Discovering 3 Stocks That May Be Priced Below Their Estimated Worth

As the Dow Jones Industrial Average reaches an all-time high, while the S&P 500 and Nasdaq experience slight declines, investors are keeping a close eye on potential interest rate cuts from the Federal Reserve. Amidst this mixed performance in major indices, identifying stocks that may be priced below their estimated worth could offer intriguing opportunities for those looking to navigate current market conditions. In such an environment, a good stock is often one with strong fundamentals and growth potential that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $115.08 | $225.65 | 49% |

| Udemy (UDMY) | $6.79 | $13.23 | 48.7% |

| Royal Gold (RGLD) | $171.45 | $329.42 | 48% |

| Perfect (PERF) | $1.91 | $3.63 | 47.4% |

| Lyft (LYFT) | $15.82 | $30.95 | 48.9% |

| Granite Ridge Resources (GRNT) | $5.26 | $10.24 | 48.6% |

| First Commonwealth Financial (FCF) | $16.67 | $32.97 | 49.4% |

| First Busey (BUSE) | $23.24 | $45.40 | 48.8% |

| e.l.f. Beauty (ELF) | $116.37 | $223.68 | 48% |

| Dime Community Bancshares (DCOM) | $28.64 | $56.56 | 49.4% |

Click here to see the full list of 190 stocks from our Undervalued US Stocks Based On Cash Flows screener.

Here we highlight a subset of our preferred stocks from the screener.

First Solar (FSLR)

Overview: First Solar, Inc. is a solar technology company that offers photovoltaic solar energy solutions across various countries including the United States, France, India, and Chile with a market cap of approximately $21.44 billion.

Operations: The company generates revenue primarily through the design, manufacture, and sale of CdTe solar modules, amounting to $4.34 billion.

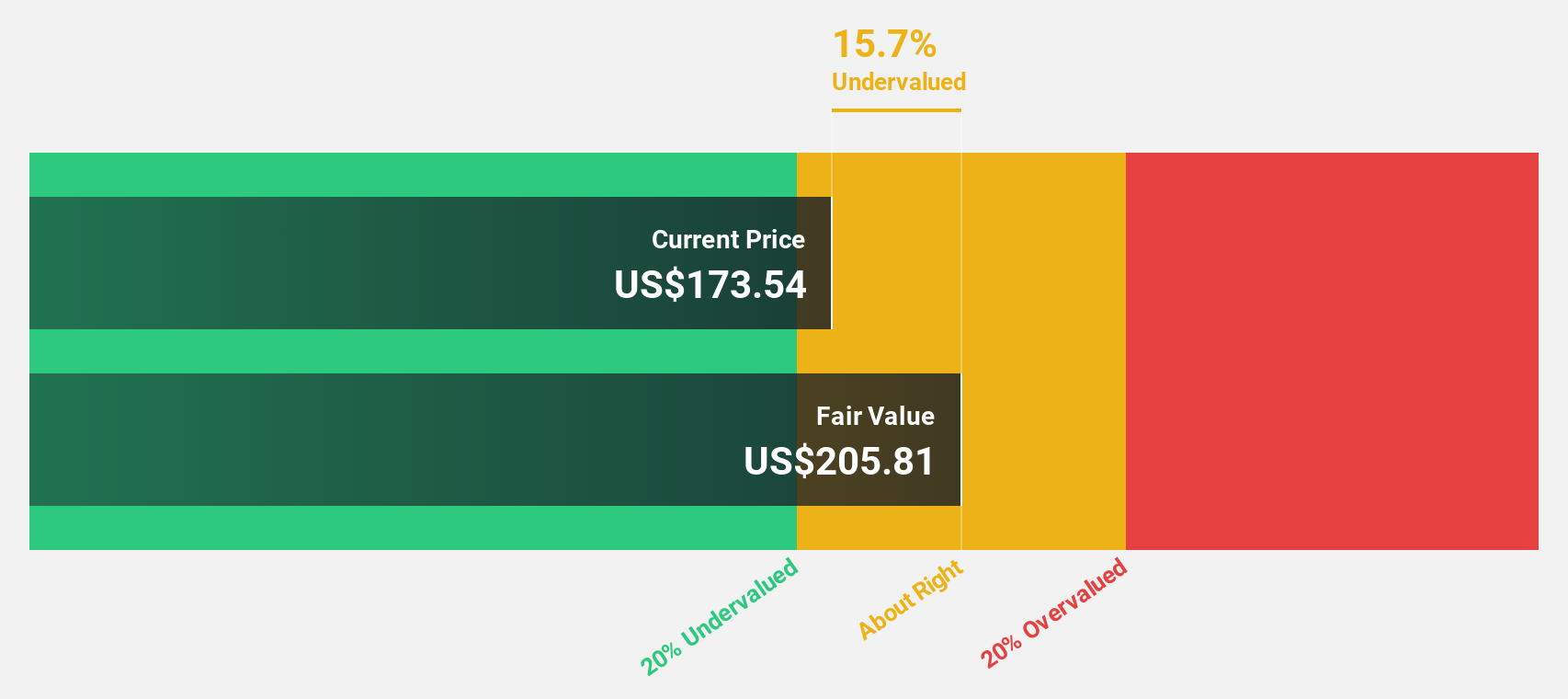

Estimated Discount To Fair Value: 30.2%

First Solar is trading at US$199.95, below its estimated fair value of US$286.59, indicating it may be undervalued based on cash flows. Earnings are expected to grow significantly over the next three years, outpacing the broader U.S. market. Recent agreements to increase semiconductor supply and incorporate quantum dot technology signal strategic growth in manufacturing capacity and technological advancement, supporting revenue growth forecasts of 12.4% annually, faster than the U.S. market average.

- Our expertly prepared growth report on First Solar implies its future financial outlook may be stronger than recent results.

- Take a closer look at First Solar's balance sheet health here in our report.

Coupang (CPNG)

Overview: Coupang, Inc. operates a retail business through mobile applications and internet websites in South Korea and internationally, with a market cap of $51.30 billion.

Operations: Coupang's revenue is primarily generated from its Product Commerce segment, which accounts for $27.98 billion, and its Developing Offerings segment, contributing $4.29 billion.

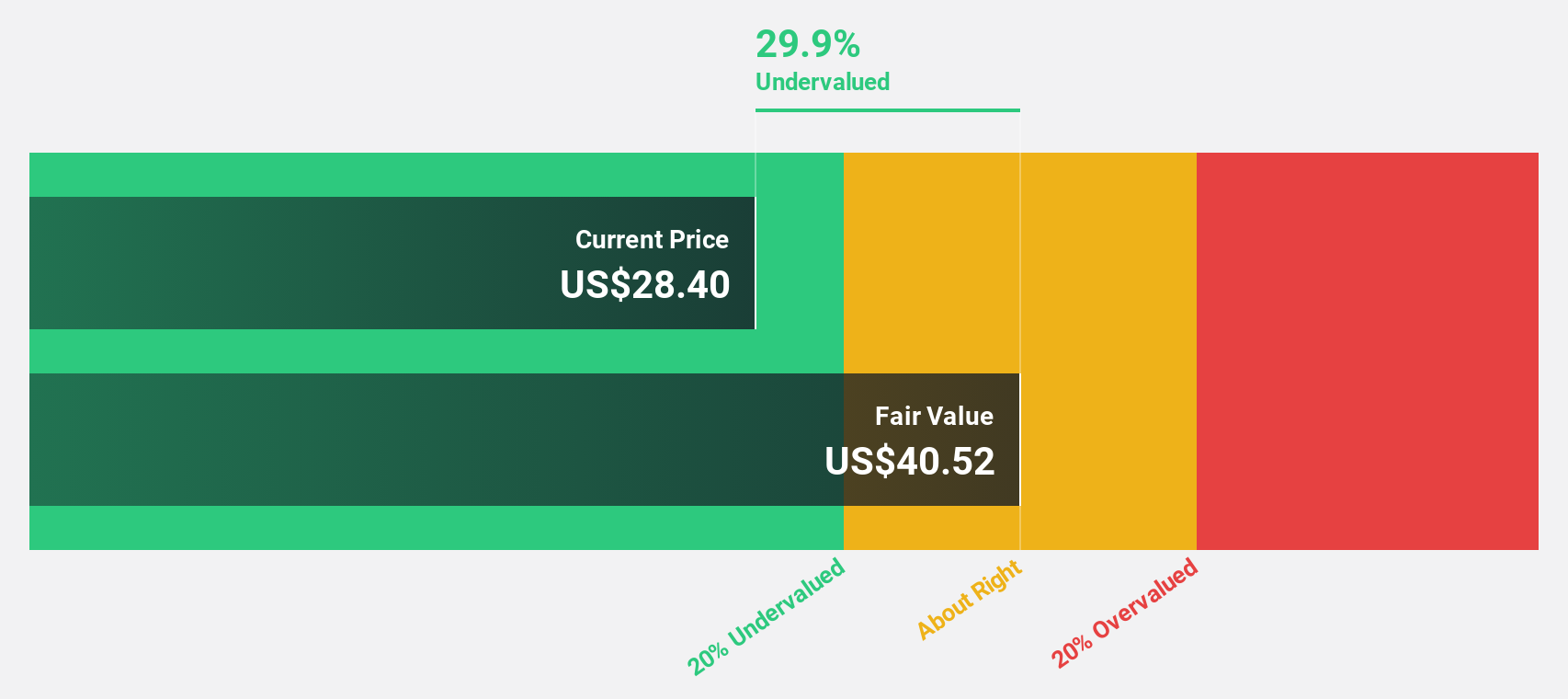

Estimated Discount To Fair Value: 39.8%

Coupang's stock, trading at US$28.14, is significantly undervalued compared to its estimated fair value of US$46.72. The company's earnings are projected to grow substantially at 41.85% annually, surpassing the U.S. market average growth rate. Recent earnings showed a positive shift with net income of US$32 million in Q2 2025, up from a loss last year, although profit margins have slightly declined. A new $1.5 billion credit facility enhances financial flexibility for future growth initiatives.

- Upon reviewing our latest growth report, Coupang's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Coupang stock in this financial health report.

HubSpot (HUBS)

Overview: HubSpot, Inc. offers a cloud-based customer relationship management (CRM) platform for businesses across the Americas, Europe, and the Asia Pacific, with a market cap of approximately $23.15 billion.

Operations: HubSpot's revenue primarily comes from its Internet Software & Services segment, totaling $2.85 billion.

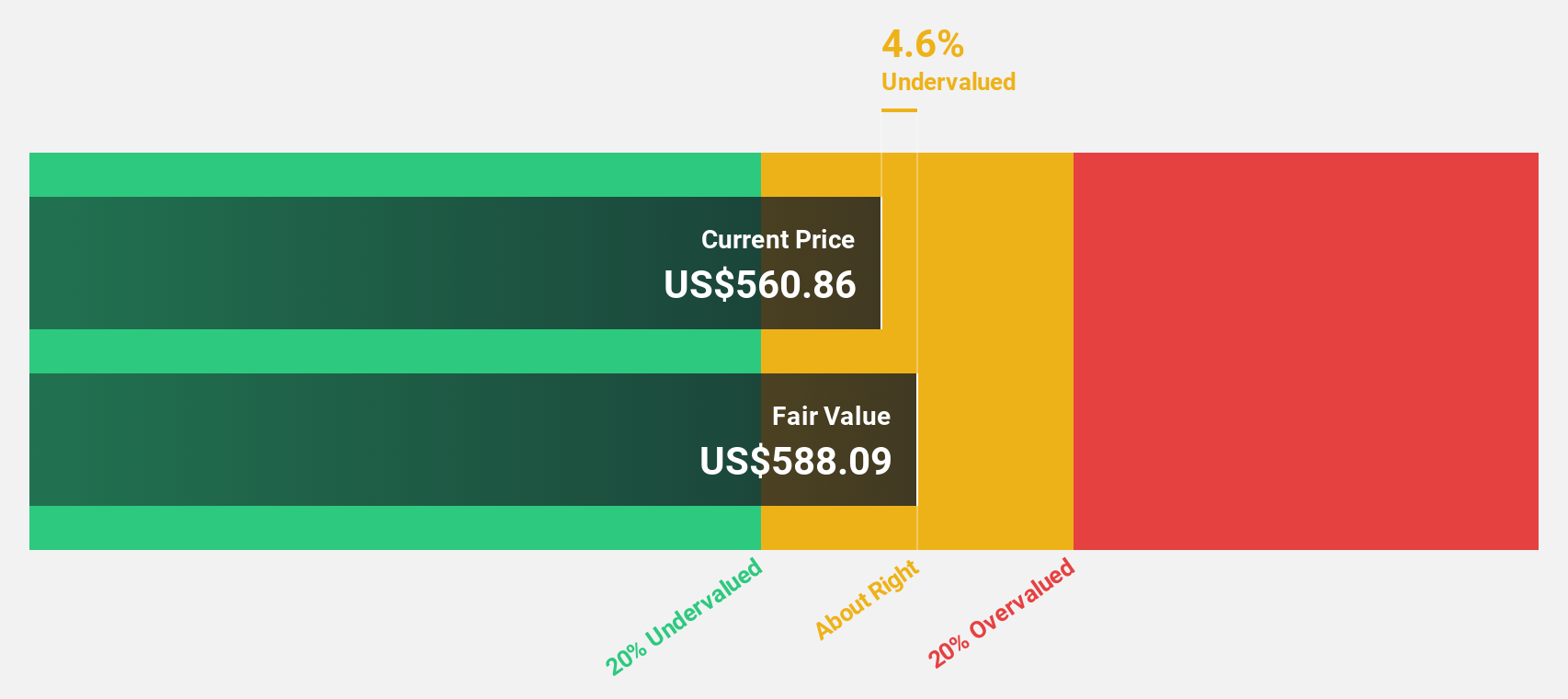

Estimated Discount To Fair Value: 44.1%

HubSpot is trading at US$439.37, significantly below its estimated fair value of US$786.51, making it highly undervalued based on discounted cash flows. Despite slower revenue growth forecasts of 14.5% annually compared to some peers, it's expected to outperform the broader U.S. market rate of 9.3%. Recent partnerships and product enhancements, including integration with FormAssembly and a CRM connector for Claude, bolster its ecosystem and could enhance future cash flow potential as profitability is anticipated within three years.

- Our earnings growth report unveils the potential for significant increases in HubSpot's future results.

- Click to explore a detailed breakdown of our findings in HubSpot's balance sheet health report.

Make It Happen

- Navigate through the entire inventory of 190 Undervalued US Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10