Duolingo (DUOL) Stock Surges 13% In One Week Ahead Of Q2 2025 Earnings Call

Duolingo (DUOL) has seen a 13% increase in its share price over the past week, coinciding with the announcement of its Q2 2025 earnings call on August 6. While this news aligns with a broader market recovery, where major indexes, including the Nasdaq and the S&P 500, exhibited gains amid decreased tariff and economic concerns, it may have added some positive momentum to Duolingo's performance. However, the tech sector's uplift, driven by strong showings from mega-cap companies, likely contributed as well, reinforcing Duolingo's upward move in the context of this positive market backdrop.

We've spotted 1 weakness for Duolingo you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

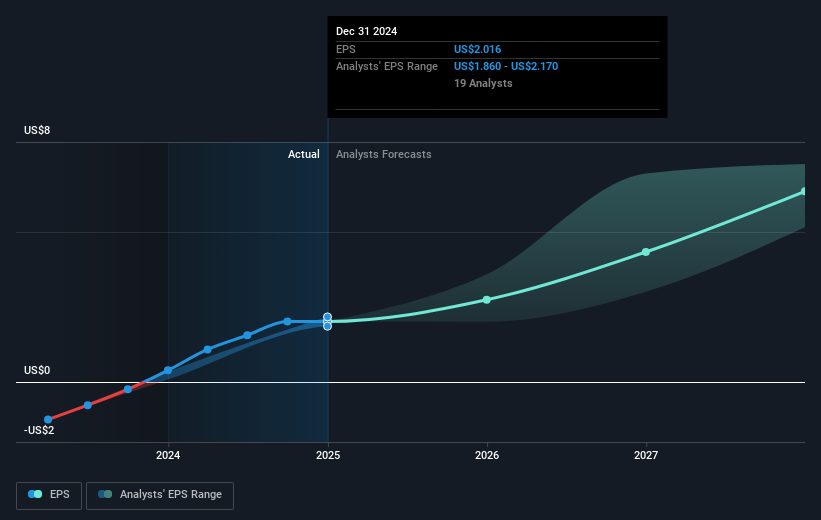

The recent 13% rise in Duolingo's share price coinciding with its Q2 2025 earnings call announcement could bolster the narrative of diversified courses and AI-driven engagement strategies. Such upward price movement underscores investor optimism about the company's initiatives in expanding course offerings, enhancing user retention, and leveraging AI to improve efficiency. Analysts' forecasts for a 27% annual revenue growth and increased profitability might gain traction if these strategic endeavors result in tangible subscriber growth and market penetration.

Over the past three years, Duolingo has demonstrated a remarkable total return of approximately 275.63%, illustrating substantial long-term growth. Despite the current share price of US$390.84 being below analyst consensus price targets—estimated at around US$497.24—this trajectory showcases confidence in the company's potential. Comparatively, Duolingo's recent performance also stands strong against the broader US market return of 19.9% over the last year, as well as outpacing the US Consumer Services industry growth of 21.1% over the same period.

The anticipation of continued revenue and earnings growth hinges on successful execution of Duolingo's expansion plans and technological advancements. As these factors align with investor expectations, they might contribute to narrowing the share price discount to the target, currently standing at 27.22%. Notably, while Duolingo's Price-To-Sales ratio indicates a premium valuation compared to industry peers, the company's potential for higher returns remains an attraction, provided its growth strategies materialize effectively.

Review our historical performance report to gain insights into Duolingo's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10