Westgold Resources (ASX:WGX) Is Up 12.9% After Unveiling A$50 Million Exploration Investment and 2026 Guidance

- Westgold Resources recently announced plans to invest A$50 million in exploration and resource definition across its Murchison and Southern Goldfields sites, while also issuing group production guidance for 2026 targeting 345,000 to 385,000 ounces, including output from third-party ore.

- This commitment to increased exploration activity alongside a higher production outlook underscores management’s confidence in expanding resource potential and scaling operations for future growth.

- We'll look at how the A$50 million exploration investment could shape Westgold's long-term production outlook and investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Westgold Resources Investment Narrative Recap

To be a shareholder in Westgold Resources, you need to believe that ongoing investment in exploration and resource definition will convert to higher, sustainable production and support margin expansion, even as the company navigates ore grade volatility and capital intensity. The recent A$50 million exploration commitment and 2026 output guidance could influence near-term sentiment but do not fundamentally change the immediate catalyst, delivering consistent higher ore grades, and lingering risk around cost inflation and integration of recent acquisitions.

Among the news items, the new 2026 production guidance of 345,000 to 385,000 ounces (including third-party ore) is particularly relevant, as it sets a clear operational benchmark for assessing the success of current exploration spending and integration efforts, directly tying to the key catalyst of production scale and resource growth.

By contrast, investors should also be aware that persistent lower ore grades at major sites could still…

Read the full narrative on Westgold Resources (it's free!)

Westgold Resources' outlook anticipates A$2.0 billion in revenue and A$876.0 million in earnings by 2028. Achieving these targets would require an annual revenue growth rate of 19.6% and an earnings increase of A$772.7 million from the current A$103.3 million.

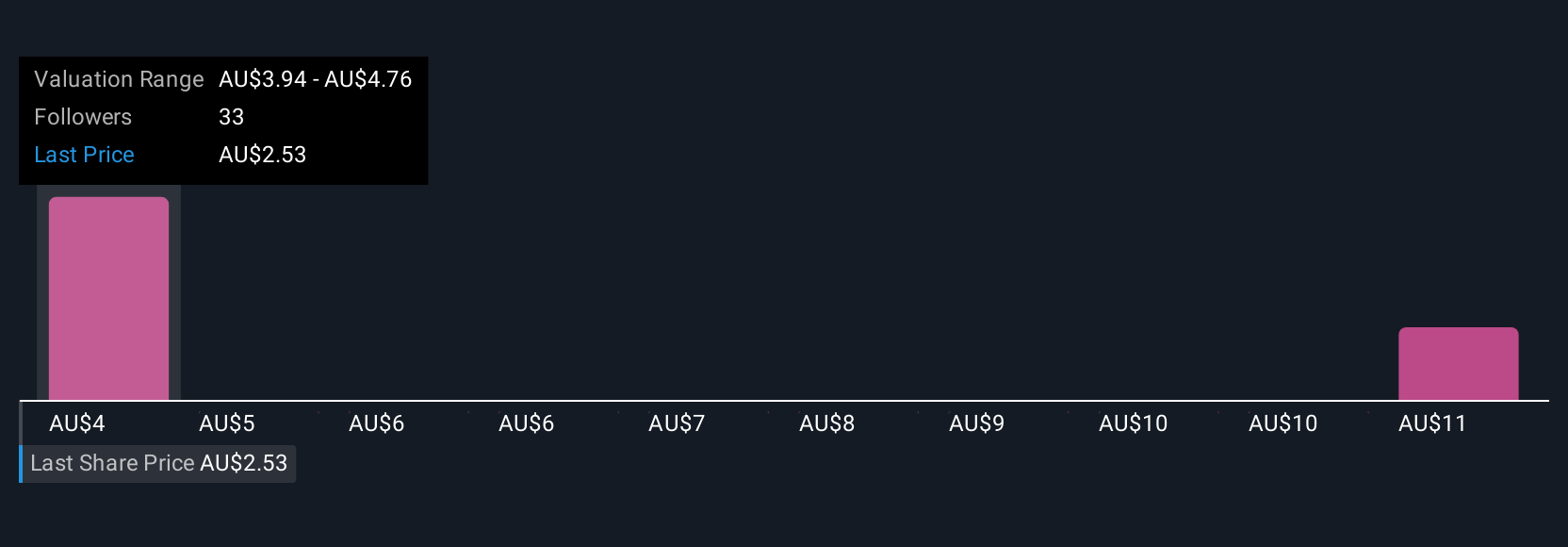

Uncover how Westgold Resources' forecasts yield a A$4.02 fair value, a 35% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community's two fair value estimates for Westgold Resources span a wide range, from A$4.02 up to A$11.30. As drilling and resource expansion accelerate, your view on whether these efforts will consistently lift production quality could steer your outlook on the company’s future performance.

Explore 2 other fair value estimates on Westgold Resources - why the stock might be worth over 3x more than the current price!

Build Your Own Westgold Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westgold Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Westgold Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westgold Resources' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westgold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10