Joby Aviation (JOBY) Reaches Milestone in FAA Certification with First Conforming Aircraft

Joby Aviation (JOBY) recently announced its preparation for the final assembly of its first conforming aircraft for the Type Inspection Authorization (TIA) flight tests, a crucial milestone aligning with FAA standards. This development underscores the company's significant progress towards commercialization and may have contributed to the impressive 185% share price increase over the last quarter. The market's general upward trend during this period would have supported such a remarkable rise. Joby's advances in product development, strategic alliances, and facility expansion likely added weight to its price movement as investors remain optimistic about its future.

We've identified 5 possible red flags with Joby Aviation (at least 1 which is a bit concerning) and understanding the impact should be part of your investment process.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Over the past year, Joby Aviation's shares experienced an impressive total return of 285.54%. This exceptional performance stands in stark contrast to the US market's 22.4% return over the same period and the US Airlines industry's 82.1% return, highlighting Joby's substantial gain relative to its peers and the broader market.

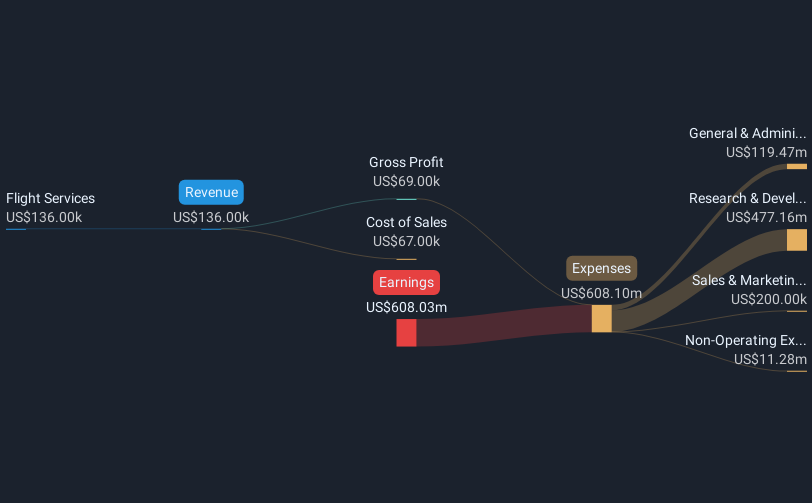

The developments mentioned in the introduction, particularly Joby's advancements in conforming aircraft assembly and strategic partnerships, could significantly influence revenue and earnings forecasts. Despite a current revenue of just US$111,000 and being forecast to remain unprofitable over the next three years, these milestones may lay the groundwork for future growth. However, the high share price, presently at US$18.93, has surpassed analysts' consensus price target of US$8.75, indicating a significant premium compared to expectations. This disparity suggests heightened market optimism, which investors should consider when evaluating Joby's long-term prospects.

Our expertly prepared valuation report Joby Aviation implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10