Alnylam Pharmaceuticals (ALNY) Is Up 9.2% After Upward Q2 Revenue Guidance Revision and Higher Analyst Forecasts—Has the Bull Case Changed?

- Alnylam Pharmaceuticals recently announced its second quarter 2025 earnings, reporting revenue of US$773.69 million, up from US$659.83 million a year earlier, while also revising its full-year guidance to a higher range of US$2.65 billion to US$2.8 billion in total net product revenues.

- This major upward revision in revenue outlook, paired with improved analyst forecasts, signals growing confidence in the company’s expanding RNAi therapies business and its future profitability prospects.

- We’ll explore how Alnylam’s sharply increased full-year revenue guidance shapes its investment narrative and future growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Alnylam Pharmaceuticals Investment Narrative Recap

To be a shareholder in Alnylam Pharmaceuticals, you need to believe in the expanding real-world adoption of RNAi therapies, especially AMVUTTRA, as a driver of sustained revenue growth, while accepting continued investments in R&D and commercialization. The sharp upward revision to 2025 revenue guidance is a strong near-term catalyst, but does not remove the ongoing risk that gross margins could compress further, limiting near-term profit expansion even as sales rise.

Among the various company announcements, the recent European regulatory approval for AMVUTTRA stands out in relation to the new revenue outlook. This product milestone not only validates the global market opportunity but also supports expectations that international expansion may contribute meaningfully to the raised revenue range, further emphasizing the importance of execution in new markets.

But in contrast to robust top-line trends, investors should pay close attention to recent margin compression driven by increased royalty obligations and...

Read the full narrative on Alnylam Pharmaceuticals (it's free!)

Alnylam Pharmaceuticals' outlook anticipates $6.9 billion in revenue and $1.8 billion in earnings by 2028. This is based on a 41.1% annual revenue growth rate and an $2.12 billion increase in earnings from current earnings of -$319.1 million.

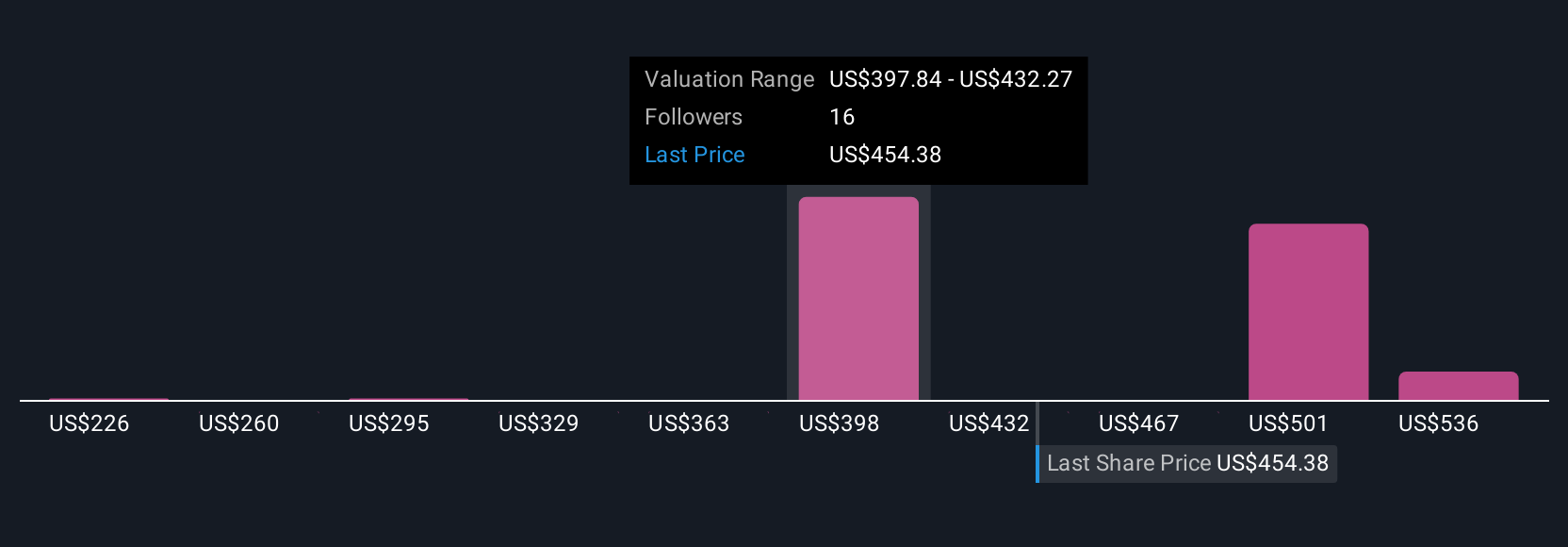

Uncover how Alnylam Pharmaceuticals' forecasts yield a $421.64 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Community fair value estimates for Alnylam Pharmaceuticals span from US$225.68 to US$1,924.18, reflecting five markedly different viewpoints from the Simply Wall St Community. Given Alnylam’s recently raised revenue guidance and international expansion, these contrasting forecasts underscore how views about the company’s global adoption and margin risks can shape wide-ranging expectations for future performance.

Explore 5 other fair value estimates on Alnylam Pharmaceuticals - why the stock might be worth over 4x more than the current price!

Build Your Own Alnylam Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alnylam Pharmaceuticals research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Alnylam Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alnylam Pharmaceuticals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10