Lucid Group (LCID) Sees US$78 Million Decrease In Net Loss In Q2 Earnings

Lucid Group (LCID) recently announced its second-quarter earnings, showing a year-over-year increase in sales to $259 million and a decrease in net loss to $539 million. Despite these improvements, the company's share price declined by 7% over the last month. This downward movement might have been influenced by the proposed reverse stock split, which can affect investor sentiment, and the signing of a Memorandum of Understanding to bolster U.S. mineral resources. While the tech-heavy Nasdaq saw a rise amidst a sector rally, Lucid's developments would have added slight downward pressure relative to the broader market gains.

We've identified 3 risks with Lucid Group (at least 1 which is potentially serious) and understanding the impact should be part of your investment process.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

The recent announcements by Lucid Group, including the reverse stock split and memorandum of understanding for U.S. mineral resources, may influence its market narrative by highlighting ongoing strategic efforts to stabilize and expand its operations. These actions align with the company's objective to fortify its supply chain and possibly enhance future margins, though the reverse stock split might have negatively affected investor sentiment, as indicated by the 7% share price decline over the past month.

Over the last year, Lucid's total shareholder return, including dividends, registered a 33.23% decline, reflecting challenges in meeting broader market and industry returns, where the US market delivered a 20.2% increase. This underperformance signals ongoing hurdles in achieving profitability and adapting to competitive and industry pressures.

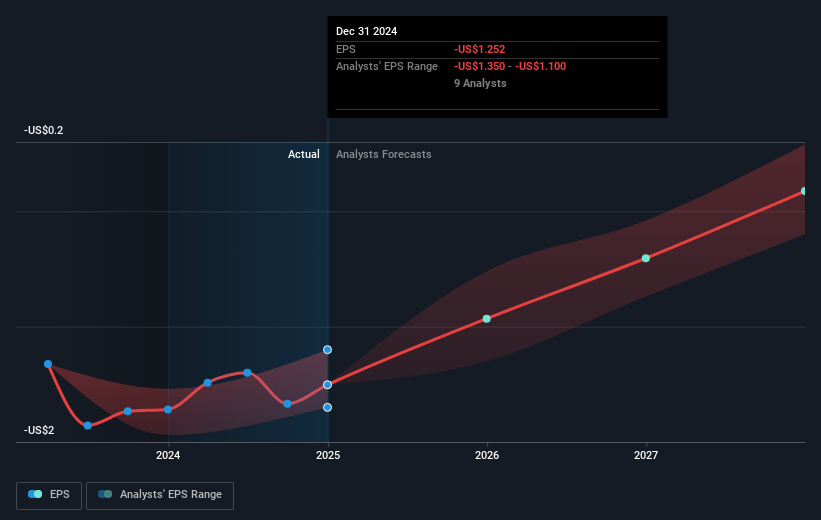

The recent news does not largely alter the existing revenue and earnings forecasts. Lucid remains focused on leveraging strategic partnerships and technological advancements to drive long-term growth. Analysts expect a revenue growth rate of 41.4% annually, although profitability may still be elusive over the next three years. The share price, currently at US$2.13, remains below the consensus price target of US$2.50, which suggests a potential upside of 13.3%. Nonetheless, uncertainties surrounding sustained profitability and diluted shareholder value remain factors that investors must weigh thoroughly.

In light of our recent valuation report, it seems possible that Lucid Group is trading beyond its estimated value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10