Will Truist’s Florida Expansion and Governance Shift Reveal a New Long-Term Strategy for TFC?

- In late July 2025, Truist Financial Corporation appointed a new regional president and market president for its Florida commercial banking team, added six new wealth advisors, and amended its bylaws to update procedures for shareholder proposals and director nominations in line with North Carolina law.

- These changes suggest Truist is aiming to strengthen both its presence in key Florida markets and its corporate governance framework, reflecting a focus on leadership and transparency.

- We'll now examine how Truist's refreshed Florida leadership and bylaw updates may shape its longer-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Truist Financial Investment Narrative Recap

To be a Truist Financial shareholder, you need to believe in the company’s ability to leverage its strong Sunbelt presence, expand wealth management, and balance investment in traditional banking with digital transformation. The recent executive appointments and bylaw amendments reinforce Truist’s effort to strengthen leadership and governance; however, these actions do not materially shift the short-term focus, which remains on managing credit exposure in commercial real estate and controlling rising costs in an evolving banking environment.

Among recent news, Truist’s decision to appoint Scott Cathcart as Florida Regional President stands out, given Florida’s importance to the bank’s growth ambitions. This move aligns with Truist’s ongoing strategy to build deeper client relationships and drive business in key markets, supporting medium-term goals of expanding revenue from client acquisition and wealth management, even as structural margin pressures from higher expenses and regulatory demands remain.

On the other hand, investors should keep in mind the ongoing risks tied to Truist’s above-average commercial real estate exposure and what it could mean if property markets continue to shift...

Read the full narrative on Truist Financial (it's free!)

Truist Financial's outlook anticipates $22.5 billion in revenue and $6.3 billion in earnings by 2028. This assumes a 7.5% annual revenue growth rate and a $1.4 billion increase in earnings from the current $4.9 billion.

Uncover how Truist Financial's forecasts yield a $48.69 fair value, a 13% upside to its current price.

Exploring Other Perspectives

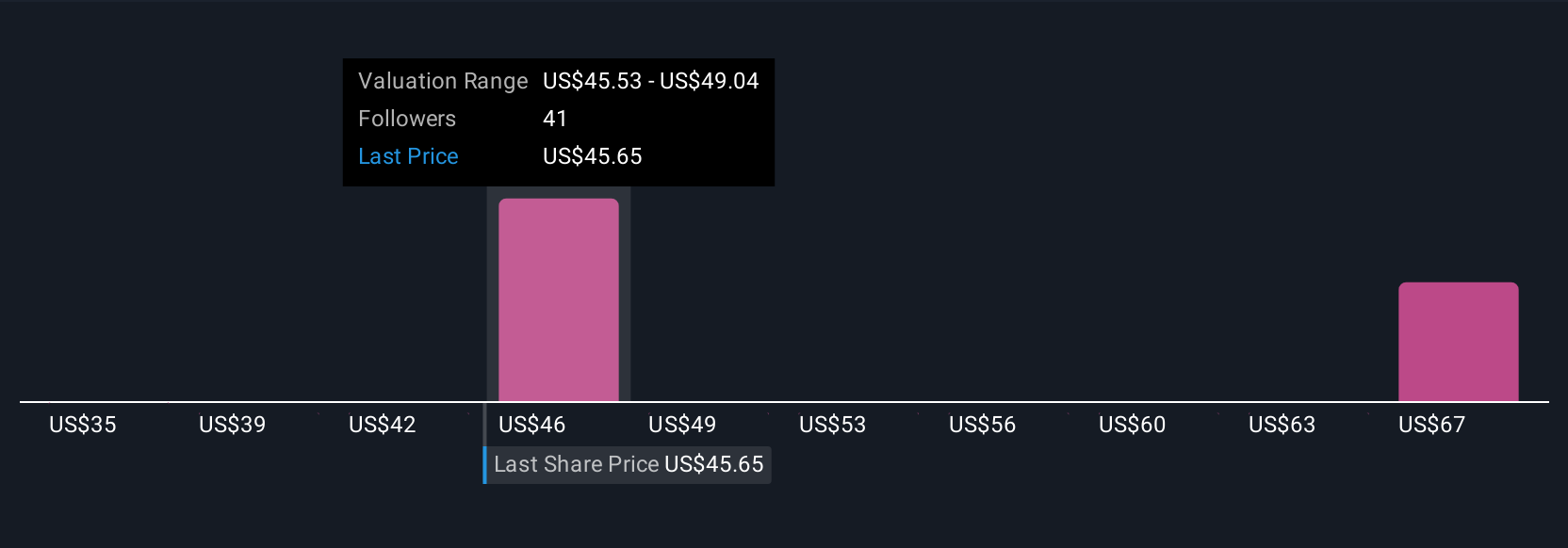

Retail investors in the Simply Wall St Community offered four fair value estimates for Truist ranging widely from US$35.00 to US$57.45 per share. Even with this range, concerns about the sustained cost of Truist’s large branch network highlight why opinions may differ so greatly on the stock’s future potential.

Explore 4 other fair value estimates on Truist Financial - why the stock might be worth 19% less than the current price!

Build Your Own Truist Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Truist Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Truist Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Truist Financial's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10