the payout ratio could be 22% by next year, which we think can be pretty sustainable going forward.

See our latest analysis for UL Solutions

UL Solutions Is Still Building Its Track Record

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth May Be Hard To Achieve

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Earnings has been rising at 4.5% per annum over the last three years, which admittedly is a bit slow. If UL Solutions is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

Our Thoughts On UL Solutions' Dividend

Overall, we think UL Solutions is a solid choice as a dividend stock, even though the dividend wasn't raised this year. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 11 analysts we track are forecasting for UL Solutions for free with public analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10