Etsy (ETSY) Is Down 8.7% After Q2 Revenue Tops Estimates but Profits and Buyers Decline

- Etsy reported past second-quarter 2025 earnings with revenue of US$672.66 million, surpassing estimates and marking year-on-year growth, even as net income nearly halved and active buyer numbers fell compared to the prior year.

- Despite missing on profit, Etsy saw gains from on-site advertising and higher take rates, while a significant share buyback and investment in AI-powered features highlighted management's efforts to boost platform engagement amid evolving industry challenges.

- We will explore how Etsy's revenue growth, driven by increased advertising and platform innovation, impacts the company's investment narrative and future prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Etsy Investment Narrative Recap

To be a shareholder in Etsy, you need conviction in the company’s ability to reignite demand and sustain revenue growth through AI-powered innovation and platform improvements, even as buyer activity softens. The latest earnings report underscores steady top-line growth and advances in site monetization, but persistent declines in gross merchandise sales and active buyers remain the central near-term risk; these declines are significant and could impact Etsy’s path to re-accelerating growth if not addressed.

Among recent announcements, Etsy’s large-scale share buyback, repurchasing over 6 million shares in Q2 2025 for US$334.65 million, stands out for its scale and timing. This buyback follows ongoing challenges around user retention and declining GMS and may signal management’s continued focus on supporting shareholder value during a critical period for the business.

However, investors should also be aware of ongoing competitive threats from larger e-commerce players, as these can exert pressure on Etsy’s growth prospects if...

Read the full narrative on Etsy (it's free!)

Etsy's outlook projects $3.1 billion in revenue and $365.3 million in earnings by 2028. This is based on a 2.8% yearly revenue growth rate and a $177.1 million increase in earnings from the current $188.2 million.

Uncover how Etsy's forecasts yield a $55.15 fair value, a 4% downside to its current price.

Exploring Other Perspectives

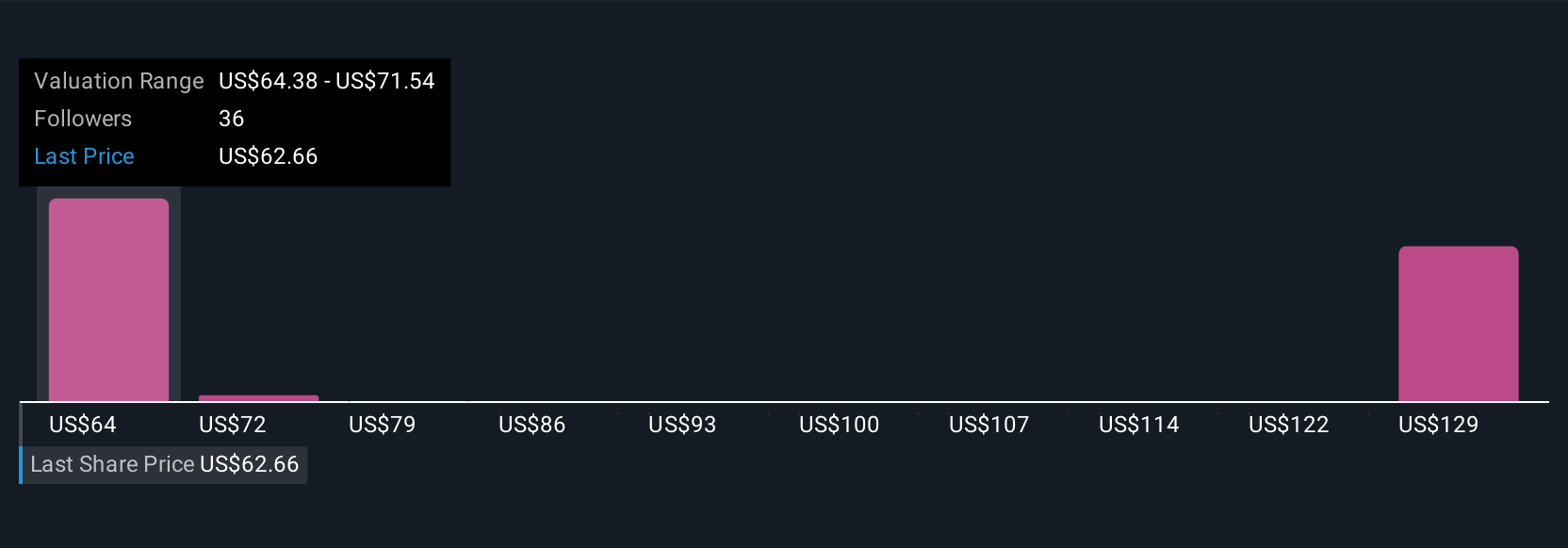

Seven Simply Wall St Community members estimate Etsy’s fair value between US$55 and US$141 per share, showing broad valuation dispersion. As buyer engagement remains a key concern, these differing viewpoints invite you to explore various growth and risk scenarios for Etsy’s future.

Explore 7 other fair value estimates on Etsy - why the stock might be worth over 2x more than the current price!

Build Your Own Etsy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Etsy research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Etsy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Etsy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10