Comcast (CMCSA): Evaluating the Valuation as Shares Drift Lower Without Major News

Most Popular Narrative: 14.2% Undervalued

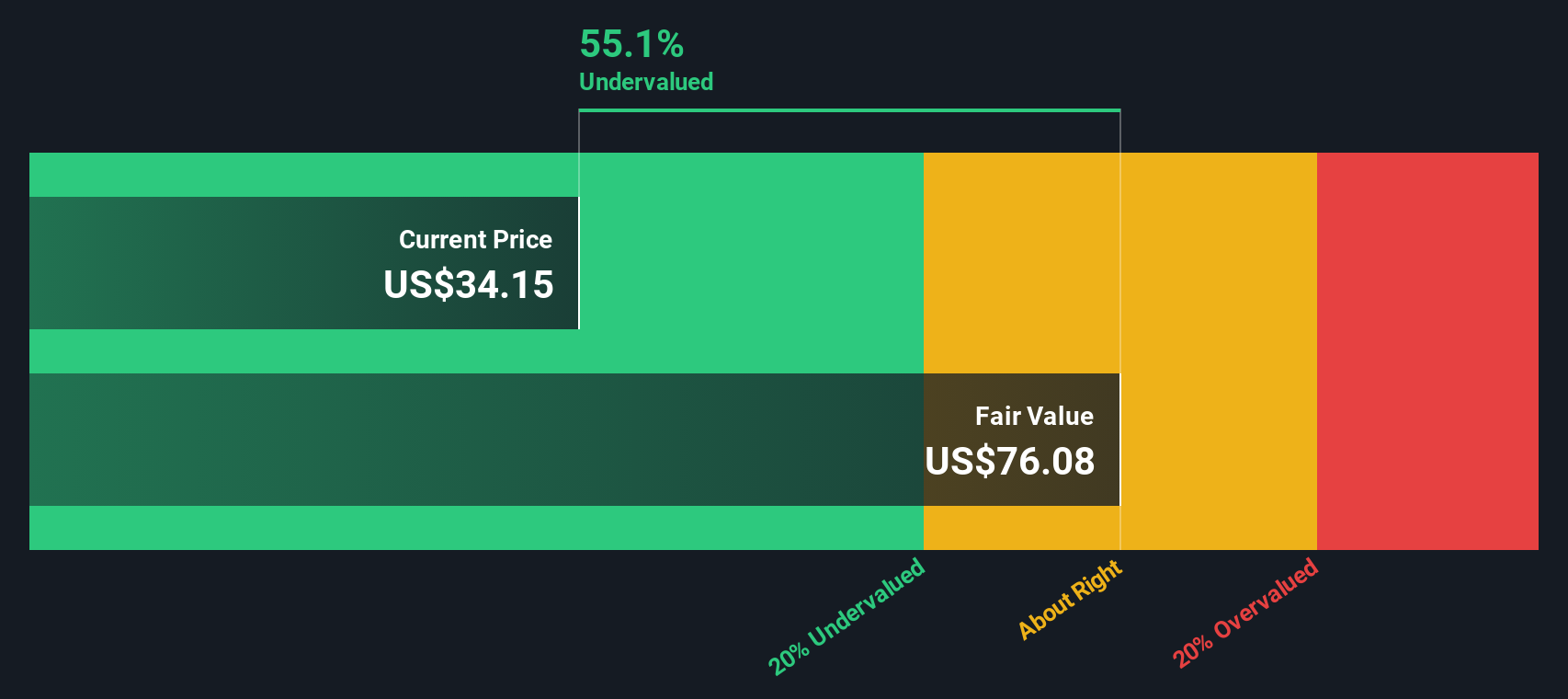

According to community narrative, Comcast appears to be undervalued, with analysts projecting a fair value above the current share price based on future business performance and financial forecasts.

"Comcast's ongoing investments in network innovation, including rapid deployment of DOCSIS 4.0, expansion of gig+ broadband speeds across its footprint, and strategic focus on delivering intelligent WiFi and seamless mobile integration, are aligning with persistent increases in high-speed internet demand driven by hybrid work, connected homes, and cloud applications. This is likely to sustain subscriber growth and support ARPU expansion, directly benefitting revenue and margin durability."

Ready to see why analysts are backing Comcast’s turnaround? A bold set of forecasts about future earnings, margins, and valuation multiples shape this price target. There is one critical assumption behind it all. Want to know what separates this narrative from the market’s view? Find out which numbers underpin this undervaluation call.

Result: Fair Value of $39.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing competition in broadband and rising content costs could limit Comcast’s ability to deliver on optimistic earnings and margin forecasts.

Find out about the key risks to this Comcast narrative.Another View

Taking a different approach, our DCF model also suggests Comcast may be trading below its estimated worth. This finding echoes the earlier analysis. However, valuation models depend on specific assumptions. Could these outlooks both be right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comcast for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comcast Narrative

If you see things differently or want to dig into Comcast’s numbers yourself, you can shape your own perspective in just a few minutes, or even do it your way.

A great starting point for your Comcast research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to seize your next opportunity, let Simply Wall Street guide you toward companies positioned for outsized returns. Act now or risk missing out on trends that could shape your portfolio’s growth this year. Here are three smart ways to get started right away:

- Supercharge your portfolio by hunting for undervalued stocks based on cash flows. In this selection, future cash flows might signal notable upside potential.

- Unlock the potential of healthcare innovation by targeting the latest healthcare AI stocks. These advancements are transforming medical tech and diagnostics.

- Grow your passive income stream by zeroing in on dividend stocks with yields > 3%. This group offers yields and consistent payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10