Thermo Fisher Scientific (TMO) Unveils Glow-in-the-Dark Bottles and Opens Carbon Neutral Facility

Thermo Fisher Scientific (TMO) recently opened a new, carbon-neutral manufacturing facility in North Carolina and launched the innovative GloWyld collection through its Nalgene Outdoor unit. These developments highlight the company's focus on sustainability and product innovation. The company saw a 22.9% share price increase last quarter, potentially reflecting market optimism towards these expansions and product launches. This rise aligns with broader market gains, spurred by the Federal Reserve's indication of potential interest rate cuts, which lifted investor sentiment. While TMO's news added positive weight, it primarily mirrored the overall market trajectory rather than deviating in a unique direction.

Every company has risks, and we've spotted 1 weakness for Thermo Fisher Scientific you should know about.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Thermo Fisher Scientific's recent initiatives in sustainability and product innovation could signal positive long-term impacts on its operational narrative. The opening of a carbon-neutral facility aligns with the company's commitment to sustainability, possibly enhancing its reputation and client engagement in environmentally-conscious markets. Meanwhile, the launch of the GloWyld collection continues the company's trajectory of product innovation, potentially boosting consumer interest and market presence. Over the past five years, the company delivered a total return of 16.48%, indicating a moderate growth trajectory when viewed in this extended context.

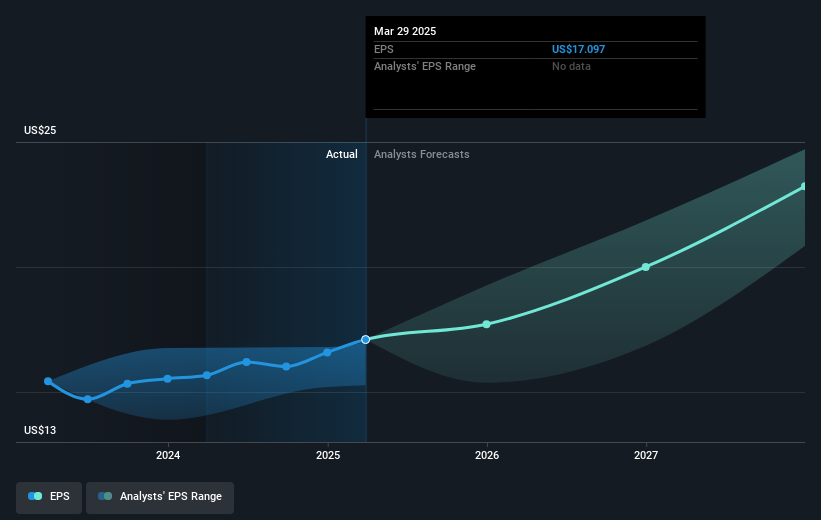

Short-term, Thermo Fisher's share price increased significantly last quarter, mirroring the general market uptrend, yet it remains below the consensus analyst price target of US$550.28. Analysts' forecasts suggest that the new developments could bolster revenue and earnings projections by boosting customer integration and addressing market demands in pharmaceuticals and biotech. However, these expansions also introduce potential challenges, such as navigating international headwinds and leadership transitions. Comparing recent performance, Thermo Fisher outperformed the US Life Sciences industry over the past year, although it lagged behind the overall US market. By aligning its strategy with growth sectors, Thermo Fisher positions itself for sustained future improvements in revenue and margin expansion, aiming to reach projected targets despite external uncertainties.

Jump into the full analysis health report here for a deeper understanding of Thermo Fisher Scientific.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10