Evolution Mining (ASX:EVN) Is Up 7.0% After Doubling Net Income in Full-Year 2025 Results

- Evolution Mining Limited recently announced its full-year results for the period ended June 30, 2025, reporting sales of A$4.35 billion and net income of A$926.17 million, both significantly higher than the prior year.

- This marked increase in revenue and profitability highlights improved operational performance, potentially drawing new investor attention to the company’s financial health.

- With net income more than doubling from the previous year, we’ll explore how this earnings strength shapes Evolution Mining’s investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Evolution Mining Investment Narrative Recap

To be a shareholder in Evolution Mining, you need to trust in the long-term global demand for gold and base metals and the company’s ability to turn strong operational results into sustained growth and solid cash flow. The recent jump in revenue and net income signals operational gains, though it does not lessen near-term risks tied to capital-intensive expansions, particularly at its Cowal and Mungari sites, nor does it ease the pressure on margins if gold prices turn volatile. While the earnings beat increases optimism, execution risks on new projects remain the single most important catalyst affecting short-term fortunes.

The commissioning of the expanded Mungari mill at the end of June is especially relevant, as this project is expected to double processing capacity and plays directly into the recent surge in profitability. Investors are likely monitoring how efficiently this expansion is ramped up, as cost overruns or underperformance could quickly reverse the financial gains just posted.

However, despite the positive headlines, it’s important for investors to consider how much depends on the timely completion of these major projects, especially if…

Read the full narrative on Evolution Mining (it's free!)

Evolution Mining's outlook anticipates A$4.8 billion in revenue and A$1.2 billion in earnings by 2028. This is based on a projected 7.0% annual revenue growth and an earnings increase of A$509.5 million from the current A$690.5 million.

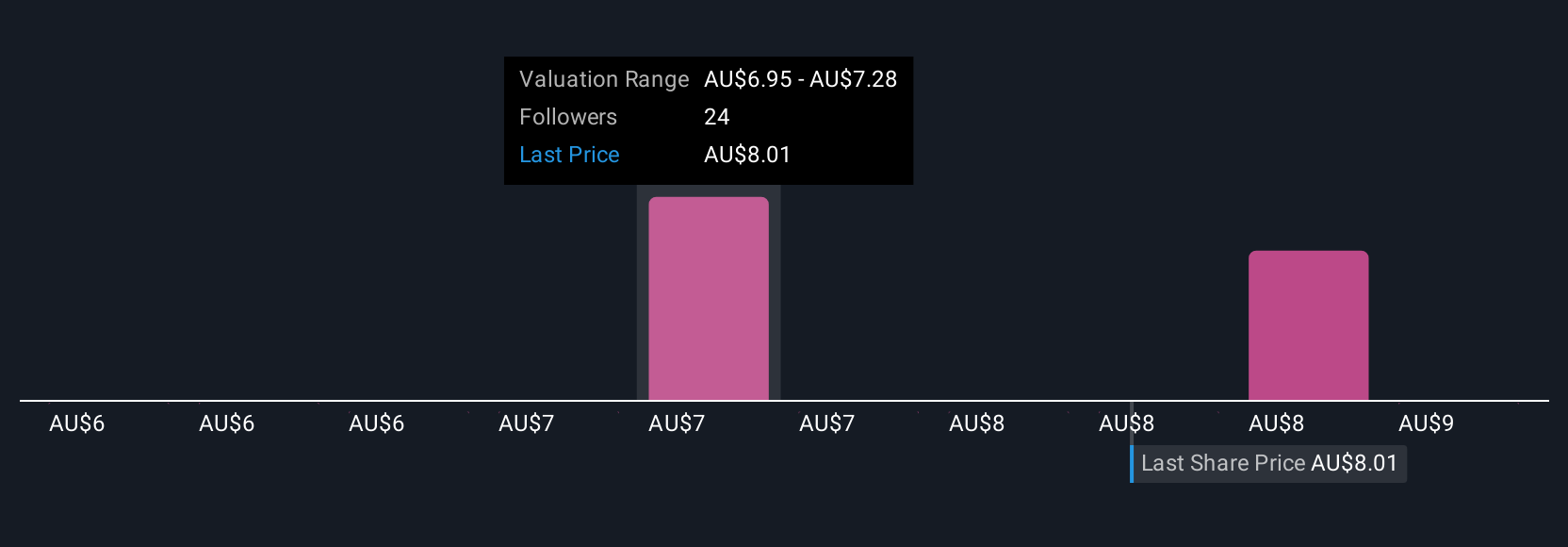

Uncover how Evolution Mining's forecasts yield a A$7.12 fair value, a 11% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted 5 distinct fair value estimates for Evolution Mining, ranging from A$5.65 to A$8.70 per share. As you weigh these varied views, keep in mind that successful execution of capital projects is emerging as a real focal point for short-term performance.

Explore 5 other fair value estimates on Evolution Mining - why the stock might be worth 29% less than the current price!

Build Your Own Evolution Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolution Mining research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Evolution Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolution Mining's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolution Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10