Did Insider Alignment Just Reshape Pure Storage's (PSTG) Investment Narrative?

- Pure Storage recently announced its upcoming second quarter fiscal 2026 earnings call set for August 27, 2025, and a technology-focused analyst meeting on September 25, 2025, where executives will share future strategies.

- An interesting insight is that company insiders currently hold a substantial US$941 million stake, highlighting strong alignment between management and shareholders.

- To assess the impact, let's explore how robust insider ownership and management alignment shape Pure Storage's current investment narrative.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Pure Storage Investment Narrative Recap

Pure Storage shares appeal to those who believe in the company's ability to outpace the technology sector in both revenue and profit growth, while sustaining high investor confidence reflected in its valuation. The recent announcement of the second quarter fiscal 2026 earnings call does not materially change the immediate catalyst, which remains tied to management’s plans for product innovation and the pace of large Evergreen//One service contracts. The main risk remains the potential for compressed revenue growth if deal cycles remain slow or market adoption of new offerings falters. Among the updates, the upcoming analyst meeting at Pure//Accelerate NYC stands out as especially relevant, with executives pledging to outline the next phase of product strategy and business model shifts. The September event presents a key moment for shareholders and prospective investors to gain insight into Pure Storage's evolving positioning and the company's ability to address competitive challenges and future demand cycles. Yet, if supply chain cost pressures and NAND pricing persist, investors should also be aware that...

Read the full narrative on Pure Storage (it's free!)

Pure Storage's narrative projects $4.7 billion in revenue and $569.8 million in earnings by 2028. This requires 12.7% yearly revenue growth and a $442 million increase in earnings from the current $127.8 million.

Uncover how Pure Storage's forecasts yield a $71.00 fair value, a 23% upside to its current price.

Exploring Other Perspectives

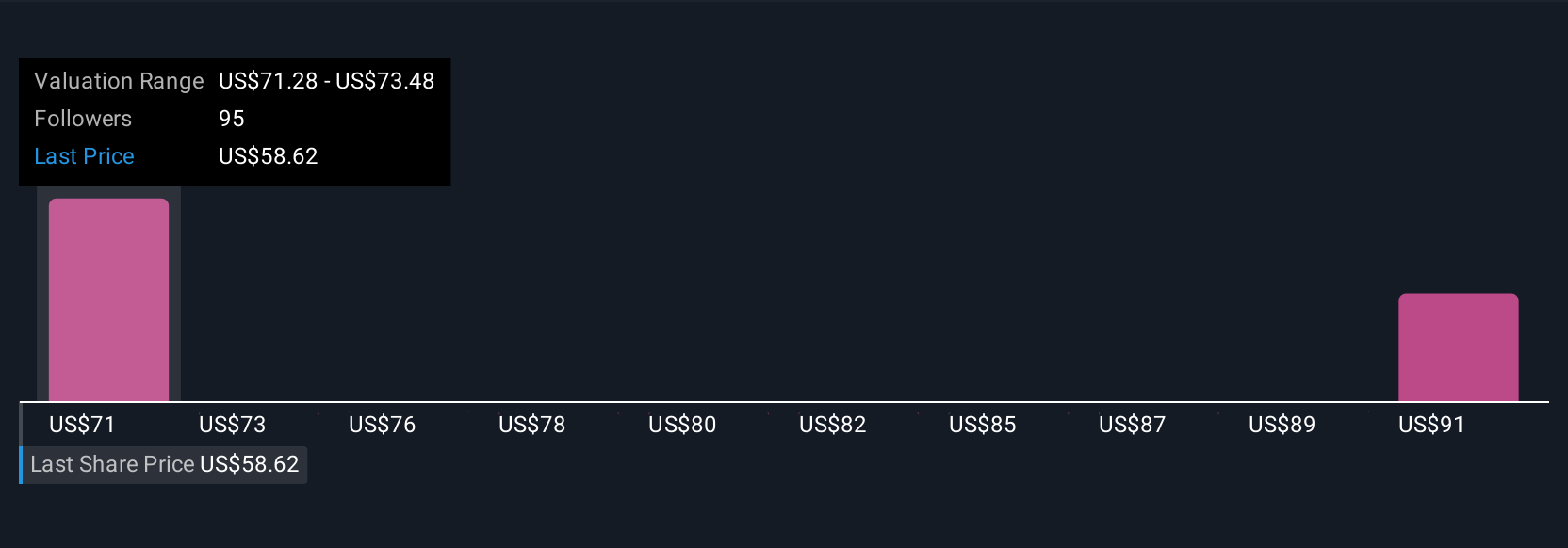

Four fair value estimates from the Simply Wall St Community range from US$71.00 to US$93.46 per share, reflecting a wide span of investor targets. In contrast, slow deal cycles for Evergreen//One services could affect confidence in future growth, so consider multiple opinions before forming your view.

Explore 4 other fair value estimates on Pure Storage - why the stock might be worth as much as 62% more than the current price!

Build Your Own Pure Storage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pure Storage research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pure Storage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pure Storage's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10