What Teradyne (TER)'s Launch of Next-Gen HBM Memory Tester Means For Shareholders

- Earlier this month, Teradyne unveiled the Magnum 7H, a next-generation memory tester designed to address the complex testing requirements of high bandwidth memory devices used in generative AI and cloud infrastructure, with shipments already ramping at major HBM manufacturers.

- This launch marks a significant advancement for Teradyne, positioning the company to meet increasing demand for robust, efficient testing solutions as AI and high-performance computing technologies evolve.

- We'll examine how Teradyne’s expansion into advanced HBM testing tools may influence its investment narrative and future growth drivers.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Teradyne Investment Narrative Recap

To be a Teradyne shareholder today, you likely need conviction in the continued growth of AI, semiconductors, and automation, and confidence that the company's expanding test offerings, such as the new Magnum 7H, will sustain relevance as next-generation computing unfolds. This product launch may reinforce Teradyne’s role as a supplier for leading-edge HBM manufacturing, which could positively influence near-term industry demand, yet uncertainties in customer spending and demand visibility, particularly beyond the second quarter, remain the biggest wildcard. In the short term, while Magnum 7H addresses an important technological shift, the primary near-term business risk, fluctuating demand, driven by external macro and geopolitical factors, has not fundamentally changed.

Among recent announcements, Teradyne’s updated third-quarter guidance stands out: the company expects revenue between US$710 million and US$770 million, with GAAP net income of US$0.62 to US$0.80 per diluted share. This guidance will now be measured against the potential impact of new HBM test solutions, as demand for advanced AI and semiconductor infrastructure evolves.

But even as new products roll out, investors should keep an eye on...

Read the full narrative on Teradyne (it's free!)

Teradyne's outlook anticipates $4.1 billion in revenue and $972.1 million in earnings by 2028. This reflects a 13.2% annual revenue growth rate and an earnings increase of $502.9 million from the current $469.2 million.

Uncover how Teradyne's forecasts yield a $114.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

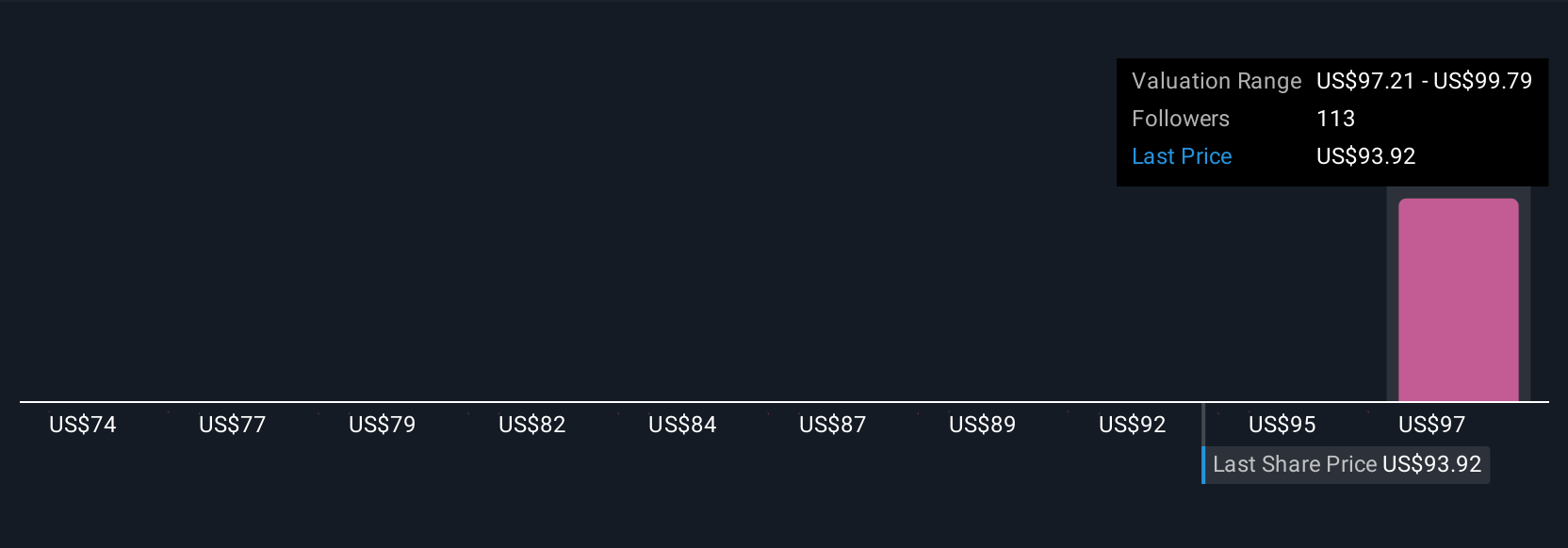

Fair value estimates from six Simply Wall St Community members range from US$91.14 to US$126.95 per share. With demand visibility limited by global economic factors, you’ll find a variety of opinions, explore these views to see how your outlook compares.

Explore 6 other fair value estimates on Teradyne - why the stock might be worth 15% less than the current price!

Build Your Own Teradyne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradyne research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Teradyne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradyne's overall financial health at a glance.

No Opportunity In Teradyne?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10