Will UL Solutions (ULS) Shelf Offering Reveal a Shift in Its Capital Allocation Priorities?

- Earlier this week, UL Solutions Inc. affirmed its 2025 guidance for mid single-digit constant currency organic revenue growth and reported second quarter sales rising to US$776 million from US$730 million a year ago, though net income for the quarter fell to US$91 million from US$101 million.

- In addition, the company filed a shelf registration for potential future issuances of common and preferred stock, debt securities, depositary shares, warrants, purchase contracts, and units, providing it with financial flexibility for upcoming initiatives.

- We'll explore how reaffirming its growth outlook amid higher sales but mixed profit performance may shape UL Solutions' investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

UL Solutions Investment Narrative Recap

For those considering UL Solutions, the central case rests on the belief that demand for safety, testing, and certification services will remain resilient as global supply chains grow more complex and regulatory standards evolve. The company’s reaffirmed guidance and rising sales offer reassurance for near-term revenue predictability, but the continued dip in quarterly net income keeps margin pressure and competitive pricing as live risks; the latest news does not materially shift the primary short-term catalyst, which remains the ramp-up of new lab capacity, nor the chief risk, which is intensifying competitive pressure on pricing and profitability.

Among recent developments, UL Solutions’ shelf registration filing for possible future debt or equity issuances stands out for how it prepares the company to move quickly on investment opportunities, should catalysts like global energy transition or digital infrastructure demand accelerate. Having added new laboratory operations and expanded testing programs across battery and compliance segments, the company’s financial flexibility can support its efforts to secure market share in growth areas.

Yet, in contrast to the reassuring topline trends, investors should also be aware of the ongoing risk that pricing pressure from new and fast-moving competitors may...

Read the full narrative on UL Solutions (it's free!)

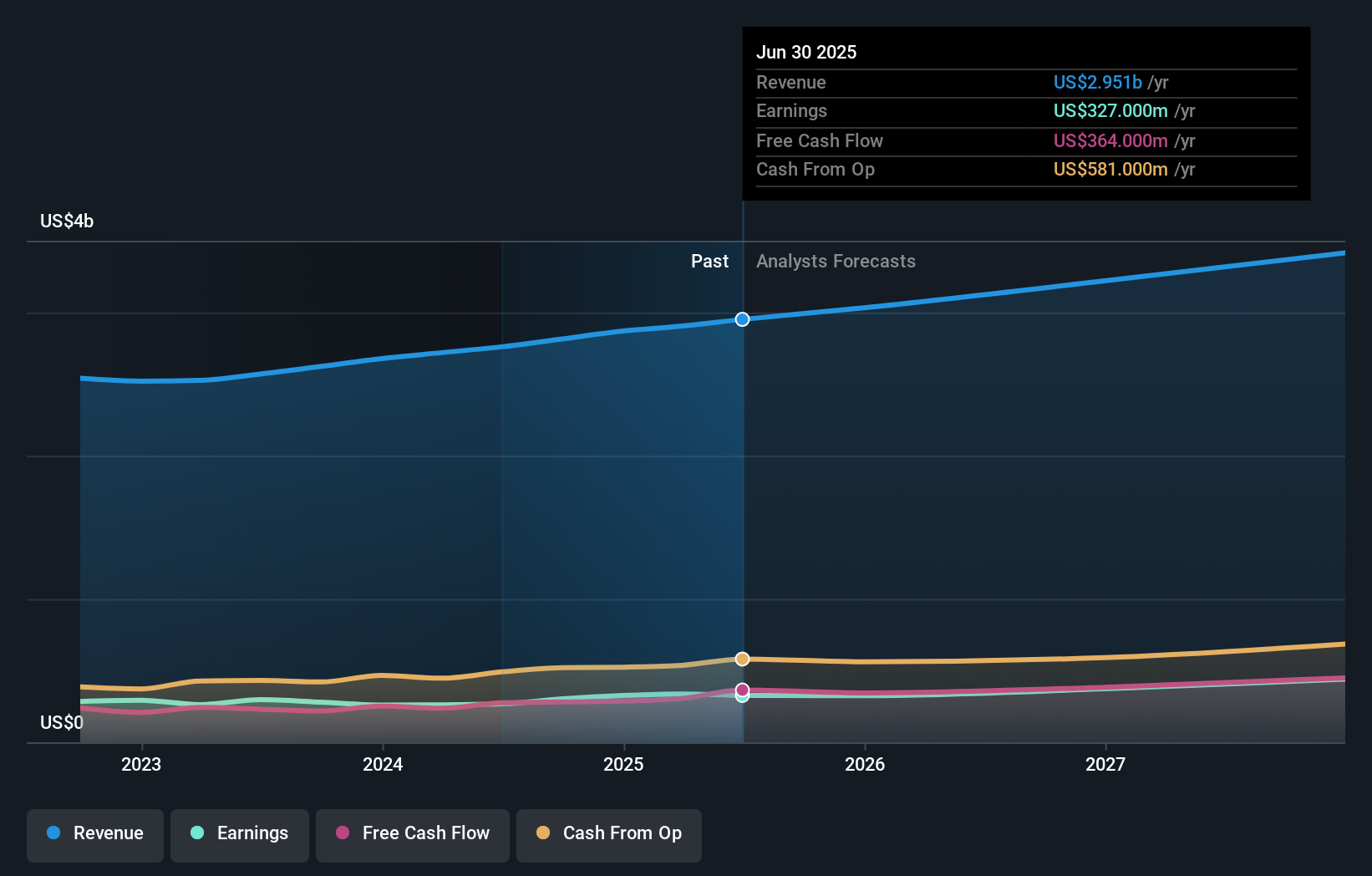

UL Solutions' outlook anticipates $3.5 billion in revenue and $477.8 million in earnings by 2028. This scenario is based on a 6.1% annual revenue growth rate and a $150.8 million increase in earnings from the current level of $327.0 million.

Uncover how UL Solutions' forecasts yield a $71.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Just one member of the Simply Wall St Community values UL Solutions at US$71.50 a share, with no diversity of outlook reflected. While the focus remains on capturing growth from global infrastructure trends, intensifying competition may challenge the company’s ability to maintain margins. Explore more viewpoints to inform your assessment.

Explore another fair value estimate on UL Solutions - why the stock might be worth as much as 7% more than the current price!

Build Your Own UL Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UL Solutions research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free UL Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UL Solutions' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10