Why Centrus Energy (LEU) Is Down 19.5% After $700 Million Convertible Note Offering and Dilution Risk

- Centrus Energy recently completed a private offering of US$700 million in zero-coupon, convertible senior notes due 2032, upsized from the initial US$650 million on strong investor demand, to provide capital for business expansion in the nuclear fuel sector.

- This substantial convertible debt raises the possibility of future share dilution, reflecting investor appetite for exposure to Centrus Energy’s growth plans in high-assay, low-enriched uranium production for advanced nuclear reactors.

- We’ll examine how this large convertible debt issuance and the associated dilution risk may alter the investment narrative for Centrus Energy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Centrus Energy Investment Narrative Recap

To be a Centrus Energy shareholder right now, you need to believe in the company's ability to capture and expand its role as the leading American supplier of advanced nuclear fuel, especially in high-assay, low-enriched uranium (HALEU). The recent upsized US$700 million convertible debt deal provides substantial capital, supporting Centrus’ growth plans, but also amplifies dilution risk for current shareholders. This could impact the attractiveness of the stock in the short term but does not materially change the core catalyst: rapid scale-up to meet new market demand remains paramount. Among recent company milestones, the Department of Energy's extension of Centrus’ HALEU production contract until at least June 2026 stands out. This extension reinforces the underlying premise that government support and multi-year contracts can backstop significant revenue visibility, even as funding developments and execution timelines continue to be the biggest variables to monitor. By contrast, one risk investors should be keenly aware of is the potential for share dilution over time as a result of the...

Read the full narrative on Centrus Energy (it's free!)

Centrus Energy's outlook anticipates $611.7 million in revenue and $58.9 million in earnings by 2028. This is based on an annual revenue growth rate of 11.9%, but represents a decrease in earnings of $45.9 million from the current $104.8 million.

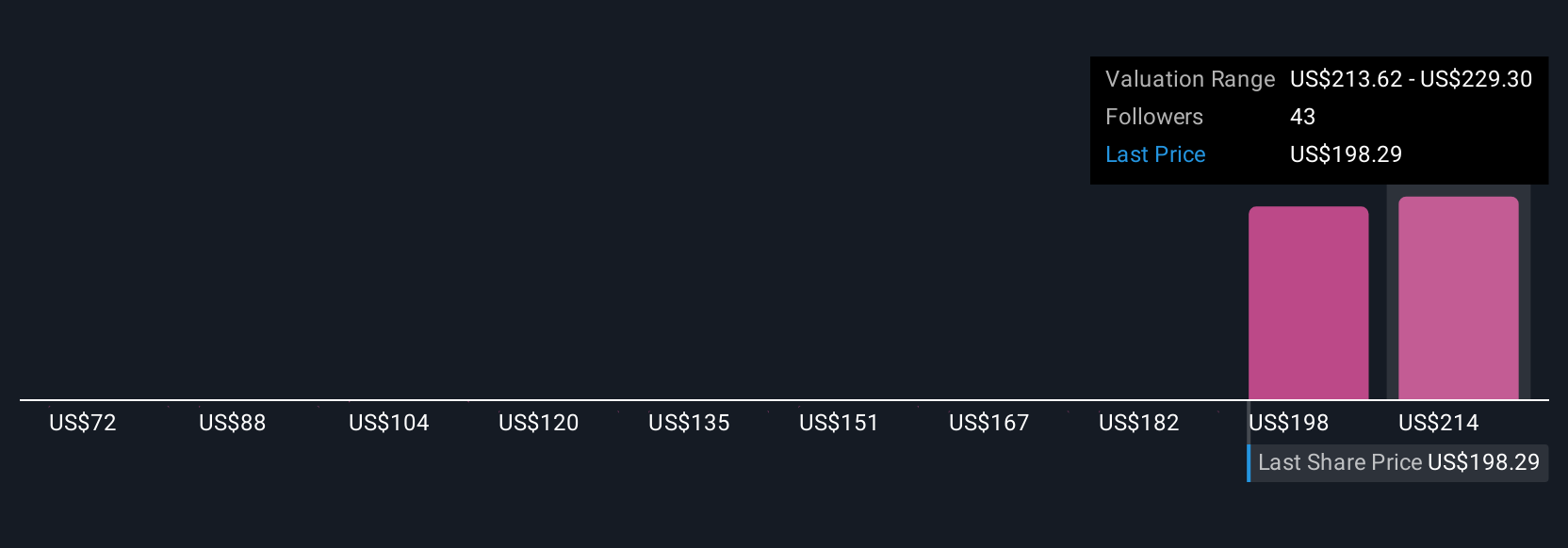

Uncover how Centrus Energy's forecasts yield a $227.73 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Six estimates from the Simply Wall St Community value Centrus Energy from US$72.48 to US$227.73 per share. As investors eye recent capital raising, many remain focused on how government contracts and market demand could influence the company’s future trajectory.

Explore 6 other fair value estimates on Centrus Energy - why the stock might be worth as much as 20% more than the current price!

Build Your Own Centrus Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centrus Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centrus Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centrus Energy's overall financial health at a glance.

No Opportunity In Centrus Energy?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10