Should Verizon’s (VZ) New Staples Retail Kiosks Change the Investment Story for Growth Investors?

- Staples recently announced an expansion of its partnership with Verizon, rolling out Verizon kiosks in 35 Staples stores across key markets during the summer of 2025, offering device upgrades, internet services, consultations, and business solutions to both consumers and small businesses.

- This collaboration brings Verizon’s full suite of wireless, tech, and connectivity services directly into major retail locations, making advanced solutions more accessible to a wider range of customers while supporting Staples' effort to transform its in-store experience.

- We'll explore how this enhanced retail access could influence Verizon's investment narrative, particularly as it targets growth among small business and consumer segments.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Verizon Communications Investment Narrative Recap

Being a Verizon shareholder is often about believing in the company’s ability to leverage its vast network assets, reliable dividend, and expanding suite of enterprise and consumer connectivity solutions to drive stable returns, even as competition and market maturation present ongoing hurdles. The latest Staples partnership enhances Verizon’s retail and service visibility, but does not appear to meaningfully shift the near-term catalyst: converting fixed wireless and broadband momentum into sustainable revenue and margin growth. Current risks around subscriber churn and heavy capital spending commitments remain material, and thus unchanged by this event.

One recent announcement that ties into this catalyst is the launch of Verizon’s collaboration with Bar Partners, using Fixed Wireless Access to ensure reliable connectivity for business venues, a clear example of how Verizon’s 5G and FWA rollout is helping the company widen its addressable markets. This is central to offsetting pressures from stalled organic wireless growth, underscoring how new retail and business alliances aim to supplement its established connectivity leadership.

By contrast, investors should be mindful that even with new retail access points, the risk of persistent churn and margin pressure from promotions remains a concern that...

Read the full narrative on Verizon Communications (it's free!)

Verizon Communications' narrative projects $144.6 billion in revenue and $22.2 billion in earnings by 2028. This requires 1.8% annual revenue growth and a $4.0 billion earnings increase from current earnings of $18.2 billion.

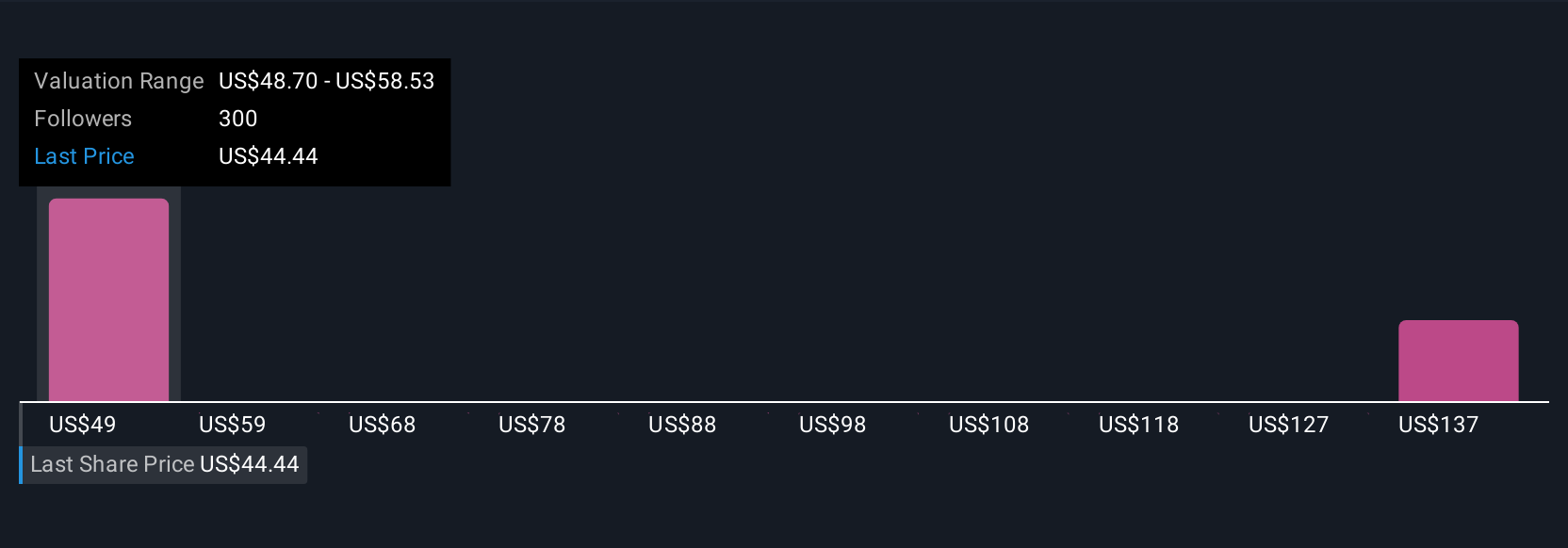

Uncover how Verizon Communications' forecasts yield a $48.74 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered 10 fair value estimates for Verizon, spreading from US$48.74 up to US$146.73, reflecting significant differences in opinion. These varying outlooks highlight how key catalysts around fixed wireless expansion could play a major role in the company’s future resilience, so consider exploring these diverse viewpoints.

Explore 10 other fair value estimates on Verizon Communications - why the stock might be worth just $48.74!

Build Your Own Verizon Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verizon Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verizon Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verizon Communications' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10