How Will Regeneron’s (REGN) Solid Earnings and R&D Progress Shape Its Risk-Reward Balance?

- Regeneron Pharmaceuticals recently reported second quarter revenue of US$3.68 billion and net income of US$1.39 billion, maintained its quarterly cash dividend, and completed a share repurchase of over 1.57 million shares for US$867.7 million, while also participating in the 13th Annual Immuno-Oncology Summit with a key R&D presentation by Senior Director David J. DiLillo in Philadelphia.

- Investor commentary has highlighted Regeneron's attractive long-term growth potential and robust research pipeline, even as the company continues to address recent legal challenges and regulatory developments.

- We’ll take a look at how stable earnings results and renewed investor optimism could influence Regeneron's investment outlook and risk profile.

This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

Regeneron Pharmaceuticals Investment Narrative Recap

To be a shareholder in Regeneron Pharmaceuticals, you need to believe in the company’s ability to defend its leading franchises while converting its broad pipeline into future blockbusters. The recent earnings update, which highlighted steady top-line growth and ongoing share repurchases, does not materially change the biggest short-term catalyst, how effectively Regeneron can offset competitive and pricing pressures on EYLEA revenue, or the key risk of further legal and policy headwinds threatening US product sales. The essential risk-return themes remain intact for now.

Among the latest announcements, Regeneron’s board reaffirmed its quarterly cash dividend. While dividend affirmations often signal management confidence, the more pressing issue for investors right now is the company’s performance in safeguarding EYLEA’s position as branded and biosimilar competition intensifies. Stability in shareholder returns might offer reassurance amid the sector’s shifting landscape, but the need to see sustained pipeline execution is paramount.

But in contrast, investors should be aware that looming government pricing reforms and legal actions linked to EYLEA’s reimbursement are still unresolved...

Read the full narrative on Regeneron Pharmaceuticals (it's free!)

Regeneron Pharmaceuticals' narrative projects $16.5 billion revenue and $4.5 billion earnings by 2028. This requires 5.1% yearly revenue growth and no earnings change from current earnings of $4.5 billion.

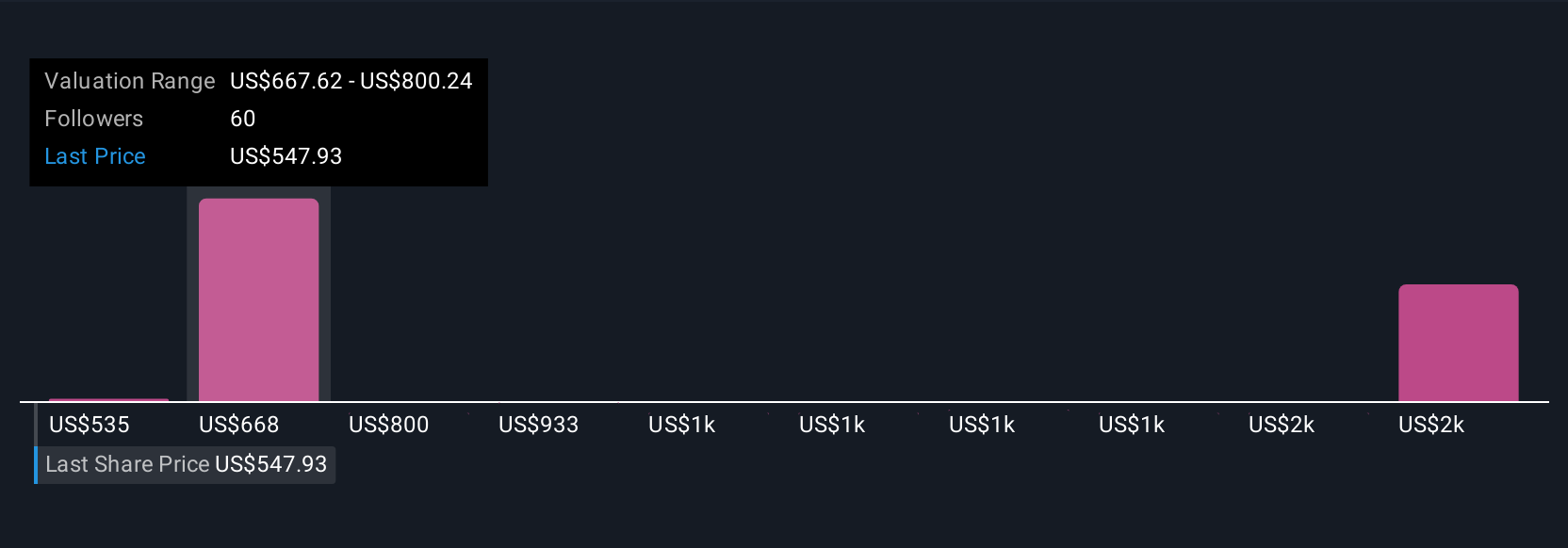

Uncover how Regeneron Pharmaceuticals' forecasts yield a $708.91 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Some analysts hold a far more optimistic view, predicting as much as US$17.7 billion in annual revenue and US$6.1 billion in earnings by 2028. This upbeat narrative highlights a belief in rapid expansion of Regeneron’s share in global immunology and oncology markets, much more aggressively than the consensus. If you think the recent news could reshape these expectations, it is important to consider how alternative scenarios may better reflect your own outlook.

Explore 9 other fair value estimates on Regeneron Pharmaceuticals - why the stock might be worth over 3x more than the current price!

Build Your Own Regeneron Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regeneron Pharmaceuticals research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Regeneron Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regeneron Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10