Will Securing NZ$311 Million Highway Contract Reshape Downer EDI’s (ASX:DOW) Transformation Narrative?

- On August 1, 2025, Downer EDI Limited announced its participation in a Project Alliance Agreement to construct the southern section of the taki to North of Levin highway in New Zealand, securing approximately NZ$311 million (A$280 million) in revenue as part of the 2NL South Alliance for NZ Transport Agency Waka Kotahi.

- This extensive project award came after more than a year of collaborative project scoping and paves the way for Downer's continued role in major New Zealand infrastructure developments.

- We’ll assess how winning such a sizable highway contract in New Zealand could affect Downer’s ongoing transformation strategy and future opportunities.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Downer EDI Investment Narrative Recap

Downer EDI shareholders must believe in the company's ability to execute its transformation strategy and secure high-quality infrastructure contracts in Australia and New Zealand. The recent NZ$311 million (A$280 million) highway contract in New Zealand represents a welcome addition to revenue, but does not resolve the underlying uncertainty about management’s ability to maintain a stable pipeline of new work, the most important short-term catalyst, just as timing gaps in contract wins remain the biggest risk.

One of the most relevant recent announcements is the A$540 million Powerco Electricity Field Services Agreement signed in March 2025. This long-term contract, like the New Zealand highway award, is significant for Downer’s future work pipeline and aligns with the transformation strategy aimed at revenue stability, though both do not necessarily guarantee the elimination of risk around contract timing issues.

In contrast, investors should be aware of timing gaps between contract wins and their impact on...

Read the full narrative on Downer EDI (it's free!)

Downer EDI's outlook anticipates A$12.2 billion in revenue and A$401.8 million in earnings by 2028. This is based on an annual revenue growth rate of 4.6% and an increase in earnings of A$341.9 million from the current A$59.9 million.

Uncover how Downer EDI's forecasts yield a A$6.21 fair value, a 9% downside to its current price.

Exploring Other Perspectives

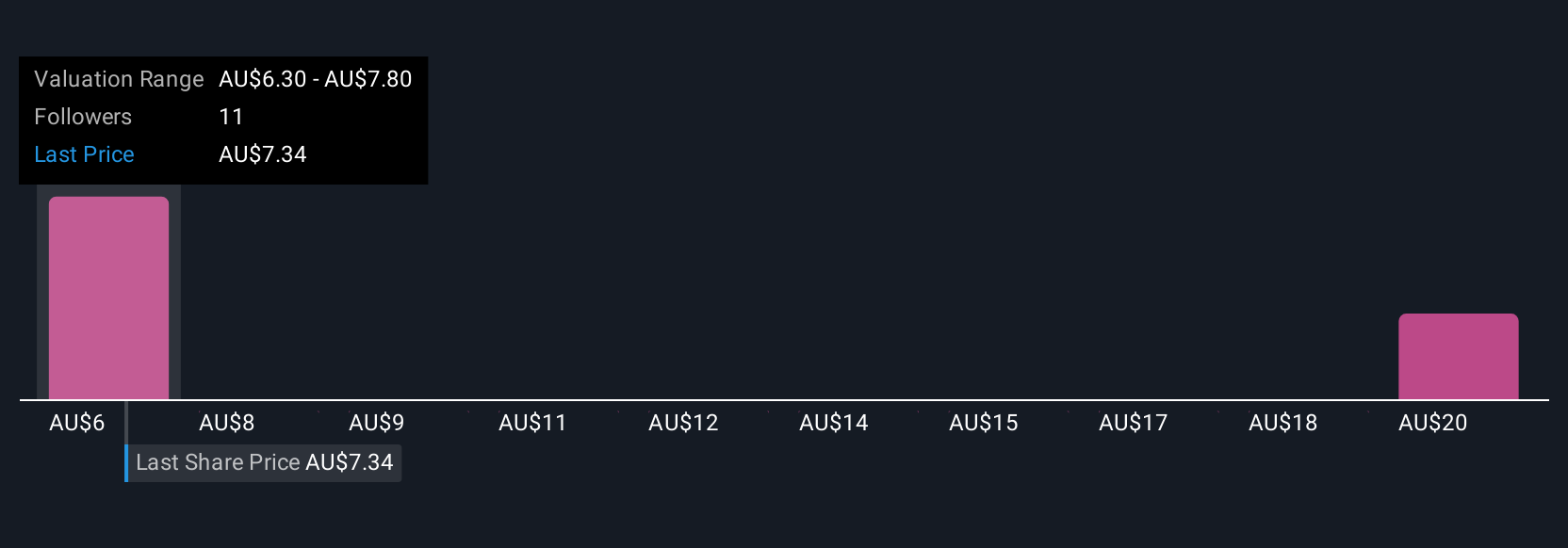

Fair value estimates from four Simply Wall St Community members range from A$6.21 to A$41.51 per share. With ongoing uncertainty around future contract pipelines, you could see substantial differences in opinions about Downer EDI’s potential, investor perspectives like this highlight why it’s valuable to compare several viewpoints when considering the stock.

Explore 4 other fair value estimates on Downer EDI - why the stock might be worth 9% less than the current price!

Build Your Own Downer EDI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Downer EDI research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Downer EDI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Downer EDI's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10