Why 10x Genomics (TXG) Is Down 6.0% After Tariff-Driven Q2 Revenue Surge and Guidance Update

- 10x Genomics, Inc. announced earnings for the second quarter of 2025, reporting revenue of US$172.91 million and net income of US$34.54 million, compared to a net loss a year earlier, along with updated revenue guidance for the third quarter between US$140 million and US$144 million, impacted by accelerated purchases from Chinese customers ahead of potential tariff changes.

- An interesting insight is that this shift in purchasing patterns suggests external factors like trade policy are currently influencing the company’s quarterly revenue distribution, adding unpredictability to reported results.

- We will examine how 10x Genomics’s improved net income and tariff-driven revenue timing may influence its longer-term investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

10x Genomics Investment Narrative Recap

To be a shareholder in 10x Genomics, you need to believe in the company’s potential to deliver sustained revenue growth by driving broad adoption of innovative single-cell and spatial analysis products. The recent earnings beat, followed by lower third quarter guidance due to Chinese customers pulling purchases forward in response to potential tariff changes, highlights that the most influential short-term catalyst remains product adoption, while the biggest immediate risk is disruption from shifting external factors like trade policy. The latest guidance does not materially affect these core investment considerations.

Among recent announcements, the corporate guidance update for Q3 is the most relevant, as it directly reflects the influence of geopolitical factors on revenue timing. Although product innovation and expansion efforts are ongoing, the recent shift in Chinese purchasing patterns calls attention to underlying volatility in quarterly results, which could mask or amplify apparent momentum in key growth areas. However, investors should also keep an eye on how broader market conditions and regulatory changes might affect future revenue consistency…

Read the full narrative on 10x Genomics (it's free!)

10x Genomics' outlook anticipates $685.0 million in revenue and $97.5 million in earnings by 2028. This is based on 3.1% annual revenue growth and a $254.5 million increase in earnings from the current level of -$157.0 million.

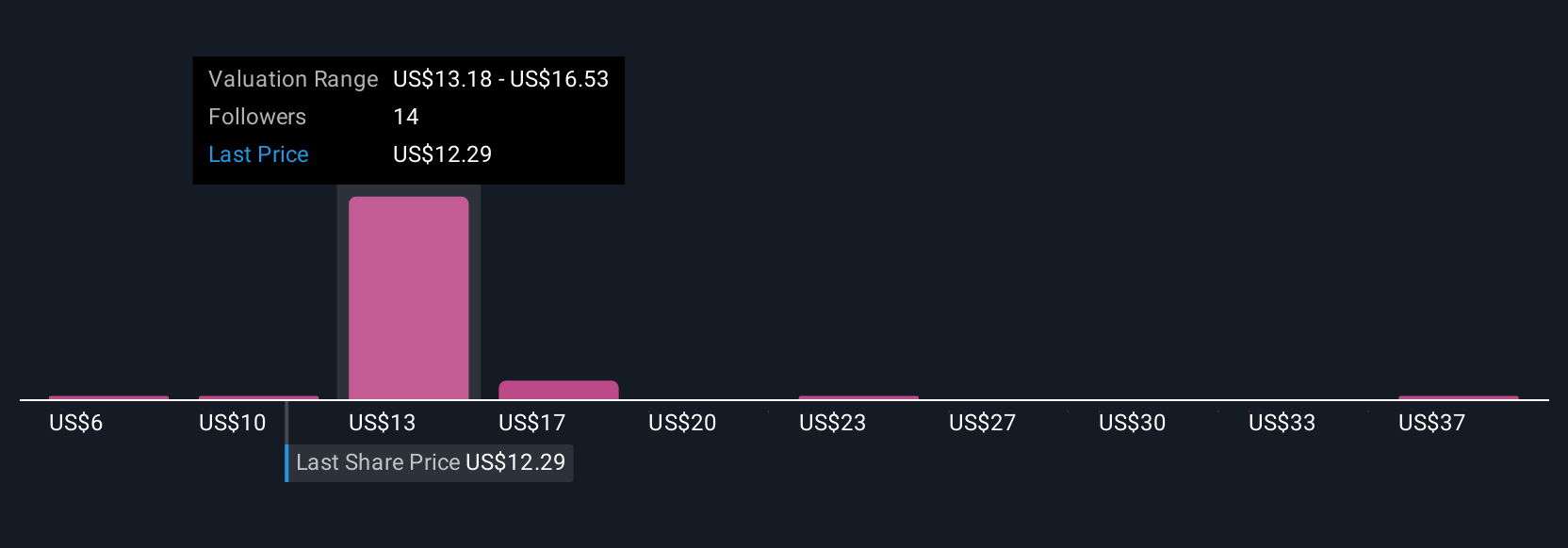

Uncover how 10x Genomics' forecasts yield a $13.54 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Seven community members’ fair value estimates for 10x Genomics range from as low as US$6.47 to US$40 per share. With product adoption still central to the investment case, it is clear views on the company’s future performance can differ dramatically, take time to review several independent perspectives before forming your own outlook.

Explore 7 other fair value estimates on 10x Genomics - why the stock might be worth 47% less than the current price!

Build Your Own 10x Genomics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 10x Genomics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free 10x Genomics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 10x Genomics' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10