Dutch Bros (BROS) Is Up 15.4% After Raising Full-Year Guidance on Strong Q2 Results

- Dutch Bros Inc. recently reported its second quarter 2025 results, showing sales of US$380.5 million and net income of US$25.62 million, both meaningfully higher than the same period last year. The company also revised its full-year 2025 guidance upward, projecting revenues of US$1.59 to US$1.60 billion and an expected same shop sales growth of approximately 4.5%.

- What stands out is Dutch Bros' confidence in continued expansion, as signaled by raising its outlook for total revenues, same shop sales, and adjusted EBITDA following stronger quarterly profits.

- We will now assess how this guidance increase, reflecting management’s optimism on operational performance, affects Dutch Bros’ longer-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Dutch Bros Investment Narrative Recap

To be a Dutch Bros shareholder, you need to believe in its ability to consistently open new shops and drive more revenue per location, while managing the cost and competition pressures in the fast-growing drive-thru coffee sector. The company’s stronger-than-expected quarterly results and raised full-year guidance may reinforce confidence in its shop expansion plans, but do not completely eliminate the short-term risk of rising coffee seed and raw material costs impacting margins. The most immediately relevant recent announcement is Dutch Bros’ upward revision of its 2025 guidance, following higher sales and profitability for the second quarter. This raised outlook directly ties to the company’s operational momentum, increasing investor focus on whether efficiency and scale can offset inflationary pressures as Dutch Bros accelerates its planned shop openings. Yet, investors should also watch for signs that cost headwinds, especially from higher coffee bean prices, are proving harder to absorb than anticipated...

Read the full narrative on Dutch Bros (it's free!)

Dutch Bros' narrative projects $2.5 billion revenue and $191.5 million earnings by 2028. This requires 22.5% yearly revenue growth and a $148 million earnings increase from $43.5 million today.

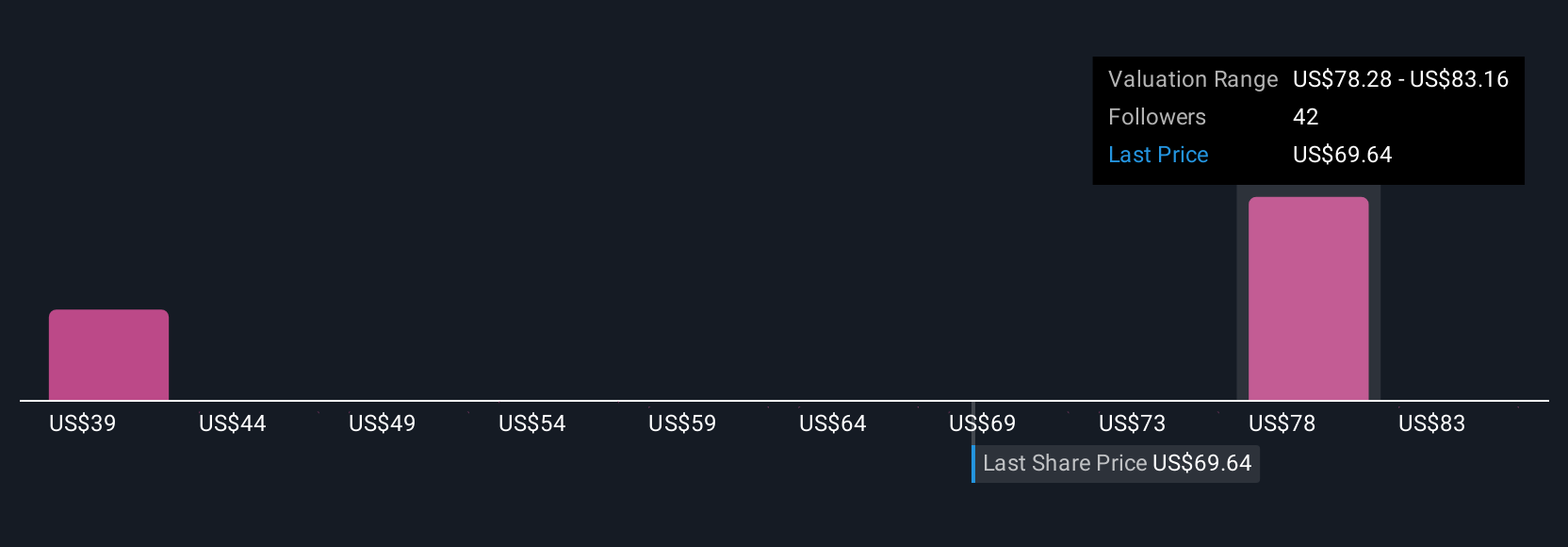

Uncover how Dutch Bros' forecasts yield a $78.94 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community gave fair value estimates for Dutch Bros, with figures from US$39.39 up to US$88.05. While many are optimistic, the critical question remains whether projected shop growth can withstand execution risks in a highly competitive market.

Explore 8 other fair value estimates on Dutch Bros - why the stock might be worth as much as 30% more than the current price!

Build Your Own Dutch Bros Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dutch Bros research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dutch Bros research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dutch Bros' overall financial health at a glance.

No Opportunity In Dutch Bros?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10