Toast (TOST) Partners With American Express To Enhance Dining Experiences

Toast (TOST) announced its Q2 2025 earnings with notable growth in revenue and net income and unveiled a partnership with American Express to enhance dining experiences. Despite these positive developments, Toast's stock price remained flat over the last month, reflecting broader market trends, where major indexes like the Nasdaq Composite and S&P 500 experienced slight increases. The introduction of the Toast Go® 3 device and integration with Adentro for data-driven marketing decisions were key moves aiming to bolster its market presence. These corporate activities provided weight to market sentiments but did not significantly impact the stock's performance independently.

Be aware that Toast is showing 1 weakness in our investment analysis.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

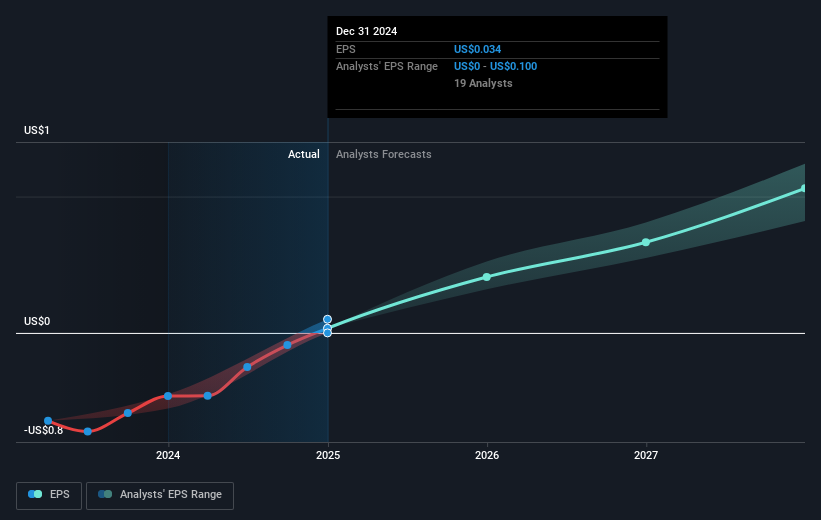

The recent announcement from Toast (TOST) regarding its Q2 2025 earnings and partnership with American Express may have longer-term implications on its revenue and earnings forecasts. This collaboration aims to enhance dining experiences, potentially increasing customer engagement and transaction volumes over time. As Toast introduces devices like the Toast Go 3 and integrates with Adentro for data-driven marketing, the company is positioned to capture a larger share of the restaurant technology market, potentially leading to increased recurring revenues.

Over the past three years, Toast's total shareholder return, including share price appreciation and dividends, has been 124.73%. This suggests substantial long-term value creation, contrasting with the past year's performance, where Toast surpassed both the US Diversified Financial industry and the broader US market. Given the current share price of US$43.08, which reflects a discount to the consensus price target of US$50.04, it indicates analysts believe there is room for potential price appreciation.

The new product launches and strategic partnership may bolster revenue and earnings growth, aligning with analysts' expectations of revenue reaching $8.9 billion by 2028 and earnings of $753.6 million. However, with Toast trading above the estimated fair value, investors may need to consider the potential risks and headwinds identified in the broader industry context. The flat stock performance in the near term, while broader indexes have seen slight increases, highlights the market's cautious stance amid execution risks and competitive challenges.

Gain insights into Toast's outlook and expected performance with our report on the company's earnings estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10