Toll Brothers (TOL): Assessing Valuation Following Strong Results, Upbeat Guidance, and New Community Launches

If you’re weighing what to do with Toll Brothers right now, you’re certainly not alone. The past week has brought a flurry of headlines: quarterly results, upbeat guidance for the year ahead, and a showcase of new communities in markets from California to Texas. On the surface, this looks like a confident builder flexing its muscle at a time when investors are hungry for clarity around both operational performance and market opportunity.

Digging in, Toll Brothers has delivered steady revenue growth over the last twelve months and managed to improve earnings per share in its most recent quarter, even as net income dipped slightly. That operational resilience has encouraged investors, with the stock jumping nearly 10% over the past month and gaining 33% in the past 3 months. However, shares are still down about 6% for the year, reflecting some skepticism or risk adjustment as the housing market transitions from boom times to a more uncertain rate environment. Product launches and recent buybacks reinforce management’s view that demand is durable, but the market appears split on how much of that optimism should be priced in.

After this year’s bumpy ride and fresh guidance from management, is Toll Brothers now offering real value, or is everyone already betting on another growth leg ahead?

Most Popular Narrative: 2.7% Undervalued

According to community narrative, Toll Brothers is trading slightly below its estimated fair value, with analysts viewing the future as driven by a blend of demographic demand and operational execution.

Demographic tailwinds from affluent Millennials and Gen Z entering peak homebuying years, combined with persistent housing shortages, are creating pent-up demand for larger, luxury homes. This is a core Toll Brothers offering that supports sustained high average selling prices, revenue growth, and pricing power.

Curious about what’s fueling this near-fair valuation? Analysts are betting on a set of bullish assumptions, but there is a twist in the numbers that could surprise you. Which underlying trends are set to drive, or possibly disrupt, the next phase of growth? Unlock the full calculation behind the consensus target and get the scoop on the pivotal factors in play.

Result: Fair Value of $143.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if demand for luxury homes softens or incentives climb further, Toll Brothers’ earnings momentum could quickly shift direction.

Find out about the key risks to this Toll Brothers narrative.Another View: Discounted Cash Flow Perspective

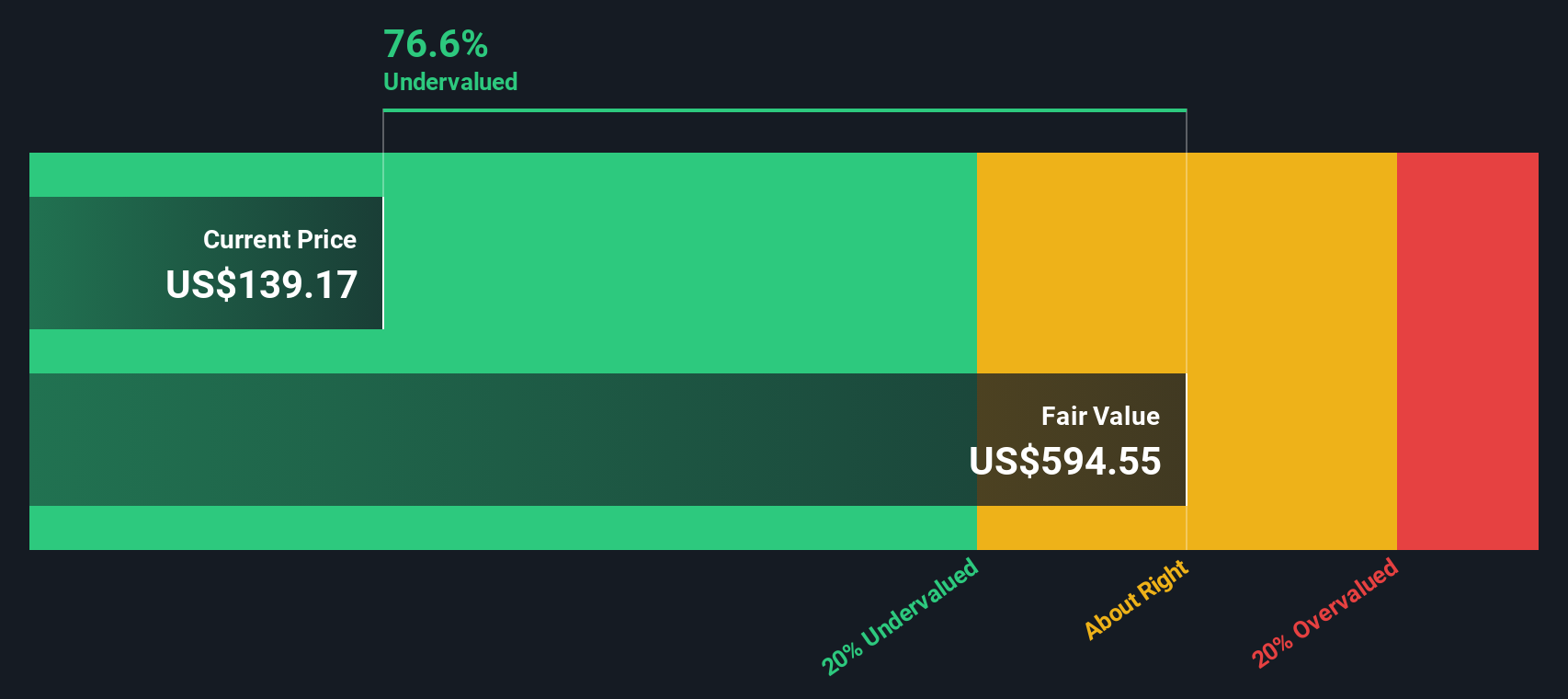

While analysts rely on future growth and market multiples to set expectations, our DCF model takes a different approach. It suggests that Toll Brothers is trading well below its intrinsic worth. Could the SWS DCF model be identifying value that others are not seeing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Toll Brothers Narrative

If you see things differently or want to dig into the numbers first-hand, you can shape your own perspective quickly and easily, do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Toll Brothers.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by when there’s a world of promising companies to consider. Uncover stocks with unique growth stories, resilient financials, and future-ready innovations through Simply Wall Street’s tailored screeners. Make your next investing move count and put your research to work with these standout ideas:

- Spot reliable income streams by browsing dividend stocks with yields > 3% and uncovering stocks that offer strong dividend yields above 3%, which can help balance risk in any portfolio.

- Amplify your returns by seeking out undervalued stocks based on cash flows. Here, you’ll find stocks that the market may be overlooking based on robust cash flow analysis.

- Embrace the future of medicine by exploring healthcare AI stocks to find public companies leading the way in artificial intelligence breakthroughs in healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10