High Growth Tech Stocks in the US for August 2025

As of August 2025, the U.S. stock market is experiencing a period of relative stability with major indices like the S&P 500 and Nasdaq Composite hovering near record highs, despite mixed investor sentiment influenced by upcoming retail sector earnings and potential Federal Reserve policy shifts. In this environment, identifying high-growth tech stocks requires careful consideration of companies that demonstrate resilience and innovation, particularly those well-positioned to navigate economic fluctuations and capitalize on emerging technological trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.87% | 25.66% | ★★★★★☆ |

| Palantir Technologies | 25.25% | 31.57% | ★★★★★★ |

| Workday | 11.35% | 29.90% | ★★★★★☆ |

| RenovoRx | 65.63% | 68.83% | ★★★★★☆ |

| OS Therapies | 38.35% | 16.51% | ★★★★★☆ |

| Mereo BioPharma Group | 51.44% | 64.61% | ★★★★★★ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Gorilla Technology Group | 27.72% | 125.89% | ★★★★★☆ |

| Circle Internet Group | 26.95% | 78.47% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Trade Desk (TTD)

Simply Wall St Growth Rating: ★★★★★☆

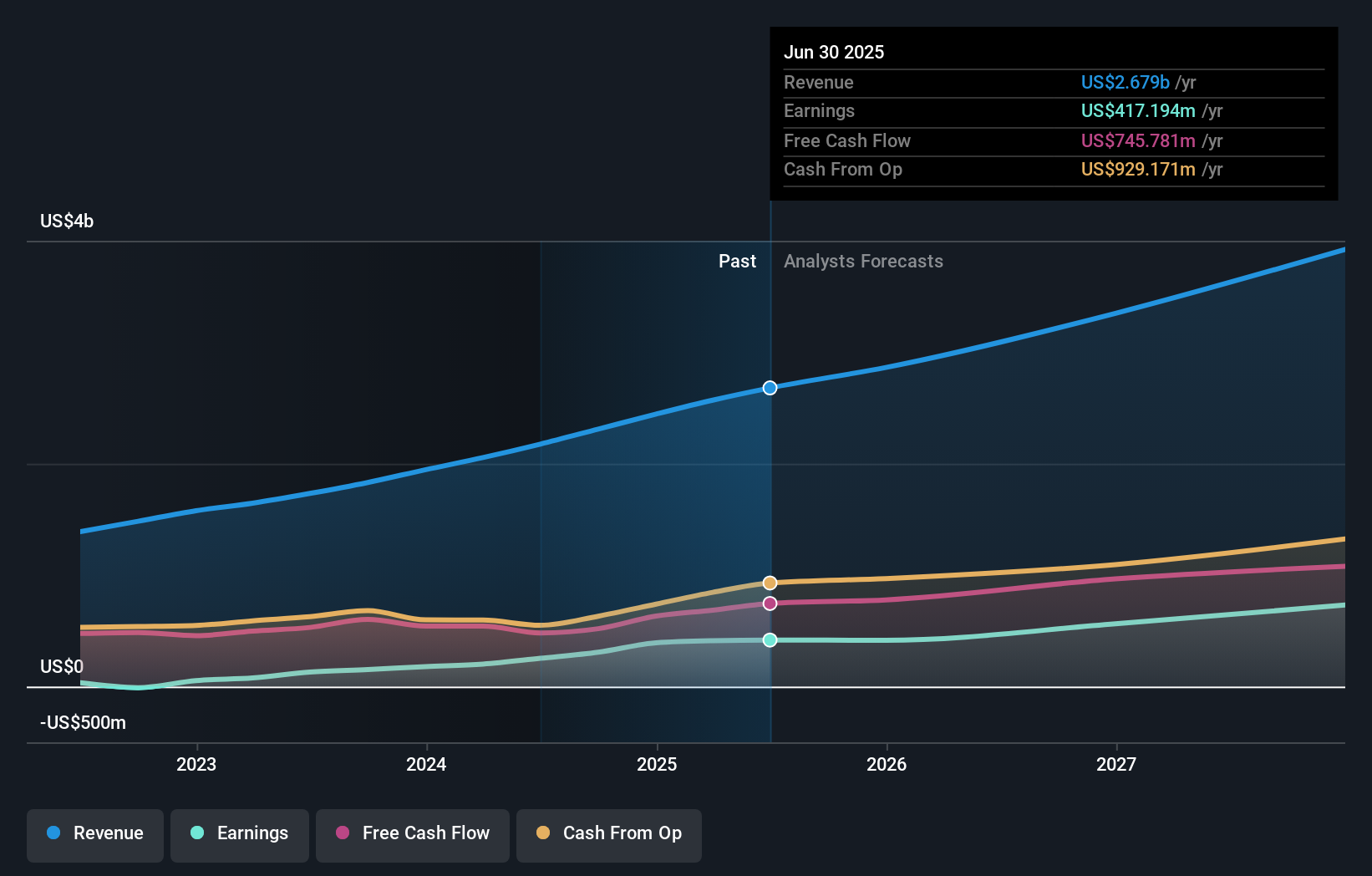

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform for buyers and has a market capitalization of approximately $25.48 billion.

Operations: The company generates revenue primarily from its advertising technology platform, which reported $2.68 billion in sales.

Trade Desk has demonstrated robust growth, with earnings surging by 64.7% over the past year, significantly outpacing the media industry's average of 16.1%. This performance is underpinned by a strategic focus on innovative advertising technologies and AI-driven solutions, as evidenced by their recent partnership with Rembrand to enhance creative ad placements. Looking ahead, Trade Desk anticipates continued momentum, projecting at least $717 million in revenue for the upcoming quarter. Their commitment to R&D and technological advancements positions them well to capitalize on evolving market dynamics and maintain their competitive edge in the high-growth tech sector.

- Get an in-depth perspective on Trade Desk's performance by reading our health report here.

Understand Trade Desk's track record by examining our Past report.

MNTN (MNTN)

Simply Wall St Growth Rating: ★★★★★☆

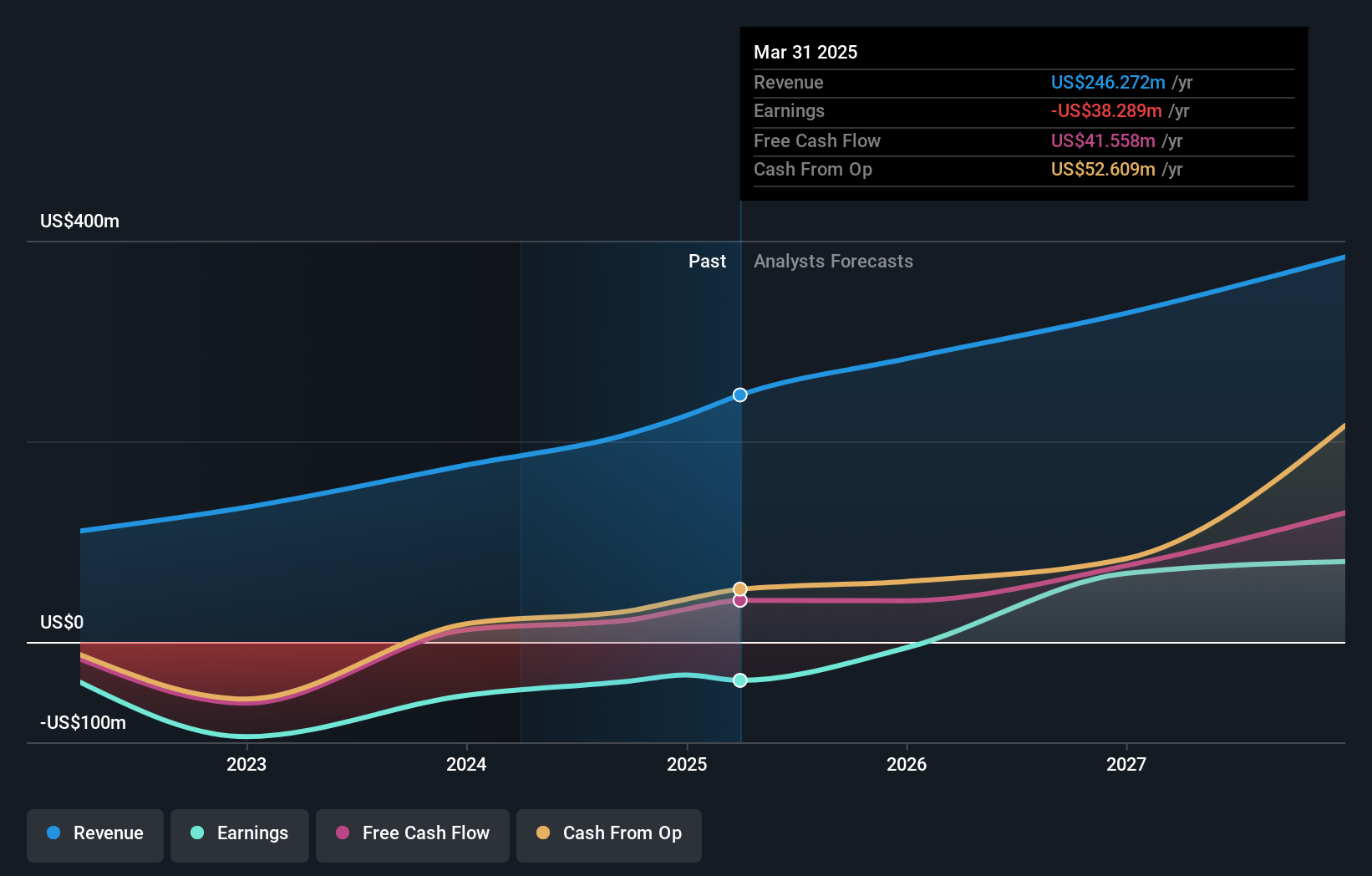

Overview: MNTN, Inc. operates a technology platform focused on performance marketing for Connected TV and has a market cap of $1.55 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $259.91 million. The focus on performance marketing for Connected TV positions it within the digital advertising space.

MNTN's strategic partnership with ZoomInfo exemplifies its innovative approach in the tech sector, transforming B2B marketing by integrating streaming TV ads with precise targeting capabilities. This collaboration not only expands their market reach but also taps into a $39 billion advertising potential. Despite being currently unprofitable, MNTN is poised for significant growth with expected earnings to surge by 121.8% annually and revenue projected to grow at 18% per year, outpacing the US market average of 9.3%. Their recent IPO raised $187.2 million, setting a solid foundation for future expansions and profitability within three years, underscoring their robust potential in high-growth tech environments.

- Navigate through the intricacies of MNTN with our comprehensive health report here.

Evaluate MNTN's historical performance by accessing our past performance report.

Pure Storage (PSTG)

Simply Wall St Growth Rating: ★★★★★☆

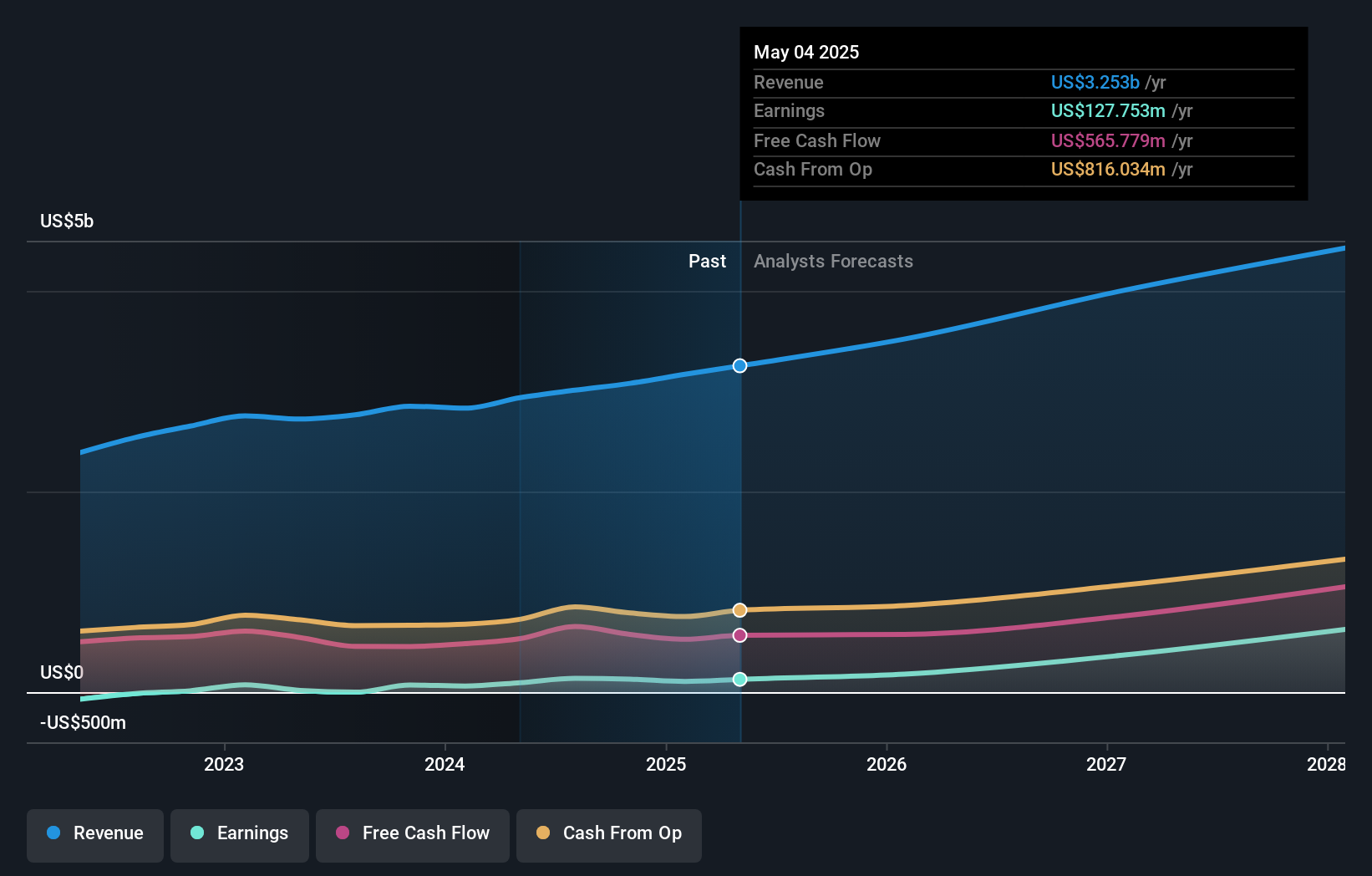

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally with a market cap of $19.16 billion.

Operations: The company generates revenue primarily from computer storage devices, totaling $3.25 billion.

Pure Storage is demonstrating robust growth with a 34.4% forecast in annual earnings and an 11.3% increase in revenue, outpacing the US market's average. The recent appointment of Tarek Robbiati as CFO is poised to further enhance financial strategies, given his track record at major tech firms. Additionally, Pure Storage's innovative Enterprise Data Cloud (EDC) and strategic alliances, like those with Rubrik and CrowdStrike, underscore its commitment to integrating cutting-edge AI and cybersecurity solutions into its offerings. These initiatives not only address current technological demands but are also likely to set new industry standards in data management and security.

- Take a closer look at Pure Storage's potential here in our health report.

Gain insights into Pure Storage's past trends and performance with our Past report.

Where To Now?

- Click this link to deep-dive into the 67 companies within our US High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10