3 Top Dividend Stocks To Consider For Your Portfolio

In a dynamic market environment where the Dow Jones Industrial Average has reached an all-time high while the S&P 500 and Nasdaq have experienced slight declines, investors are keenly observing potential interest rate cuts by the Federal Reserve. Amidst these mixed signals, dividend stocks can offer a reliable income stream and stability, making them an attractive consideration for portfolios in times of economic uncertainty.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.61% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.74% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.26% | ★★★★★★ |

| Ennis (EBF) | 5.54% | ★★★★★★ |

| Dillard's (DDS) | 5.04% | ★★★★★★ |

| DHT Holdings (DHT) | 8.48% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.62% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.86% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.58% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.41% | ★★★★★☆ |

Click here to see the full list of 137 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

CareTrust REIT (CTRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CareTrust REIT is a publicly-traded real estate investment trust focused on owning, acquiring, developing, and leasing seniors housing and healthcare-related properties, with a market cap of $7.57 billion.

Operations: CareTrust REIT generates revenue primarily from its investments in healthcare-related real estate assets, totaling $373.42 million.

Dividend Yield: 4%

CareTrust REIT's dividend yield of 3.95% is below the top quartile of US dividend payers, and its high payout ratio (582.6%) indicates dividends are not well covered by earnings, though they are supported by cash flow (99.4% payout). Despite stable and growing dividends over a decade, recent shareholder dilution through a $640 million equity offering raises concerns about sustainability. Earnings growth has been robust but may not fully support current dividend levels without improvement in coverage metrics.

- Unlock comprehensive insights into our analysis of CareTrust REIT stock in this dividend report.

- Our expertly prepared valuation report CareTrust REIT implies its share price may be lower than expected.

Terreno Realty (TRNO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Terreno Realty Corporation acquires, owns, and operates industrial real estate in six major coastal U.S. markets with a market cap of approximately $5.60 billion.

Operations: Terreno Realty Corporation generates revenue of $426 million from its investments in industrial real estate.

Dividend Yield: 3.8%

Terreno Realty's recent dividend increase to $0.52 per share reflects its commitment to shareholder returns, supported by earnings coverage at a 76.2% payout ratio and cash flow coverage at 88.3%. Despite a dividend yield of 3.84%, below the top US payers, dividends have been stable and growing over the past decade. Recent acquisitions in strategic locations like Washington and California enhance its industrial portfolio, potentially bolstering long-term revenue despite forecasted earnings decline challenges ahead.

- Get an in-depth perspective on Terreno Realty's performance by reading our dividend report here.

- Our valuation report here indicates Terreno Realty may be undervalued.

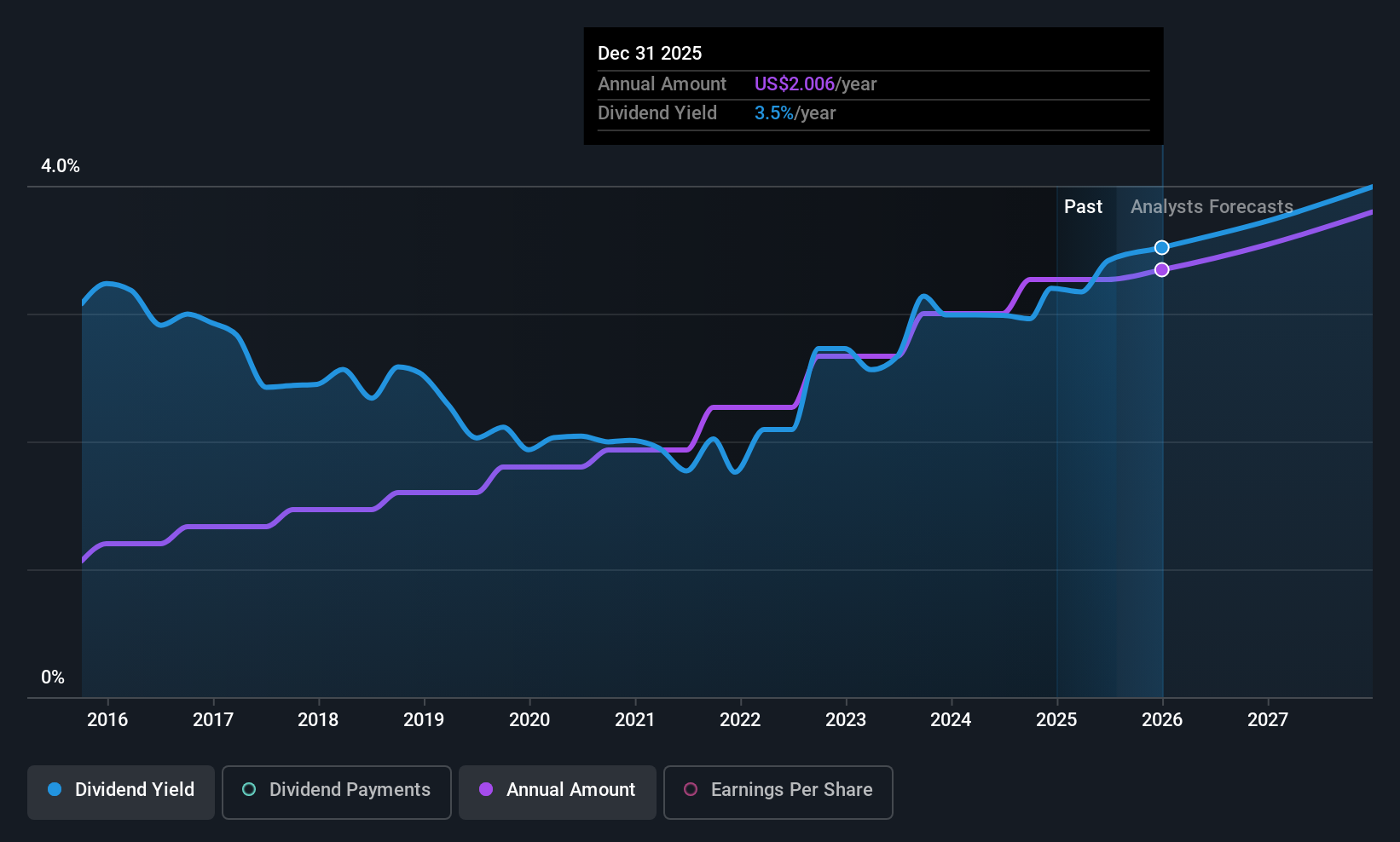

United Parcel Service (UPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Parcel Service, Inc. is a package delivery and logistics provider that offers transportation and delivery services, with a market cap of approximately $74.99 billion.

Operations: United Parcel Service, Inc. generates revenue through its three main segments: U.S. Domestic Package at $60.45 billion, International Package at $18.19 billion, and Supply Chain Solutions at $11.67 billion.

Dividend Yield: 7.4%

United Parcel Service maintains a regular dividend, recently affirming a quarterly payout of US$1.64 per share, though its high payout and cash flow ratios suggest sustainability concerns. Despite stable dividends over the past decade, current coverage by earnings and free cash flow is insufficient. Labor-related settlements may impact financials, yet strategic partnerships like the PeriShip agreement could bolster service offerings. UPS's dividend yield ranks in the top tier of US payers but faces challenges from high debt levels.

- Click to explore a detailed breakdown of our findings in United Parcel Service's dividend report.

- Our comprehensive valuation report raises the possibility that United Parcel Service is priced lower than what may be justified by its financials.

Seize The Opportunity

- Explore the 137 names from our Top US Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10