Major Equity Raise Might Change the Case for Investing in Liontown Resources (ASX:LTR)

- In early August 2025, Liontown Resources completed a follow-on equity offering totaling A$316 million, issuing over 432 million new ordinary shares at A$0.73 per share, following earlier filings to raise additional funds via direct listing and other placements.

- The scale of these equity raisings is significant, as it alters Liontown's capital structure and could influence both funding flexibility and shareholder dilution.

- We'll explore how this major capital raise and influx of new shares shapes Liontown Resources' investment outlook and risk profile.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Liontown Resources Investment Narrative Recap

To hold shares in Liontown Resources, investors typically need to believe in the long-term demand for lithium and the company’s ability to ramp up efficient production at its Kathleen Valley project. The recent A$316 million equity raising significantly boosts Liontown’s cash reserves, supporting its underground production ramp-up, but also introduces additional shareholder dilution. This influx of capital may enhance funding flexibility for near-term project milestones, although its impact on operational catalysts and cost risks appears incremental rather than transformative right now.

Among the company’s latest announcements, the commencement of underground production stoping at Kathleen Valley’s Mt Mann orebody stands out as most relevant. This milestone aligns closely with the objectives behind the equity raising, as additional funds can help maintain momentum in underground operations, which are expected to deliver quality and cost advantages over time. Yet, with ongoing cost pressures and operational risks in play, the ability to realize these benefits will depend on...

Read the full narrative on Liontown Resources (it's free!)

Liontown Resources is projected to achieve A$714.3 million in revenue and A$52.0 million in earnings by 2028. This outlook relies on a 92.2% annual revenue growth rate and a A$101.1 million improvement in earnings from the current A$-49.1 million.

Uncover how Liontown Resources' forecasts yield a A$0.608 fair value, a 28% downside to its current price.

Exploring Other Perspectives

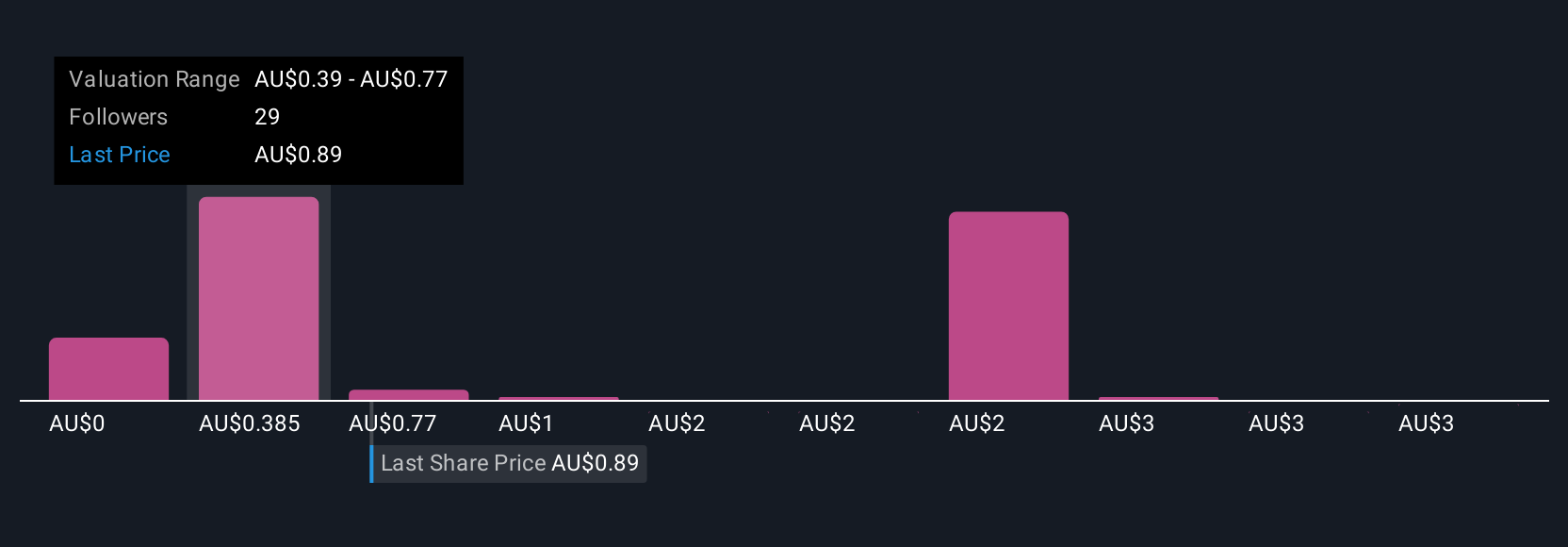

Seventeen members of the Simply Wall St Community estimate Liontown’s fair value between A$0.59 and A$5.87 per share, revealing substantial differences in expectations. While some see significant long-term growth potential, others caution that additional new shares could increase dilution and pressure future returns, perspectives that matter as you consider how equity funding might shape outcomes.

Explore 17 other fair value estimates on Liontown Resources - why the stock might be worth over 6x more than the current price!

Build Your Own Liontown Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liontown Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Liontown Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liontown Resources' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10