T-Mobile US (TMUS) Launches New Pixel Lineup With Starlink Connectivity And Exclusive Offers

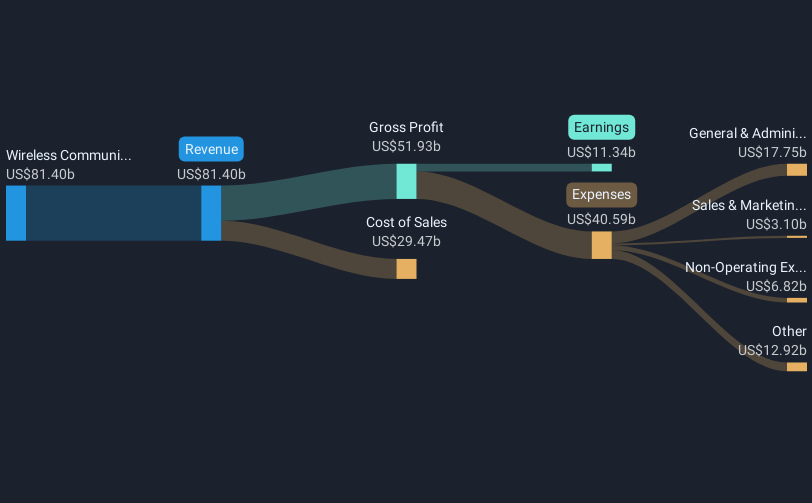

T-Mobile US (TMUS) recently announced a new lineup of Google Pixel devices, including innovative features like Gemini AI integration and T-Satellite, enhancing connectivity and user experience. Coupled with client promotions and T-Mobile's network recognition, these developments likely underpinned the company's 11% share price increase over the past month. This positive movement contrasts with the broader market's recent 1.5% decline, as concerns regarding Federal Reserve policies influenced investor sentiment. T-Mobile's robust product strategy and technological advancements seem to have bolstered investor confidence, outweighing prevailing market challenges.

We've identified 2 weaknesses for T-Mobile US that you should be aware of.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

The introduction of new Google Pixel devices with advanced features like Gemini AI and T-Satellite is poised to enhance T-Mobile US's (TMUS) service offerings, potentially impacting its revenue and earnings forecasts positively. These product innovations, aligned with client promotions and network recognitions, reinforce T-Mobile's market proposition, which could stimulate customer acquisition and retention efforts. With the company's share price increasing 11% over the past month against a broader market decline of 1.5%, these advancements might bolster investor sentiment. However, the current share price of US$259.01 remains slightly below the consensus price target of US$272.08, signaling potential future upside, though investors should remain cautious given market volatility.

Over the past five years, T-Mobile's total return, including share price gains and dividends, has been substantial at 130.68%. In the same timeframe, the company posted impressive growth, reflecting successful strategies in expanding its 5G and T-Fiber networks. Over the past year, T-Mobile's performance has been mixed; while it exceeded the broader U.S. market's return of 14.4%, it underperformed the US Wireless Telecom industry, which grew by 33.2%. Going forward, how the recent developments in technology and network enhancements affect the company's long-term growth trajectory will be crucial. Analysts are divided on forecasts, with some suggesting constraints due to tariffs and competitive pressures might impact future performance.

Our expertly prepared valuation report T-Mobile US implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10